Canadian investors’ well-documented bias toward their home country doesn’t serve them well. That’s because Canada’s stock markets represent only 3% of global market capitalization, a reality that can greatly limit investing opportunities. In addition, the narrow focus of Canada’s equities markets in three sectors – financials, energy and materials – further reduces opportunities for diversification.

Still, according to a study from Pennsylvania-based Vanguard Group Inc., Canadians persist in holding 60% of their equities investments at home. However, Canadians are beginning to get the message that opportunity abounds outside our borders and are increasingly warming up to global markets.

That trend is well illustrated by recent ETF inflows. In the 12-month period ended Dec. 31, 2017, Canadian ETF assets under management (AUM) held in U.S., international, global and emerging-market equities increased by a healthy 46% to $46.2 billion from $31.6 billion a year earlier, according to figures from the Canadian Exchange-Traded Funds Association.

Investment Executive asked two ETF portfolio strategists – Tyler Mordy, president and chief investment officer with Forstrong Global Asset Management Inc. in Kelowna, B.C.; and Jeremy Fehr, founder and CEO of SIA Wealth Management Inc. in Calgary – to identify their top 10 U.S. and international ETF picks for a globally diversified portfolio. The ETFs chosen could focus on broad market indices as well as on narrow niches or sectors.

Most of their choices differed dramatically. All of the ETFs Mordy selected trade on U.S. exchanges, with seven iShares ETFs from New York-based BlackRock Inc. All of the ETFs Fehr selected trade on the Toronto Stock Exchange, with seven from Toronto-based Global Asset Management Inc.

Fehr’s portfolio has a bias toward U.S. equities, with a strong focus on specific sectors in the U.S. market. Notably, he chose ETFs that are hedged to the Canadian dollar to eliminate currency risk. Mordy, on the other hand, chose a more diversified mix of ETFs, with no exposure to U.S. equities. Rather, he focuses on Europe, Australasia, Far East (EAFE)-country small-cap firms, emerging and frontier market equities, and individual country securities.

Fehr’s and Mordy’s choices overlap in one area: both chose ETFs that invest in equities from Japan, China and EAFE countries – although each portfolio manager chose different ETFs to represent these regions.

Tyler Mordy: Using themes to balance growth and risk

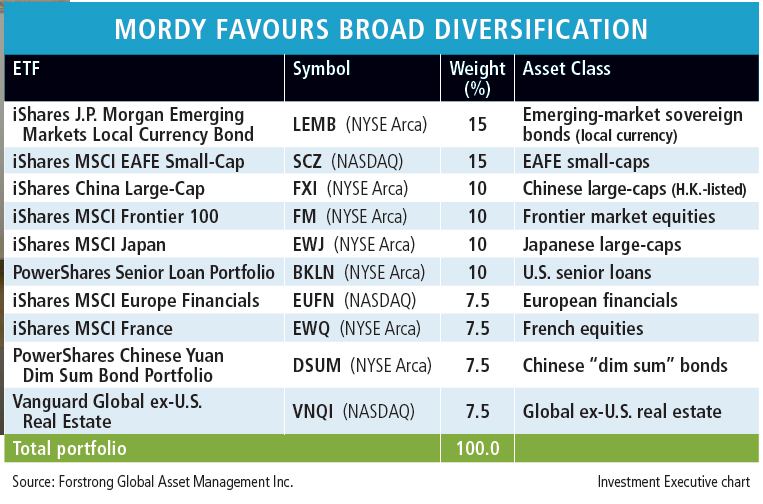

Mordy says his portfolio, which is built around investing themes, allows for risk management while providing access to opportunities. Overall, his selections are positioned to take advantage of what he calls “muted growth” in developed economies while avoiding “recurring balance sheet” issues. His picks also aim to participate in recent, consistent gains in emerging markets.

Mordy, unlike many portfolio managers, stays away from U.S. equities markets. In his view, the U.S. market now is in “late stage” growth, with corporate earnings trending downward. He also notes that the U.S. dollar (US$) has become an expensive barrier for Canadian investors.

The two largest holdings, which each represent 15% of the total, are iShares MSCI EAFE Small-Cap ETF and iShares Emerging Markets Local Currency Bond ETF.

Small-caps, Mordy says, are a high-value play as these firms stand to make large gains from improving credit conditions, rising consumer confidence and earnings growth. He also believes higher-yielding emerging-market bonds are attractive to institutional investors, given very low bond yields in developed markets.

Smaller holdings include a focus on Asia and frontier markets. Mordy’s selection includes 10% weightings in each of iShares MSCI Japan, iShares China Large-Cap and iShares MSCI Frontier Markets. In Japan, Mordy notes, “improving corporate profits recently hit a record high relative to [gross domestic product].” The yen is at its cheapest in 32 years.

Similar thinking about growth potential applies to China. Mordy believes that Chinese equities still have much upside potential, particularly in sectors that will benefit from consumer-led growth and financial reforms.

Frontier markets – mostly in South America, Africa and Eastern Europe – also have caught Mordy’s attention because of their potential for strong gains. These economies are “starting from an extremely low economic base and have the ability to embrace technology and tap into an increasingly urbanized work force, which can lead to a relatively long period of rapid growth,” Mordy says.

Lower-risk picks include PowerShares Senior Loan Portfolio, which Mordy uses to bolster yield and hedge against the possibility of higher interest rates in the U.S. The remaining 30% of the portfolio is allocated equally to Chinese “dim sum” bonds, global real estate, French equities and European financials.

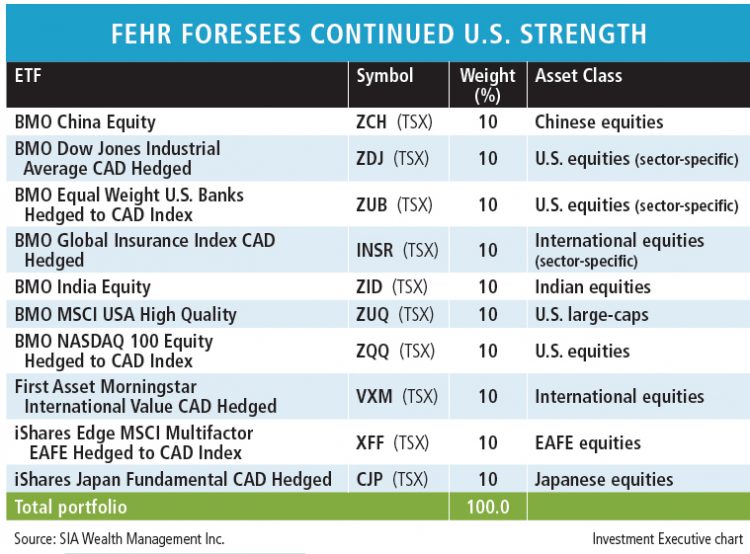

Jeremy Fehr: A technical analysis using equal weightings

Fehr selected 10 equally weighted ETFs for his sample portfolio, an approach based on the view that the odds for each asset class are generally about the same most of the time. “Equal weight allows us to capture this performance success,” he says, “without betting on which holdings will be our outperformers.” All of these holdings trade in Canadian dollars, with seven of the 10 hedging US$ currency risk to the Canadian dollar. Fehr says this strategy simplifies trading and currency risks.

In selecting the holdings, Fehr initially used his firm’s version of an “equity action call tool” to measure the pace, direction and flow of global equities. “If money flows are positive into equities, we stand a far better chance of having a positive outcome,” he says.

Fehr then conducted an analysis to assess which of seven asset classes – international equities, U.S. equities, Canadian equities, bonds, currencies, commodities or cash – are receiving the most positive cash flows on a global basis. He concluded that the top two asset classes in terms of cash inflows are international and U.S. equities.

Within those two asset classes, he chose ETFs using a relative strength analysis to determine which funds offer the best risk/reward benefits. Says Fehr: “In addition, we diversify within these ETFs to make sure that any overlap is minimized, both geographically and by sector.”

The resulting portfolio has a 30% exposure to broad U.S. equities markets, including allocations of 10% each to ETFs linked to dominant U.S. indices: the NASDAQ 100, the Dow Jones industrial average, and the MSCI USA high-quality index.

Fehr’s portfolio also has a 20% exposure to specific sectors: 10% to U.S. banks and 10% to the Russell developed large-cap insurance index. An additional 10% is allocated to First Asset Morningstar International Value ETF.

The remaining 40% of the portfolio is allocated to EAFE, Chinese, Japanese and Indian equities.