Canadian financial services companies are struggling in the wake of the sharp drop in oil prices, weak metals prices and sluggish global equities markets – and those conditions are likely to continue. Even with the recovery in oil prices in recent months, the price of oil remains low by historical standards.

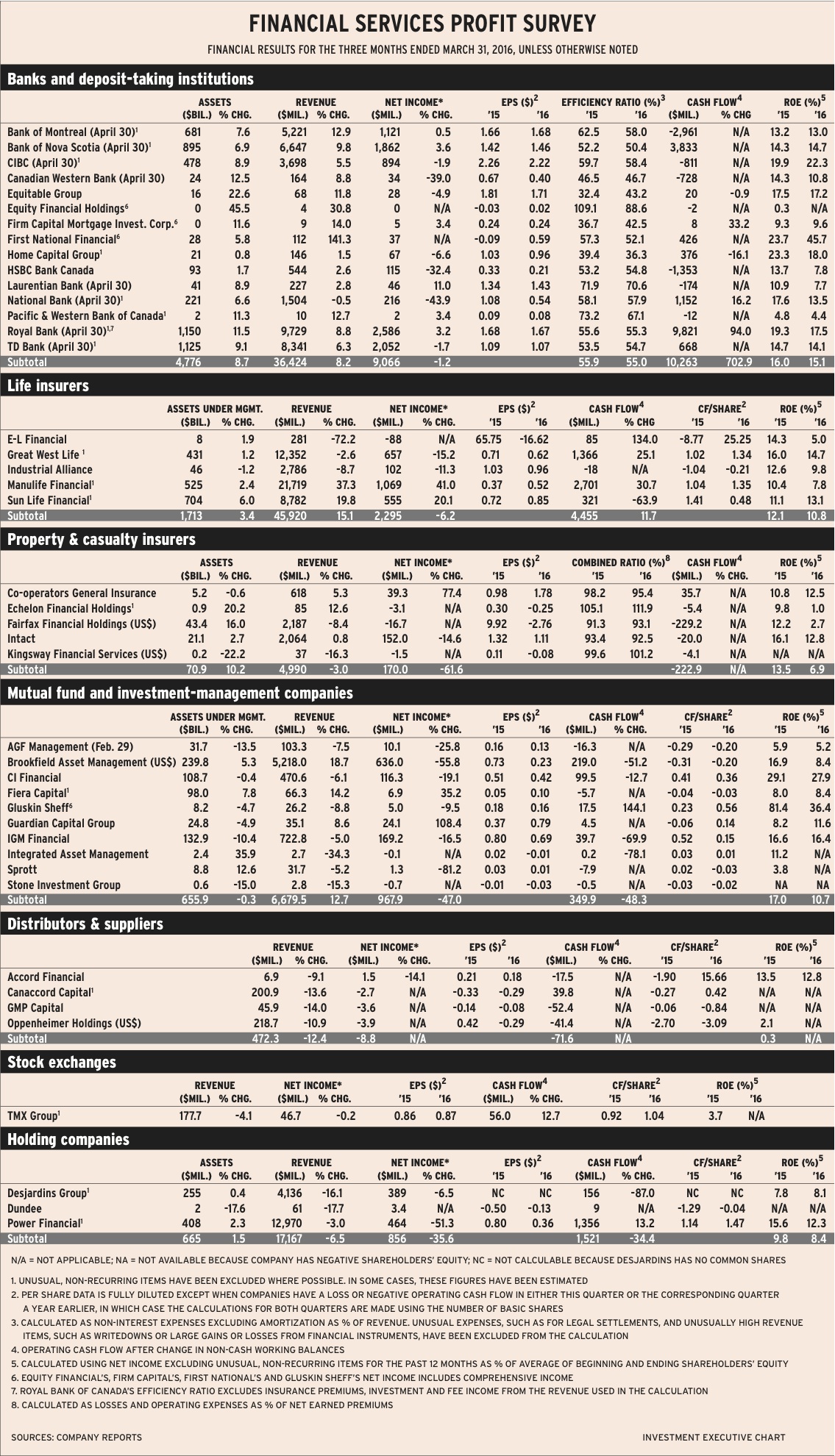

Net income was down by an average of 11.9% for the 41 companies in Investment Executive’s quarterly profit survey for the first fiscal quarter (Q1) of 2016. (These figures exclude Great-West Lifeco Inc. (GWL) and IGM Financial Inc., the results of which are consolidated in Power Financial Corp.’s figures.)

All subsectors had a decline in net income overall, although the earnings for the 15 deposit-taking institutions were down by just a minuscule 1.2% and the drop for TMX Group Ltd., the sole securities exchange in the group, was down by only 0.2%.

Still, compared with Q1 2015, 11 firms had higher earnings and three reported positive net income vs a loss. Six of those with increased profits were banks: that included three of the Big Five, the diverse operations of which generate many sources of income.

It’s noteworthy that six banks raised their quarterly dividends. This group included some that had lower earnings this quarter, such as Canadian Imperial Bank of Commerce (CIBC), Equitable Group Inc. and National Bank of Canada. The specific dividend increases were by Bank of Montreal (BMO), to 86¢ from 84¢; CIBC, to $1.21 from $1.18; Equitable, to 21¢ from 20¢; Laurentian Bank, to 60¢ from 58¢; and, National Bank, to 55¢ from 54¢. In addition, First National Financial Corp., raised its monthly dividend to 14¢ from 13¢.

In contrast, independent investment banks, including Canaccord Genuity Group Inc. and GMP Capital Inc., are fully exposed to the plunge in the shares of oil-related firms, as well as weak prices for the shares of mining firms. (See page 35.)

Mutual fund and investment-management firms also are vulnerable due to the lack of diversity in their businesses; these firms have little to fall back on when demand for the investment products they offer declines. Six of the 10 companies in this subsector (including IGM) had declines in net income in Q1 2016. Integrated Asset Management Corp. and Stone Investment Group Ltd. remained in loss positions.

Property and casualty (P&C) insurers also are “one business” companies. Only Co-operators General Insurance Co. had higher earnings in Q1 2016. Net income dropped at Intact Financial Corp., while Echelon Financial Holdings Inc., Fairfax Financial Holdings Ltd. and Kingsway Financial Services Inc. were all in a loss position. Echelon is sufficiently concerned about the future that it is suspending its dividend in order to provide capital for future growth initiatives.

Life insurers are more diverse because of their large wealth-management operations. Both Manulife Financial Corp. and Sun Life Financial Inc. had strong earnings gains. Two firms in this group announced increases in their quarterly dividends: Industrial Alliance Insurance and Financial Services Inc., to 32¢ from 30¢; and, Sun Life, to 40.5¢ from 39¢.

Here’s a look at the subsectors in more detail:

– Banks. There were seven firms with lower earnings.

Toronto-Dominion Bank (TD) and CIBC were the two big banks with lower net income, but both were down by less than 2%. The reason for the decline at TD was an impairment charge of $116 million related to TD’s direct investing business in Europe, which has continuing losses. The decline at CIBC was partly due to a $56-million increase in legal provisions.

Canadian Western Bank and National Bank had large increases in loan-loss provisions related to losses among customers in the oil and gas production industry. Canadian Western’s loan-loss provision rose to $39.7 million from $7.4 million a year earlier, while National Bank’s increased to $317 million from $57 million. HSBC Bank Canada was also hit with loan-impairment charges related to energy of $85 million vs $16 million.

Most other banks increased their loan-loss provisions, but not by nearly as much. In total, loan-loss provisions rose to $2.8 billion from $2.3 billion in the previous quarter and from $1.6 billion a year earlier. Loan-loss provisions haven’t been this high since 2009, shortly after the global credit crisis.

Home Capital Group Inc.’s net income declined by 6.6%. This was partially due to $1.4 million in losses at Calgary-based CFF Bank, which Home Capital purchased in October. Home Capital anticipates that CFF’s operating losses will continue in 2016.

– Life insurers. Manulife and Sun Life increased their earnings, while GWL and Industrial Alliance had declines and E-L Financial Corp. reported a loss.

Major factors in these results were the changes in the fair value of these firms’ investments. They increased more in Q1 2016 than a year earlier for both Manulife and Sun Life, but by less for GWL and Industrial Alliance.

E-L was hit even harder due to the strengthening of the Canadian dollar (C$), which reduced the value of foreign investments in C$. More than 84% of E-L corporate investments are in common shares and units that are denominated in foreign currencies.

GWL’s Canadian and U.S. operations produced lower net income, while European operations were up. Industrial Alliance’s group insurance was up, but individual insurance, individual wealth management, and group savings and retirement were down. At Manulife, Canadian operations were up, but the U.S. and Asia were down. At Sun Life, all regions’ operations were up.

– Property and casualty insurers. Co-operators, Fairfax and Intact made underwriting profits, while Kingsway and Echelon lost money.

All the P&C firms had lower investment income and/or losses in the fair market value of their investments. In the case of Fairfax, these results pushed it into a loss position.

– Mutual fund and investment-management companies. Only Fiera Capital Corp. and Guardian Capital Group Ltd. reported higher earnings. Fiera’s increase followed the acquisition of U.S.-based Samson Capital Advisors LLC last October, which added US$7.2 billion to its assets under management. Guardian had a gain of $11.8-million from the sale of 204,000 BMO shares. (Guardian received a large number of BMO shares when it sold its mutual fund business to BMO in 2001.)

Other declines in this subsector were substantial. Gluskin Sheff + Associates Inc. had the smallest decrease – still, a significant 9.5% – as performance fees pretty much dried up. Sprott Inc.‘s 81.2% drop was partly due to a $3-million impairment charge related to a management contract.

Brookfield Asset Management Inc.‘s 55.8% decline is due mostly to a smaller gain in the fair value of assets: $352 million vs $1.1 billion in Q1 2015.

AGF Management Ltd., CI Financial Corp. and IGM Financial Inc. all had quite steep drops in earnings. IGM had net sales in Q1 2016, but both AGF and CI were in net redemptions.

– Distributors and suppliers. The three investment bank/brokerages in this category were in the red. Accord Financial Corp.’s earnings dropped due to lower fees.

– Exchanges. TMX Group Ltd. has cut expenses, which kept its earnings mostly unchanged despite a 4.1% drop in revenue.

– Holding companies. Dundee Corp. had positive net income of $3.4 million vs a $38-million loss in Q1 2015, as the fair value of its real estate and precious metals investments rose. Desjardins Group‘s 6.5% decline was because Q1 2015’s net income was pushed up by gains in derivative hedges. Power Financial’s 51.3% drop was mainly because of a large impairment charge at its Europe-based subsidiary, Pargesa Holding SA.

© 2016 Investment Executive. All rights reserved.