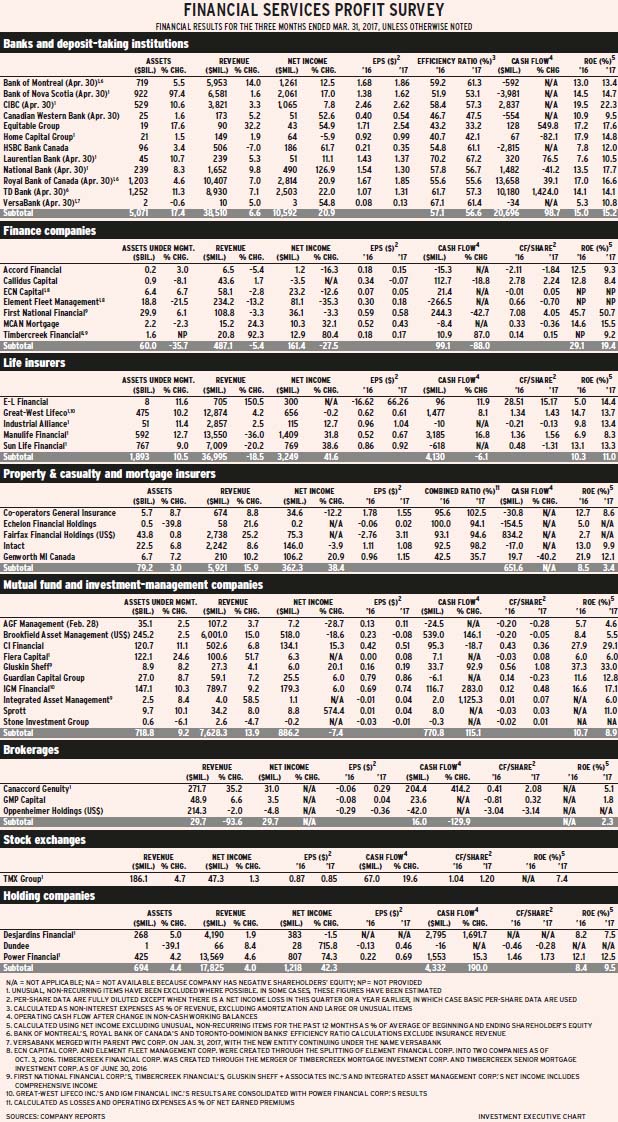

Many financial services companies’ earnings continued to increase, despite modest Canadian economic growth throughout the year and 14 of them were sufficiently optimistic that they raised their dividends.

Twenty-one of the 42 companies in Investment Executive’s profit survey for fiscal quarters that ended between Nov. 30, 2016, and Jan. 31, 2017, had increases in net income vs the corresponding period a year earlier. Five other firms reported positive net income vs a loss year-over-year. (These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., as the results of both are consolidated with those of Power Financial Corp.)

Overall, there was a 9.3% increase in net income. But, there were some very big swings among individual companies.

For example, Brookfield Asset Management Inc.’s net income dropped by US$1.1 billion, to US$97 million from US$1.2 billion, and Fairfax Financial Holdings Inc. reported a US$704.2-million loss vs positive net income of US$133.1 million in Q4 2015.

Without those two firms, the average increase in earnings for the other 40 was 25.8%.

The deposit-taking institutions, as a group, had a 19.8% earnings increase. Quarterly dividend increases were announced by: Bank of Nova Scotia, to 76¢ from 74¢; Canadian Imperial Bank of Commerce, to $1.27 from $1.24; Equitable Group Inc., to 23¢ from 22¢; Royal Bank of Canada, to 87¢ from 83¢; and Toronto-Dominion Bank (TD), to 60¢ from 55¢. Notably, most of the banks have increased their dividends at least once in the past year.

Three life insurance companies also raised their quarterly dividends: GWL, to 36.7¢ from 34.6¢; Industrial Alliance Insurance and Financial Service Inc., to 35¢ from 32¢; and Manulife Financial Corp., to 20.5¢ from 18.5¢.

The other companies announcing quarterly dividend increases in Q4 2016 included: Intact Financial Corp., to 64¢ from 58¢; Brookfield, to 14¢ from 13¢; Fiera Capital Corp., to 17¢ from 16¢; Guardian Capital Group Ltd., to 10¢ from 8.5¢; and Power Financial Corp., to 36.7¢ from 34.6¢.

First National Financial Corp. increased its monthly dividend to 15.4¢ from 14.1¢.

Here’s a look at the industries in more detail:

– Banks. Of the 12 deposit-taking institutions, only CWB and Home Capital Group Inc. had declines in net income.

CWB’s drop was minor, at 0.9% – impressively small, given the recession in Alberta, where many of CWB’s branches are located. The bank prudently took $39.7 million in loan-loss provisions in the spring of 2016.

Home Capital’s drop was much bigger, at 27.8%, mainly the result of much higher expenses year-over-year: $71 million vs $54.7 million in Q4 2015. Part of this is explained by two impairment charges totalling $12.8 million. The company has undertaken an expense-savings initiative aimed at saving $15 million a year.

HSBC Bank Canada’s return to profitability was the result of improving loan quality. The company was able to release $61 million in loan-loss provisions in Q4 2016 vs the $164 million in provisions it took in Q4 2015.

The Big Six banks had double-digit increases in net income, with all major divisions reporting stronger results. The biggest gain was National Bank of Canada’s 87.3% increase. However, that increase didn’t come from a surge in profitability this quarter; rather, year earlier earnings were weak because the bank wrote off an equity interest in Maple Financial Group Inc. to the tune of $145 million.

Allegations of inappropriate sales practices recently came to light at TD’s Canadian retail branches. A recent report from credit rating agency DBRS Ltd. states TD is expected to “proactively investigate the issues raised”; the report also “anticipates that regulators will be increasingly focused on this issue and [will] review sales practices, incentive compensation and whistleblower procedures at all banking institutions.”

Another development was the Jan. 31 amalgamation of VersaBank with its parent, PWC Corp. The new entity will continue operating as VersaBank. The company used previous unrecognized deferred income tax assets of $8.8 million in the quarter ended Jan. 31, 2017; resulting in a 427.9% increase in the firm’s net income.

– Finance companies. First National Financial and Timbercreek Financial Corp. had large earnings gains, while Accord Financial Corp., Element Fleet Management Corp. and MCAN Mortgage Corp. had drops. ECN Capital Corp. reported a loss vs positive net income in Q4 2015.

On Oct. 3, 2016, Element Financial Corp. split into two companies: Element Fleet, a global company providing management services and financing for commercial vehicle and equipment fleets; and ECN Capital, a North American equipment finance company.

– Life insurers. GWL, Industrial Alliance and Sun Life had earnings gains. Industrial Alliance’s huge 5,000% gain was because net income was pulled down sharply in Q4 2015 as a result of a large increase in actuarial reserves.

E-L Financial Corp. and Manulife had declines in earnings. E-L had much lower gains on investments this quarter vs Q4 2015, while Manulife had charges of $1.2 billion related to changes in financial markets.

– Property & casualty and mortgage insurers. Fairfax’s big loss dominates the results in this industry. The company focuses on investments and, in Q4 2016, it had losses on investments of US$1.1 billion vs a loss of US$200.1 million for Q4 2015.

Regarding the other four companies, their underwriting results mainly determine their earnings. Thus, higher underwriting profits resulted in increased net income at Co-operators General Insurance Co. and Genworth MI Canada Inc. However, declines in underwriting profits pushed down net income at Echelon Financial Holdings Inc. and Intact Financial Corp.

– Mutual fund and investment-management companies. Brookfield dominates this industry, accounting for 80% of the group’s revenue, and the company’s net income is very volatile due to changes in the value of its assets. In Q4 2016, Brookfield reported a drop of $130 million in the fair value of assets vs a $2.2 billion gain in Q4 2015.

Four of the other seven companies had increased earnings. Sprott Inc. reported $754,000 in net income vs a loss of 4.1 million loss in Q4 2015. CI Financial Corp. had a 4.6% decline in earnings. Fiera’s net income was down 31% but only because of amortization of intangible assets for acquisitions. Struggling firms Integrated Asset Management Corp. and Stone Investment Group Ltd. had losses.

Among the Big Three mutual fund companies, both CI and IGM had large net redemptions in Q4 2016 – $2.6 billion and $1.3 billion, respectively. These were the result of portfolio- management changes at institutional clients – something that happens from time to time and usually isn’t damaging for a big firm. In IGM’s case, the drop was at its subsidiary, Mackenzie Financial Corp. Investors Group Inc. and Investment Planning Counsel Inc. had net sales.

AGF Management Ltd. also was in net redemptions – which is more worrisome, as it’s a continuing trend.

– Brokerages. All three companies continue to struggle, which is not surprising, given anticipated volatility in financial markets. Canaccord Genuity Inc. had a big swing to net income of $4.5 million from a loss of $342.4 million in Q4 2015; that loss was due to a significant impairment charge. GMP Capital Inc. had a large increase in revenue, but its earnings remain low. Oppenheimer Holdings Inc. reported a loss.

– Exchanges. TMX Ltd. had positive net income vs a loss in Q4 2015, which had been caused by a $215.8-million impairment charge.

– Holding companies. Like the banks, Desjardins Group had a solid increase in earnings. Power Financial also did well, thanks to good performance at GWL and IGM.

© 2017 Investment Executive. All rights reserved.