Financial services companies reported better results in the third quarter (Q3) of 2016, vs a year earlier but that doesn’t mean firms are out of the woods. Canada’s economic growth is expected to remain sluggish this year and household debt continues to climb. The latter increases the possibility of rising personal bankruptcies, particularly if there’s a significant downturn in housing prices.

Also overhanging the outlook are the promises of U.S. president-elect Donald Trump. No one is sure what he’s going to do, but his platform included rewriting or dumping the North American Free Trade Agreement, which could be very negative for Canadian exporters. On the other hand, he promised to encourage fossil-fuel production and use, which could be positive for Canadian oil producers (especially if he approves the Keystone XL pipeline, which Barack Obama, the outgoing president, rejected).

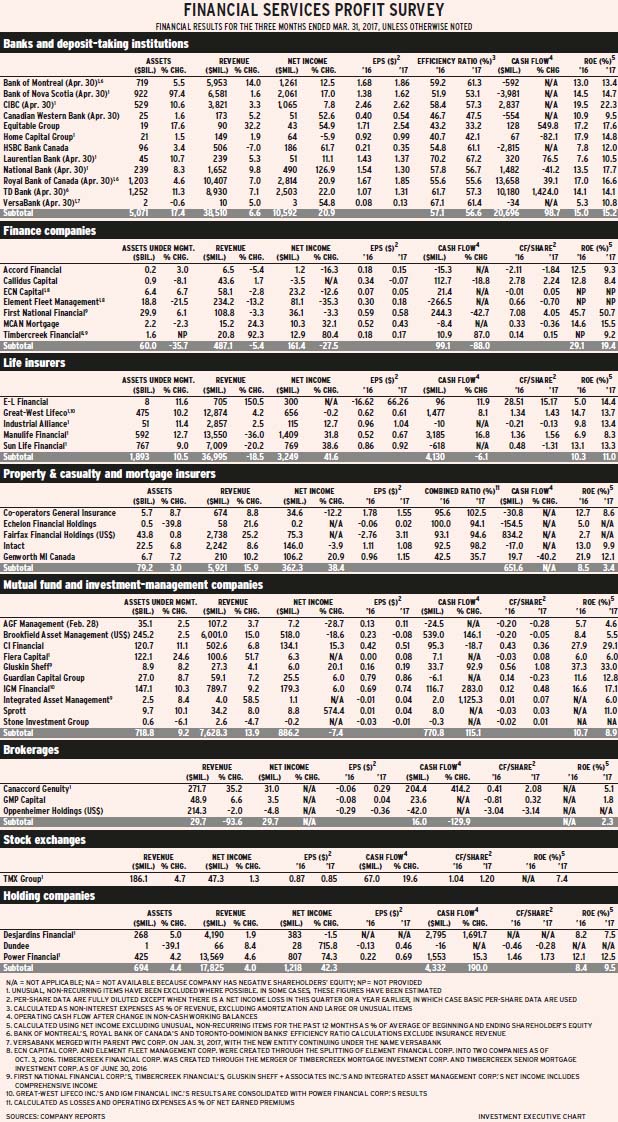

The majority of firms in Investment Executive‘s quarterly profit survey had higher earnings (20) or reported positive net income vs a loss a year earlier (five). However, there were 13 firms with lower net income and four in a loss position. (These figures exclude Great-West Lifeco. Inc. [GWL] and IGM Financial Inc., as the results for both are consolidated in those of Power Financial Corp.)

On an industry basis, the banks, finance companies, life insurers, mutual fund and asset-management companies, and holding companies reported increased earnings.

Six banks raised their quarterly dividends, a sure sign that they are optimistic about their future earnings prospects. Bank of Montreal‘s rose to 88¢ from 86¢; Canadian Imperial Bank of Commerce‘s, to $1.24 from $1.21; Equitable Group Inc.‘s, to 22¢ from 21¢; Home Capital Group Inc.‘s, to 26¢ from 24¢; Laurentian Bank‘s, to 61¢ from 60¢; and National Bank‘s, to 56¢ from 55¢.

There were only a few other dividend increases: MCAN Mortgage Corp.‘s rose to 30¢ from 29¢ and Sun Life Financial Inc.‘s rose to 42¢ from 40.5¢. As well, Callidus Capital Corp. announced that its monthly dividend will rise to 10¢ from 8.33¢ as of October.

Here’s a look at the industries in more detail:

– Banks. There was an average 5.3% gain in earnings for the 11 deposit-taking firms, but most of the increase was concentrated in the big banks.

The Big Six banks have broad operations encompassing retail and commercial banking, wealth management and capital markets. All these banks’ major divisions had higher earnings than a year earlier – except for Royal Bank of Canada‘s insurance operations, which were down marginally.

In contrast, most of the smaller banks have been struggling. These include Canadian Western Bank (CWB), Home Capital and HSBC Bank Canada.

CWB’s earnings have held up well, considering the negative impact of low oil prices. Earnings dropped by only 5.8% vs a year earlier and the bank continues to pay a 23¢ quarterly dividend.

HSBC also has been affected negatively by low oil prices, which have resulted in higher loan-impairment charges related to the oil and gas industry. In addition, HSBC’s costs rose due to increased investment to meet global regulatory standards, for risk and compliance activities, and for strategic initiatives aimed at lowering costs in the future.

Home Capital’s decline in net income was due mainly to higher expenses in the wake of issues regarding income verification for mortgages, which resulted in the suspension of 45 brokers who provided originations. The firm’s quarterly report also notes that changes to mortgage rules mandated by the government could have a dampening effect on the housing market.

– Finance companies. Two companies reported lower earnings: Accord Financial Corp.‘s drop reflected a decline in revenue; Callidus Capital Corp. raised its loan-loss provisions to $25.8 million from $7.5 million a year earlier.

The other four companies in this industry saw earnings rise strongly. First National Financial Corp., MCAN Mortgage Corp. and Timbercreek Financial Corp. are mortgage providers that have experienced strong growth in originations and, thus, revenue.

Element Financial Corp.‘s revenue and earnings were pushed up by the acquisition of GE Capital’s fleet-management operations in the U.S., Mexico, Australia and New Zealand in Q3 2015. (On Oct. 3, 2016, the company changed its name to Element Fleet Management Corp. after spinning off its commercial finance operations into ECN Capital Corp., a separate public company.)

– Life insurers. E-L Financial Corp., GWL, Industrial Alliance Insurance and Financial Services Inc. and Sun Life Financial Inc. had big gains in the fair value of assets vs losses in Q3 2015. This resulted in strong earnings gains for all but GWL, for which expenses rose sharply, leaving that firm with 8.7% lower net income.

Manulife Financial Corp. had lower gains in the fair value of investments vs Q3 2015, but still managed to generate a strong increase in earnings.

– Property, casualty and mortgage insurers. Underwriting results deteriorated for all five companies, as indicated by increases in their combined ratios. However, this was offset by investment gains, including increases in the fair value of assets, except for Fairfax Financial Holdings Ltd.

Indeed, the gains on the investment side were sufficient at Co-operators General Insurance Co. to more than offset its underwriting losses and put it in an overall profit position vs a loss in Q3 2015. Investment returns also were enough to push mortgage insurer Genworth MI Canada Inc.‘s net income up by 9.7%.

However, increases in the fair value of assets were not enough to offset lower underwriting profits at Intact Financial Corp., resulting in a 9.1% drop in net income vs Q3 2015.

Fairfax had losses on investments of US$199.5 million vs gains of US$425.6 million in Q3 2015. Fairfax is a sophisticated investor that makes extensive use of hedges and derivatives. That means the firm can record losses when other firms are reporting gains on their investments.

– Mutual fund and investment management companies. Results were mixed in this industry. Brookfield Asset Management Inc., Fiera Capital Corp., Gluskin Sheff & Associates Inc. and Guardian Capital Group Ltd. reported increases in net income. Sprott Inc. reported positive net income vs a loss in Q3 2015.

In contrast, AGF Management Ltd., CI Financial Corp. and IGM had lower earnings. Integrated Asset Management Corp. had a loss vs positive net earnings in Q3 2015.

AGF has been struggling for years and still posts net redemptions. It cut its dividend by two-thirds in Q4 2014.

CI and IGM remain solid companies, but face strong competition from the mutual fund operations of the big banks. Both CI and IGM posted net redemptions in Q3 2016.

While these big independent mutual fund companies struggle, Fiera continues to grow through acquisition. As of Sept. 30, its assets under management were almost equal to CI’s.

– Brokerages. The uncertainty that hovers over financial markets globally has hit most brokerages. Canaccord Genuity Inc. and GMP Capital Inc. also have been hurt by low oil and metal prices due to having major customers in the resources sector. With oil prices rising in the quarter, both Canaccord and GMP managed to report positive net income vs a loss in Q3 2015. Still, profits remain low by historical standards.

Oppenheimer Holdings Inc., which operates entirely in the U.S., was in a loss position.

– Exchanges. TMX Ltd. reported a 30.4% earnings gain, thanks mainly to lower costs.

– Holding companies. Desjardins Group had a healthy 12.2% increase in net income; Power Financial’s earnings were down, reflecting the drops at GWL and IGM; and Dundee Corp. remained in a loss position, as its many resource investments continue to struggle. IE

© 2017 Investment Executive. All rights reserved.