A big challenge to provincial government finances in fiscal 2016 is the effect of drastically lower oil prices on their revenue. In some provinces, the immediate budgetary impact is harsh; in others, the impact is muted or may have a silver lining.

Given the demanding economic environment, the provinces, by and large, appear to have taken a reasonable approach in their 2016 budgets.

“They used conservative assumptions, had a good mix of measures and are taking advantage of low interest rates to borrow more temporarily,” says Sebastien Lavoie, assistant chief economist with Laurentian Bank of Canada in Montreal.

The drop in oil prices has played havoc with budgets in Alberta and Newfoundland and Labrador, with both provinces expecting large deficits for fiscal 2016 (ending March 31, 2016). However, this is likely to be a short-lived problem. Oil prices are expected move to back to profitable levels within the next few years.

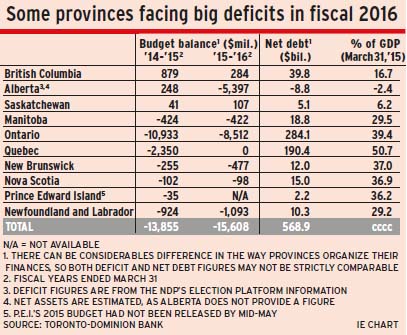

Saskatchewan has a budget surplus – despite its oil exposure – and British Columbia is also in surplus. Both have low debt levels – 6.2% and 16.7%, respectively, of gross domestic product (GDP) as of March 31, 2015 – and good economic growth prospects. Saskatchewan has potash and uranium resources, as well as oil. B.C. benefits from diversified export markets, including those in Asia, and will get a big shot in the arm if liquefied national gas (LNG) projects go ahead as expected.

Although the economic picture is not as bright in other provinces, the decline in oil prices will give them some breathing room by increasing economic growth and, thus, revenue.

Lower oil prices mean consumers have more to spend after filling their gas tanks and businesses benefit as their energy costs fall. In addition, the drop in the Canadian dollar vs the U.S. dollar (US$), which has accompanied the oil price decline, makes Canadian firms more competitive in the U.S., where demand has been rising as that economy accelerates.

This situation should help debt-laden provinces meet deficit- and debt-reducing targets, although the challenges for Ontario and New Brunswick remain daunting. Ontario’s plan to eliminate its deficit by 2018 requires average expenditure growth of just 0.3%. New Brunswick’s new Liberal government still is developing a plan to get rid of its deficit by 2021.

Meanwhile, Quebec is expecting a zero balance this year and Nova Scotia is targeting a similar outcome for 2017. Manitoba doesn’t expect a surplus until 2019; reaching that goal before then would require cutting core services.

The situation in Prince Edward Island is unclear; the Liberals didn’t bring down a budget before winning the May 4 election, although the 2014 budget forecast was for a zero balance this year.

However, none of these provinces are out of woods. Most have high debt burdens – 29%-40% of GDP for Nova Scotia, P.E.I., Ontario and New Brunswick, and 50.7% for Quebec.

Infrastructure was a theme in many provincial 2016 budgets. Saskatchewan announced a four-year, $5.8-billion program, and Manitoba is in the second year of its $5.5-billion program. Ontario added more to its infrastructure spending, and Quebec is accelerating its program. The Alberta chapter of the New Democratic Party (NDP), which won the May 5 provincial election, also is likely to place priority on infrastructure, particularly for health, education and transit.

Most provinces chose to constrain growth in spending rather than raise taxes in their 2016 budgets. However, there will be some tax hikes:

– New Brunswick will impose a 21% tax on taxable income between $150,000 and $250,000 and 25.75% on $250,000-plus vs 17.84% previously for both ranges.

– Newfoundland and Labrador is placing a tax rate of 14.3% on taxable income of $125,000-$175,000 and 15.3% on $175,000-plus as of July 1. Taxpayers previously had been taxed at 13.3%. The province also is raising its portion of the harmonized sales tax to 15% from 13% and raising its financial corporation capital tax rate to 5% from 4%.

– The Alberta NDP’s platform includes a 12% levy on taxable income between $125,001 and $150,000, 13% on $150,001-$200,000, 14% on $200,001-$300,000 and 15% on taxable income greater than $300,000. Previously, all Albertans paid 10%.

These increases would be accompanied by a reversal of various fee increases put in by the Conservatives in their pre-election budget, including the cancellation of a new health-care premium.

The new government also plans to raise the corporate income tax rate to 12% from 10%.

– Manitoba increased its financial corporation capital tax rate to 6% from 5%.

– New Brunswick was the only province to announce a significant tax cut, dropping its small-business tax rate to 4% from 4.5% despite the province’s difficult financial situation.

Here’s a brief look at the economic prospects for the provinces:

– British Columbia. The province continues with expenditure restraint and a conservative approach that doesn’t factor in the expected LNG activity, which will give a boost to economic growth as LNG projects produce a large flow of revenue when production starts.

However, there is concern that B.C. may lose a teachers’ union court case that could cost the province $1 billion. Controlling spending with increased immigration from the rest of Canada also may be difficult.

– Alberta. Growth prospects could be reduced if the NDP government’s review of the oil and gas royalty structure results in higher royalties. The NDP also plans to raise the minimum wage to $15 an hour from the current $10.20 by 2018.

– Saskatchewan. Economic growth tends to be steady here – usually, at least one natural resource industry is performing well.

– Manitoba. It has a diversified economy with steady growth prospects that will benefit from the current infrastructure program.

– Ontario. Economic prospects were enhanced by recently announced investments in the automobile sector. Ontario also has appeased credit-rating agencies by deciding to sell some assets – specifically, up to 60% of Hydro One – to fund needed infrastructure. Ontario is counting on persuading unions to accept no wage increases and, where that is not possible, finding spending cuts elsewhere to offset the higher salaries.

– Quebec. The Liberals have made excellent progress on the fiscal front. Even though they were elected last April, they have found the $7.2 billion in savings needed to balance the budget. The government also is making changes to the tax system, accelerating the infrastructure program and has a credible debt-reducing plan.

– Nova Scotia. Growth will benefit from federal shipbuilding contracts for the next 30 years. Nevertheless, the province raised a slew of user fees and lowered or eliminated some tax credits.

– New Brunswick. This is the most challenged of the provinces because it has no strong growth drivers to offset the drag from its aging population. The province may follow Ontario’s lead and monetize assets in order to get rid of its deficit.

– Prince Edward Island. This province should benefit from increased tourism, as lower gas prices make driving trips more attractive, particularly to Americans, who also will find prices inexpensive in US$ terms.

– Newfoundland and Labrador. As long as oil prices rise, the province “is very likely to be able to unlock its enormous oil potential and to bring back its public finances into a sustainable path,” Lavoie says. “They have been for most of the past decade.”

© 2015 Investment Executive. All rights reserved.