Have the discussion year-round

Help clients recognize the tax benefits both for this year and in the future

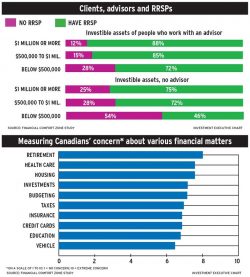

Only 31% of Canadians intend to contribute to their RRSP in 2013, down from 39% last year, according to a Scotiabank poll

The Concenta-Olympia group of appeals has met with a set-back in the Tax Court of Canada

Benefits of expansion need to be weighed against the costs, says Fraser Institute report

Canada Pension Plan should allow 35% of a worker’s income to be replaced in retirement, up from 25%

More than half of eligible Canadians say they are going to put off contributing until the last 48 hours

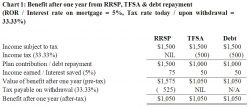

With interest rates low, does it still make sense to pay down debt? Or is contributing to an RRSP, or even a TFSA, a wiser choice? Jamie Golombek offers his advice.

Many Canadian unaware of available investment choices

Fund companies report sizable boosts in sales volumes