A taxpayer who over-contributed to his RRSP by mistake and gained no benefit from the error has failed to gain relief from the taxes that resulted. However, the Tax Court of Canada only reluctantly found for the government in the case. In the concluding remarks of the October judgment in Hall v. The Queen, Justice […]

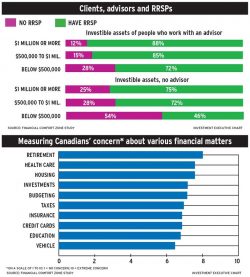

However, the percentage of taxpayers contributing to an RRSP continues to decline

Although Canadians are worried about their retirement, lack of money to invest and other financial priorities are the two big reasons why many won’t contribute to their RRSPs

Clients seeking diversification are looking beyond government bonds

With the TFSA having become a worthwhile option for your clients, it’s time to consider whether an RRSP has the same allure as it once did for certain investors

Take the opportunity to plan next year’s contributions

The average contribution for those who have already contributed was $3,984

Almost eight in 10 Canadians between the ages of 18 and 33 are unaware their RRSPs could help them buy their first home or help them go back to school, TD survey finds

Families in which one spouse has no or little independent income may find that using a spousal RRSP remains a helpful way to split income. Knowing that the non-earning spouse has assets in his or her own name also can be a comfort

A new OSFI report also finds that the use of registered pension plans dropped, in percentage terms, during the past 10 years