Nevertheless, investors are confused about their investment performance and the fees their advisors and firms charge for investment advice

The new regulatory system will necessitate advisors to follow incredibly detailed requirements

A fresh CRM2 debate has arisen among integrated fund dealers

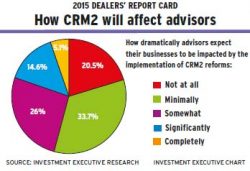

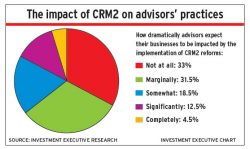

About half of the advisors who ply their trade with Canada's mutual fund and full-service dealers have a litany of concerns about the challenges that the implementation of CRM2 could mean for their businesses

Parallel orders provide dealers until the end of the year to implement new requirements relating to market value, position cost and account statements

There is no need to be the cheapest advisor on the street

Panel discusses dealers’ role in helping advisors face any negative consequences that may arise when compensation reports become mandatory

As CRM2 ramps up, more advisors are offering ETFs and fee-based accounts

Advisors ready for CRM2 changes

Notice details MFDA’s answers to frequently asked implementation questions