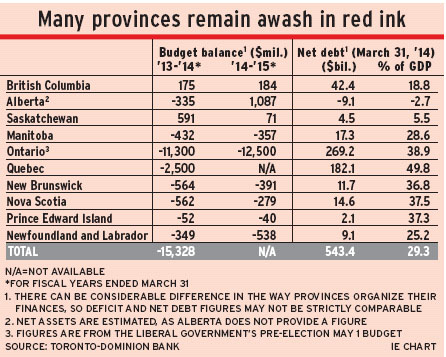

With economic growth remaining modest this year, most of Canada’s provinces continue to tighten their belts. Even British Columbia and Saskatchewan, which both have budget surpluses and relatively low debt loads, are looking at spending increases of only 1%-1.5% in this fiscal year, ending March 31, 2015. Alberta and Newfoundland and Labrador are the exceptions.

Alberta is embarking on a major infrastructure plan that will boost spending by 3.7%. The province certainly can afford this, as it’s projecting $1.1 billion surplus this year and no net debt.

Newfoundland and Labrador is planning a 5.7% increase in expenditures. That province still is in deficit and its debt load is 25.2% of gross domestic product (GDP) as of March 31, 2014. However, debt is down dramatically from the peak of 69.2% in 1999 and the provincial budget promises a return to spending restraint and a budget surplus in fiscal 2016.

The other six provinces don’t have the same wiggle room. Ontario is particularly worrisome, but New Brunswick and Nova Scotia also have very serious challenges. And Quebec’s debt burden, at 49.8% of GDP, remains a continuing concern.

Ontario’s direction will be determined in its June 12 election. If the governing Liberals win either a majority or another minority, the May 1 budget – which called for a 2.7% increase in spending this year and deficits projected to 2018 – is likely to pass with only few alterations.

But if the Progressive Conservatives (PCs) win a majority, it will be a new ball game. PC leader Tim Hudak says he would balance the budget by 2016 by cutting 100,000 people from the civil service over the next two years, lowering spending in every area except health care and implementing an across-the-board wage freeze, including for members of provincial parliament. The civil-service cuts would reduce total employment in the province by a manageable 1.5%, but it’s a scary number for those who might be affected.

If Hudak’s party achieves only a minority government, he would have to compromise to get enough support to govern, which probably would mean more spending restraint than in the Liberal budget, although probably not enough to balance the books before 2017 at the earliest.

New Brunswick’s budget projects deficits until 2018 – and this depends on unspecified spending cuts and/or revenue increases of $125 million in 2016, $225 million in 2017 and $300 million in 2018. The lack of detail is probably because the governing PCs don’t want to specify future bad news before the September election.

The new Liberal government in Nova Scotia has a less rosy picture of the province’s finances than did the former New Democratic Party (NDP) government, which was ousted in the October 2013 election. The Liberals don’t think surpluses are likely until 2018 – even with the harmonized sales tax (HST) being kept at 15% rather than reduced to 14% this year and 13% in 2015, as the NDP had planned.

Nova Scotia is experiencing net emigration, which challenges its ability to keep the standard of living from dropping. To address this, the NDP appointed a commission to “look into building our new economy.” The resulting report, released this past February, talks about the need for attitude changes in the province to encourage growth-enhancing policies, such as immigration and properly regulated resources industries.

The Liberals are appointing a One Nova Scotia Coalition to work on this, and the party also set up a regulatory and tax review panel, expected to report this autumn.

There’s a new government in Quebec, with the Liberals defeating the Parti Québécois in the April 7 election. The Liberals haven’t yet produced a budget, but they have confirmed that they plan to balance the books by 2016. The party also says that any future surpluses will be divided equally between tax cuts and debt repayment.

Manitoba is targeting 2017 for its return to surplus – and that’s with a five-year, $5.5-million infrastructure program.

Prince Edward Island expects a balanced budget in 2016.

Most of the provincial budgets had no taxation changes. The exceptions were British Columbia, Ontario and Newfoundland and Labrador – although Quebec also is likely to introduce tax changes.

B.C. had several tax breaks for children and homeowners, but it also raised its medical premiums and tobacco taxes.

The budget proposed by Ontario’s Liberals increased taxes on high-income individuals, tobacco and aviation fuel. That budget also proposed the creation of an Ontario Registered Pension Plan (ORPP), which will require mandatory contributions by employees as well as employers who don’t already have a plan in place. (See story on page 10.)

The NDP, for its part, is promising to cut the small-business tax rate and raise the minimum wage. The PCs would lower the corporate tax rate but also eliminate all corporate grants.

Newfoundland and Labrador is cutting its small-business tax rate and raising tobacco taxes.

Quebec’s Liberals have promised to phase out the health tax and to introduce several targeted personal tax breaks.

Here’s a look at the recent provincial budgets in more detail:

– British Columbia. This province projects surpluses going forward, but with continued modest spending increases averaging around 2% a year – including contingency reserves. There were modest targeted tax breaks, including an early childhood tax benefit of up to $55 a month for each child under six years of age for families with net income of up to $100,000 as of April 2015, and an increase in eligibility for the first-time homebuyers property transfer tax exemption. But tobacco taxes were increased immediately, and there will be a 4% rise in the medical services plan premium as of Jan. 1, 2015.

B.C. is getting ready for liquefied natural gas (LNG) production and will be tabling legislation for taxing it in the coming months. Revenue from this won’t start for at least three years, but it could be very lucrative – as much as $1.4 billion in tax revenue for a single LNG plant; the province promises to put a portion of the revenue into a prosperity fund.

– Alberta. Infrastructure was the main focus in this budget, with $19.2 billion to be spent on municipal infrastructure, highways and new health-care and educational facilities by the end of fiscal 2017. Although $12.2 billion will be financed by debt, the province will remain in a net asset position. The province also will spend $1.1 billion on flood recovery projects.

– Saskatchewan. Although there were some program and service enhancements for seniors, children, families and those with disabilities, as well as about a 5% increase in infrastructure spending, overall expenditures are projected to rise by only 1.5%. Saskatchewan has had surpluses every year since fiscal 2005 and its net debt is only around 6% of GDP, down from a peak of 33.6% in 1994.

– Manitoba. This was another budget focused on infrastructure – a $5.5-billion program over five years, focused on roads and bridges. Health and education spending will rise by 2%-2.5% but that’s being offset by freezes or cuts elsewhere. Other measures include enhancement of the tax credit for companies hiring new apprentices, additional daycare spaces and enhanced support for those with low income and for seniors.

– Ontario. The centrepiece of the Liberal government’s budget is the ORPP, a defined-benefit plan modelled on the Canada Pension Plan.

This budget also proposed increasing the personal income tax rate on taxable income of $150,000-$200,000 to 12.16% from 11.16% for 2014 and imposing a 13.16% tax (which used to apply just to those with income of $515,000 or more) on those with income of $220,000-$514,000. There also were increases for tobacco and aviation fuel and a small offset in the removal of the “debt retirement” charge for residential electricity usage. The budget also included a $2.5-billion jobs and prosperity fund to encourage business investment and a 10-year, $29 billion transportation infrastructure plan.

The NDP is promising to raise the minimum wage to $12 an hour from $11 and to provide an offset for small businesses by reducing that tax rate to 3% from 4.5% (both items over two years).

The PCs would lower the corporate tax rate but haven’t specified by how much or the timing.

Both the NDP and the PCs say they would lower energy costs.

– Quebec. The new Liberal government plans to cut spending by $1.3 billion in the next two years. But it has also promised several tax breaks, including: phasing out the health tax; a home-renovation credit; a tax-deductible property savings plan to help with first-time homebuyers’ down payments; and a refundable tax credit for physical fitness, arts and cultural activities for those aged 60 or older and with net income of less than $40,000.

– New Brunswick. The few new spending measures included a 3% increase in social assistance rates as of this past April and an additional $27 million for the province’s drug plan.

– Nova Scotia. This budget eliminates the efficiency tax from hydro bills as of Jan. 1, 2015, but killed the graduate retention rebate as of Jan. 1. There also were measures to ease the burden of tuition costs and student-loan repayment, plus increased support for home-care services, capping of class sizes for Grades 1 to 2 and modernization of the apprenticeship system.

– Prince Edward Island. Spending restraint – with program spending basically flat this year and next – is key to returning the budget to balance in 2016. This budget did, however, include some health initiatives for children and a new provincial chief health expert is to be appointed.

– Newfoundland and Labrador. The small-business tax rate will be reduced to 3% from 4% as of July 1 and tobacco taxes were increased. This budget also contains enhancements to seniors’ and low-income earners’ benefits, continuation of the tuition freeze, conversion of student loans to non-repayable grants, and full-day kindergarten by 2016.

© 2014 Investment Executive. All rights reserved.