Stock-pickers need some volatility

Mutual fund families that used a stock-picking portfolio-management style soared last year

- By: Catherine Harris

- February 12, 2019 October 31, 2019

- 00:15

Mutual fund families that used a stock-picking portfolio-management style soared last year

Wellington-Altus chairman Charlie Spiring is entering a new venture to do what he does best: Create wealth

There’s support for the CSA’s proposals, but criticism of regulators

Escalation of the U.S./China trade war is the biggest risk

Tax Court decision may limit the scope of the advantage tax

Most companies had improved earnings, but slower growth will mean smaller increases in profits

The new CEO of PWL is focused on embracing technology and bringing in young advisors to help the firm attract clients

Gauging Canadian millennials’ knowledge of investing

The significant market downturn many experienced may have translated into an aversion toward investing

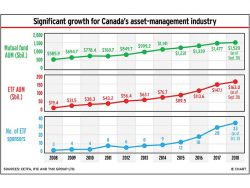

Long gone are the days when mutual funds and ETFs were two solitudes. Having both products has proven to be a winning strategy

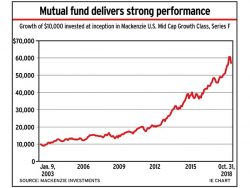

Mutual Fund Manager of the Year: Mackenzie portfolio manager Philip Taller focuses on out-of-favour stocks

Many hurdles remain for the CMRA before it becomes a reality

Richardson GMP’s new focus is on intergenerational wealth transfer

Technology also played a critical role in the proliferation of products such as ETFs during the past 10 years

The trend toward fee awareness may be contributing to some investors' growing dissatisfaction with their advisors

New guidelines recommend how much investors should save for retirement, but there are causes affecting the ability to save

There is about $233 billion held in TFSAs. The vehicle marks its 10th anniversary next month

The increase in interest rates and government borrowing will lead investors toward higher-quality government bonds

Mutual funds sales slump reflects investors’ risk-averse mentality

A divided industry awaits SCC ruling on national regulator

Fiera/Canoe deal could be the beginning of a broader relationship

Banks and asset-management firms in this country are failing to keep pace with their global counterparts

Top Under 40 Award winner's dedication to underserved communities is a reflection of where the industry is heading

Investor advocates cite lack of “best interest” standard

Common strategy’s wording problematic