This article appears in the April 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Business-owner clients struggling to absorb the cost of rising Canada Pension Plan (CPP) payroll contributions over the past five years will get little relief when the second stage of CPP expansion begins in 2024.

Most business owners are unaware the change is coming, said Armando Minicucci, tax partner with Grant Thornton LLP in Toronto: “I had two clients reach out to me [in March] about how significant their CPP contributions, or their payroll remittances, are. I had to say to them, ‘Wait another year. You’re going to be contributing [on] the second earnings ceiling.’”

Beginning next year, employers and employees each will contribute 4% on earnings between the existing “year’s maximum pensionable earnings” (YMPE) threshold and a new “year’s additional maximum pensionable earnings” (YAMPE) threshold. (See table below.)

The YAMPE will be set 7% higher than the YMPE in 2024 and 14% higher than the YMPE in 2025 and thereafter, with both thresholds indexed to inflation. The Canada Revenue Agency estimates the YMPE will be $69,700 and the YAMPE will be $79,400 in 2025.

CPP contributions for earnings between the YMPE and YAMPE will be made in addition to the 5.95% contributions, up from 4.95% in 2018, that employers and employees each pay on earnings between the fixed $3,500 exemption amount and the YMPE.

“Keep in mind, [CPP contributions] are also front-end loaded,” Minicucci said. “At the beginning of the year, all of [an employee’s] earnings are subject to CPP contributions. It’s not until the employee is at the max that [that the employer and employee] stop contributing, so at this time of the year, [employers] are looking at their payroll remittances and wondering why they’re so high.”

Business-owner clients are being squeezed by higher inflation, a tight labour market and increased payroll costs. In 2023, employers will pay $3,754.45 in contributions for each employee with earnings at or above the YMPE threshold of $66,600, an increase of 44.7% from what they paid in 2018.

“When you consider the CPP contributions [employers] are making at a time when employees are also looking for bigger raises because of the inflation rate, certainly some business owners will feel the pain just from a cash-flow perspective,” said Jason Heath, managing director of Objective Financial Partners Inc. in Markham, Ont.

“Companies are very reluctant to reduce staff because of how difficult it has been to [hire],” said Andrew Pyle, senior investment advisor and portfolio manager with CIBC Wood Gundy in Peterborough, Ont. “So they’re caught in this situation where they’re not able to do the things they would have done in the past to adjust their operations to [account for] additional cost overlays, whether it’s CPP or anything else.”

In 2016, the federal government announced it would introduce enhancements to CPP that would have benefits ultimately cover 33% of Canadians’ annual eligible pensionable earnings, up from 25% prior to the change. The move was meant to address concerns that too many Canadians were unprepared financially for retirement, particularly those without access to a workplace pension.

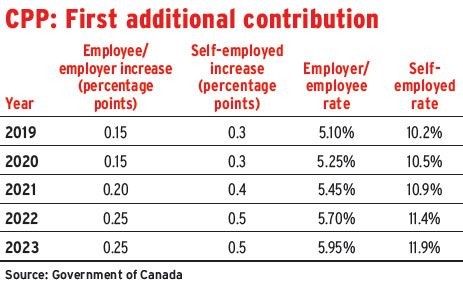

Between 2019 and 2023, contribution rates on earnings up to the YMPE threshold were increased annually and incrementally, and known collectively as the “first additional contribution.” Contributions on earnings between the YMPE and YAMPE, which will be phased in over the next two years, will be called the “second additional contribution.” Both additional contribution amounts will be tax-deductible for employees, while base contributions up to 4.95% remain refundable tax credits.

Once employees retire and begin drawing CPP, they will receive the base CPP plus an enhanced portion based on their lifetime contributions.

“CPP is a very generous program for employees,” said Todd Sigurdson, director of tax and estate planning with IG Wealth Management in Winnipeg, adding that he supports the introduction of the CPP enhancements.

Aaron Hector, private wealth advisor with CWB Wealth in Calgary, agrees. “CPP adds a nice protective floor to clients’ retirement situation, so I still see this enhancement as a net benefit overall,” he said.

Nonetheless, payroll remittances such as CPP “are the toughest tax to deal with when you’re trying to grow a business,” said Corinne Pohlmann, senior vice-president of national affairs with the Canadian Federation of Independent Business. “Not only did CPP go up this year, but EI went up too, so it was a double whammy of a year.” The maximum annual employment insurance premium for employers rose to $1,403.43 in 2023, up by 5.2% from 2022.

“When you hire somebody, you don’t just factor in how much you pay them; you factor [in] how much [in] taxes you have to pay on top of that,” Pohlmann added.

Employers who consider cutting other costs in response, such as scaling back workplace pension plans, may find such strategies “easier said than done,” according to Heath. “Employees may not appreciate the fact that their employer is contributing more to their CPP, because they don’t really see or notice it.

“Probably the best way from an overall financial perspective is to raise the cost of your goods or services to try to absorb the higher cost [of payroll contributions],” Heath added.

Pohlmann said the CFIB has been asking the government to consider freezing CPP or EI contributions for a small-business sector facing higher borrowing rates and still recovering from pandemic-era lockdowns. The CFIB also has suggested temporarily reinstating the small-business job credit, which existed from 2015 to 2016 and lowered EI premiums.

CPP enhancements: Past, present and future

Working Canadians 18 and older make Canada Pension Plan (CPP) or Quebec Pension Plan contributions based on their earnings between a fixed exemption amount of $3,500 and the year’s maximum pensionable earnings (YMPE) threshold.

Under the expanded CPP, contribution rates on earnings up to YMPE were increased annually. Self-employed people must contribute both the employer and employee amounts.

Beginning in 2024, a second, higher limit, known as the year’s additional maximum pensionable earnings (YAMPE), takes effect. This new range spans the YMPE and the YAMPE. Both the YMPE and the YAMPE will be indexed to inflation.

CPP contributions between the YMPE and YAMPE will be 4% each for the employer and employee, and known as the second additional contribution. (Self-employed people will pay 8% as their second additional contribution.)

Both additional contribution amounts are tax-deductible for employees, but the base contributions of 4.95% up to the YMPE threshold are non-refundable tax credits. All employer CPP contributions are tax-deductible.

The additional contribution amounts are held in the CPP in a separate account, but still form part of the CPP.

Self-employed clients pay double

Sole proprietors must contribute both employer and employee portions of the Canada Pension Plan (CPP), even though they receive the same benefits as everyone else. Incorporated business owners may pay themselves a salary or dividends, which are not subject to CPP contributions.

Financial advisors say many incorporated individuals choose to take a salary to create RRSP contribution room and to allow them to contribute to the CPP, even though it means contributing both the employer and employee amounts.

“If you’re looking to create a guaranteed fixed income in retirement, participating in the CPP to the full extent possible does make sense,” said Todd Sigurdson of IG Wealth Management.