The expert:

Tim McElvaine, founder of Victoria-based McElvaine Investment Management Ltd., and portfolio manager of the McElvaine Value Fund.

The philosophy:

McElvaine, a “deep value” portfolio manager who does not have a sector bias, uses a bottom-up approach to select stocks that are relatively cheap but have good long-term growth potential. He also looks for companies that “have staying power” and management who have significant “skin in the game.”

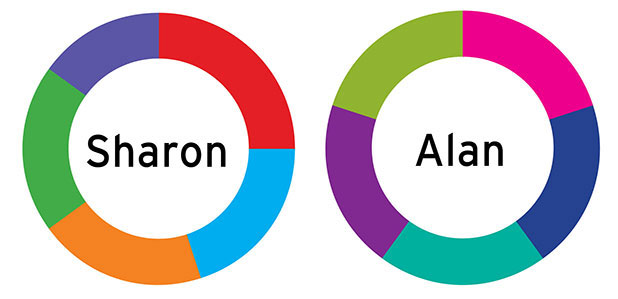

The scenario:

Sharon, 45, inherited $10 million after her mother died

The allocation:

25% in cash or equivalents for liquidity and to take advantage of buying opportunities.

20% in financial stocks, such as Jefferies Financial Group (NYSE: JEF), Fairfax Financial Holdings Ltd. (TSE: FFH), Onex Corp. (TSE: ONEX) and Berkshire Hathaway Inc. (NASDAQ: BRK.B). All are non-bank firms with strong upside potential.

20% in small-caps with good long-term growth potential, such as Montreal-based Knight Therapeutics Inc. (TSE :GUD), a pharmaceutical firm; Calgary-based Maxim Power Corp. (TSE: MXG), an independent power producer; and Texas-based Howard Hughes Corp. (NYSE: HHC), a real estate developer.

20% in Asian and emerging markets equities, such as Hong Kong-based CK Hutchison Holdings Ltd. (HKG: CKHUY), a port developer that McElvaine called “very cheap”; and Toronto-based Fairfax India Holdings Corp. (TSE:FIH-U). McElvaine said Asian emerging markets are expected to benefit from significant pro-cyclical growth.

15% in energy and materials stocks, such as Tourmaline Oil Corp. (TSE: TOU), Whitecap Resources Inc. (TSE: WCP) and PrairieSky Royalty Ltd. (TSE: PSK) — all based in Calgary. McElvaine said the three companies have “aggressive” environmental, social and governance programs.

The scenario:

Alan, 40, received an unexpected employment bonus of $10,000

The allocation:

McElvaine said Alan can afford to be somewhat aggressive, assuming that the windfall is a surplus and that he has at least 20 years to retirement. McElvaine suggested the following holdings to maximize long-term growth:

20% to AdvisorShares Ranger Equity Bear ETF (NYSE Arca: HDGE), an alpha-seeking solution to manage volatility and to hedge market risk, in lieu of cash.

20% to Knight Therapeutics Inc.

20% to Fairfax India Holdings Corp.

20% to CK Hutchison Holdings Ltd.

20% to Maxim Power Corp.

The expert:

David Kletz, vice-president and portfolio manager with Forstrong Global Asset Management Inc. in Toronto.

The philosophy:

Kletz prefers to invest with ETFs. His recommendations have a value bias as he expects value stocks to “catch up to growth stocks.” In the fixed-income space, he “skipped over the U.S. and Europe, which do not offer much yield.” While yields also are low in Canada, investing domestically “makes sense in terms of currency exposure,” he said.

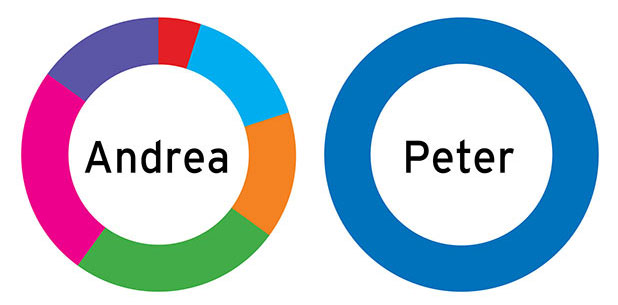

The scenario:

Andrea, 35, inherited $10 million from her grandfather

The allocation:

“If you come into such a large inheritance at a young age, it makes sense to prioritize growth,” Kletz said. “Income to offset living expenses should also be a priority.”

He recommended the following six ETFs:

5% in the CI High Interest Savings ETF (TSE: CSAV) as a volatility buffer and to provide additional liquidity.

15% in the BMO Aggregate Bond Index ETF (TSE: ZAG) as a portfolio stabilizer and to offset risk from the other recommended ETFs’ equities holdings.

15% in the iShares J.P. Morgan EM Local Currency Bond ETF (NYSE Arca: LEMB), which offers exposure to emerging markets debt as well emerging markets currencies, “which have a lot of upside potential,” Kletz said.

25% in the Vanguard FTSE Canadian High Dividend Yield Index ETF (TSE: VDY). Canadian dividends are taxed more advantageously than regular income.

25% in the iShares Core MSCI Global Quality Dividend Index ETF (TSE:XDG), which offers exposure to high-quality dividend-paying stocks in the U.S., Asia-Pacific and Europe. However, Kletz warns:“This ETF is a little more defensive and investors might be sacrificing some upside potential.”

15% in the CI WisdomTree Emerging Markets Dividend Index ETF (TSE: EMV.B), an income-oriented ETF that stands to benefit from pro-cyclical expansion in emerging markets.

The scenario:

Peter, a 28-year-old novice investor, received a $10,000 employee bonus

The allocation:

Peter should prioritize growth in a well-diversified, low-cost portfolio, given his long-term investment horizon, Kletz said.

100% in Vanguard’s Growth ETF Port folio (TSX: VGRO), which has a 80% equities/20% fixed income mandate. This globally diversified asset-allocation ETF invests in seven underlying ETFs.

Kletz said VGRO is “growth-oriented, low-cost and well-diversified.” He said asset-allocation ETFs are an efficient way of investing for novices because portfolio rebalancing is done by the portfolio manager to account for changing market conditions. As well, “allocations in the ETF are static, while its risk profile remains constant.”