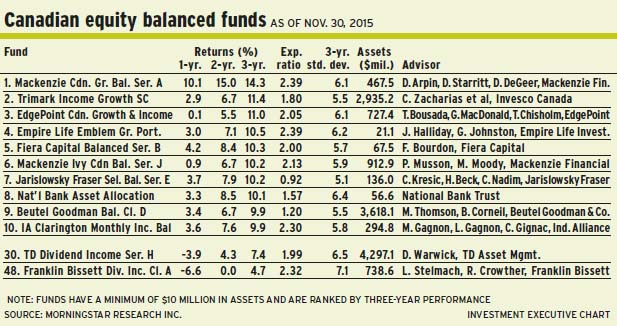

Canadian equity balanced funds generated returns in 2015 that ranged from meagre to slightly negative, as sectors such as resources were punished and fixed-income securities provided modest relief. Moving into 2016, some fund portfolio managers, including Clayton Zacharias, vice president at Toronto-based Invesco Canada Ltd., are reluctant to make a call on the market’s direction; others, including Doug Warwick, managing director at Toronto-based TD Asset Management Inc., are more optimistic.

“We don’t spend time trying to predict markets,” says Zacharias, lead portfolio manager of Trimark Income Growth Fund. “But based on our bottom-up work, in trying to find investments that meet our criteria, equity valuations are not cheap – especially for quality companies.”

Zacharias shares portfolio-management duties with Invesco vice presidents Alan Mannik and Mark Uptigrove on the equities side of the portfolio and with vice president Jennifer Hartviksen on the fixed-income side.

“Yes, the market is down,” Zacharias says. “But keep in mind that we have had a six-year run and equity valuations have gone up quite dramatically. A lot of the performance was driven by expanding multiples as opposed to underlying earnings growth.”

Zacharias argues that valuations prior to last autumn’s market weakness were already frothy, so a 10% correction does not signify much, given lofty share prices: “It’s definitely a better environment today for finding opportunities than it was six months ago. But we’re not tripping over a long list of compelling opportunities. We’re finding more select opportunities.”

Zacharias believes that parts of the beleaguered energy sector offer value: “Although the sector won’t recover in the near term, the valuations and the risk/reward for select companies are very attractive.”

Valuations for financials, which also have taken a bit of a hit, are reasonable, at about 11 times earnings – although, Zacharias notes, the market is nervous about both its exposure to the energy sector and vulnerability to a potential decline in real estate prices that could affect residential mortgages.

“With those two big headwinds, earnings growth will be pretty modest in the next couple of years,” says Zacharias, “probably in the low- to mid-single-digit range. That’s being priced into stocks.”

About 65% of the Invesco fund’s assets under management (AUM) is in equities, 25% is in fixed-income and 10% is in cash.

Regarding the fixed-income portion, Hartviksen has set the bond portion’s duration at 3.5 years, vs 7.5 years for the benchmark FTSE TMX Canada universe bond index, based on her expectation that the U.S. Federal Reserve Board will raise interest rates this winter. The bulk of the bonds are investment-grade corporate bonds.

Thirty-one names comprise the equities portion of the portfolio of the Invesco fund, which recently acquired shares in Cenovus Energy Inc., which produces about 267,000 barrels of oil equivalent per day from its oilsands operations.

“We don’t how long it will take to see a recovery in oil prices,” says Zacharias. “But the kind of company you want to own has to be one with high-quality, low-cost assets, a very strong balance sheet and a management team that gives you confidence that the company will survive this tough period.”

Cenovus stock is trading at about $20.45 a share and pays a 3.3% dividend. There is no stated target.

The past year’s malaise is attributable to investors who have pulled out of Canada and invested elsewhere, observes Warwick, lead portfolio manager of TD Dividend Income Fund.

“There’s less money chasing the same names, so prices tend to go down,” Warwick says. “But at some point, investors will realize that Canada is much cheaper and other markets will have had their run. [Investors] will come back.”

From a macroeconomic perspective, Warwick argues, Canada’s weak dollar will provide a strong tailwind and make Canadian manufacturers more competitive in 2016.

Warwick also is counting on the strength of the U.S. economy: “We have a strong U.S. consumer who is able to enjoy the low cost of imported goods because of the high dollar. U.S. home-building is also picking up, finally. With the U.S. as our largest trading partner, Canada will benefit from that.”

He believes that rising interest rates are on the horizon and, in his view, that is not such a bad thing. Warwick, pointing to in-house studies into historical equities market trends, notes that equities generally respond to rising interest rates in a positive manner because they indicate that economies are strengthening.

“I’d expect the same correlation going forward,” Warwick says. “But the Federal Reserve won’t run rates up by one or two percentage points over the next two years. I’d say there will be one to three increases over the next 18 months or so. But it will be very slow and modest.”

Rate increases are possible in Canada, he adds, thanks to inflationary pressures from government deficit spending. “But the hikes will be modest,” he says.

About 21% of the TD fund’s AUM is in bonds – 13% in corporate bonds and 8% in government bonds. That fixed-income portion, with a duration of seven years, is overseen by Geoff Wilson, managing director of TD.

On a sectoral basis, about 42% of AUM is in financials, followed by 10% in a blend of energy stocks and pipelines, 6.4% in telecom, 5.4% in industrials and smaller holdings in real estate.

One top name in the predominantly Canadian TD fund, which has about 70 equity and income-trust holdings, is Enbridge Inc., a leading North American oil and liquids pipeline operator.

“This is an energy infrastructure company that is not sensitive to the price of energy. People need oil, whether it’s at US$100 a barrel or US$40 a barrel,” says Warwick. Moreover, Enbridge has a $44-billion project backlog, of which $32 billion has been approved, but not yet built.

Enbridge stock is trading at about $48 a share and pays a 3.9% dividend. There is no stated target.

Another favourite is Brookfield Asset Management Inc., a global conglomerate with interests in commercial properties and in infrastructure and related subsidiaries. Brookfield stock is trading at about $46.50 a share and pays a 1.4% dividend.

“[Brookfield’s] yield is lower than that of its subsidiaries,” Warwick says. “But, over time, the earnings in the parent company will grow faster than its subsidiaries. We expect to get double-digit cash-flow growth.”

For some bottom-up portfolio managers, such as Ryan Crowther, vice president at Calgary-based Bissett Investment Management Ltd., the market downturn creates a bullish mood.

“When we see markets pulling back, we see valuations compress. To us, this represents more optimism about where future returns will be,” says Crowther, portfolio co-manager of Franklin Bissett Dividend Income Fund. He is assisted by Les Stelmach, portfolio co-manager and vice president at Franklin Bissett.

“But this [mood] all comes back to the individual securities,” Crowther says. “Our research and fundamental approach is bottom-up. We look for securities that have a better risk/reward than in general. The volatility that we’ve seen in the market represents opportunity for us.”

Volatility began to accelerate with the decline in the oil price in the autumn of 2014, says Stelmach: “But there is now a higher level of volatility due to a combination of ultra-low interest rates and a lot of momentum investors chasing particular themes. It’s not a happy time when markets are going down.

But the combination of declining market prices and greater volatility does increase the opportunities – if you are being vigilant about them.”

Indeed, some of the opportunities have been in energy infrastructure plays that are less cyclical in nature, but have been hit by declining commodity prices.

Although the Franklin Bissett fund’s portfolio managers are well aware of economic headwinds such as rising interest rates and China’s slowing economy, which will hurt Canadian resources players, Crowther argues that he and Stelmach focus on companies that are well positioned to manage these challenges.

“If [stocks] are cyclical or commodity-priced based,” Crowther says, “we want to be sure we own companies that can weather these storms. When it comes to higher interest rates, we’re always thinking about that.”

He notes that the Franklin Bissett fund is run on a total-return basis, using a discounted cash-flow methodology that relies on interest rate assumptions to determine a stock’s attractiveness.

About 14% of the Franklin Bissett fund’s AUM is in corporate bonds with an average duration of 5.8 years. There also is 3% in preferred shares, and 83% in equities. In regard to equities, 63% of AUM is in Canada and 20% is in the U.S.

From a sectoral viewpoint, 36.4% of the equities portion is in financials, followed by 22.5% in energy and 10.8% in industrials, with smaller weightings in sectors such as consumer staples and health care.

One top holding in the 62-stock Franklin Bissett portfolio is Inter Pipeline Ltd., an Alberta-based petroleum transportation and natural-gas liquids-extraction firm.

“[Inter Pipeline’s] profitability has not been impacted by the decline in commodity prices. Yet, sentiment is poor and these kinds of stocks have come back on our radar screen as interesting investments,” says Stelmach, noting that the Franklin Bissett fund acquired the stock last spring. “Inter Pipeline is a really good example of that. [It has] pretty stable, cash-generating assets.”

Inter Pipeline stock is trading at $23.10 a share and pays a 6.75% dividend. Although there is no stated target, says Crowther, “the stock is significantly undervalued.”

Another favourite holding is Canadian National Railway Co. (CN).

“Historically, [CN’s] execution has been very impressive. The efficiencies [CN has been] able to drive through [its] system have been a huge source of earnings growth,” says Crowther. “CN continues to surprise beyond people’s expectations.”

CN stock is trading at about $80 (18 times forward earnings). It pays a 1.56% dividend.

© 2016 Investment Executive. All rights reserved.