New advisors looking for mentorship in the full-service and mutual fund dealer space may face business obstacles that many of their peers in other parts of the industry don’t. That was among the key takeaways from Investment Executive’s 2025 Dealers’ Report Card.

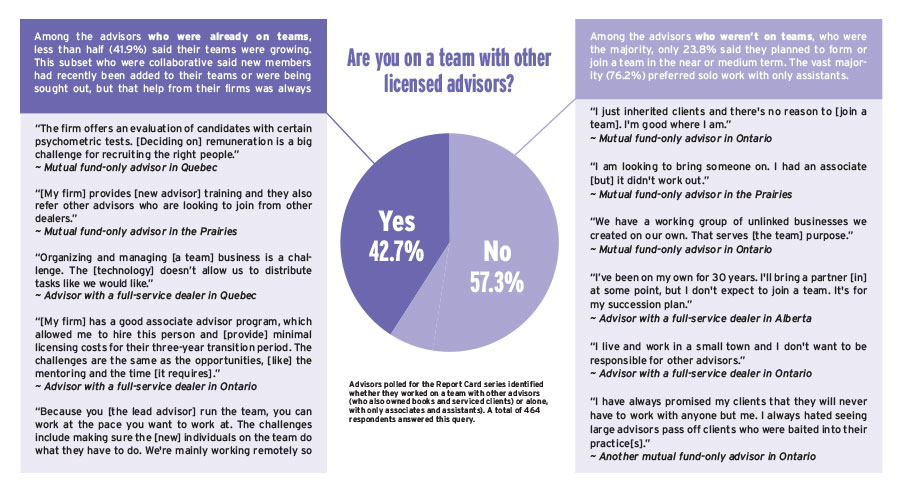

Among all dealer advisors surveyed, less than half (42.7%) said they were part of a team. While that marked a small increase from 39.5% in 2024, these team advisors remained in the minority. This means the dealer segment is still predominantly made up of independent professionals who tend to work outside of large teams and training-heavy corporate structures. (See Are you on a team.)

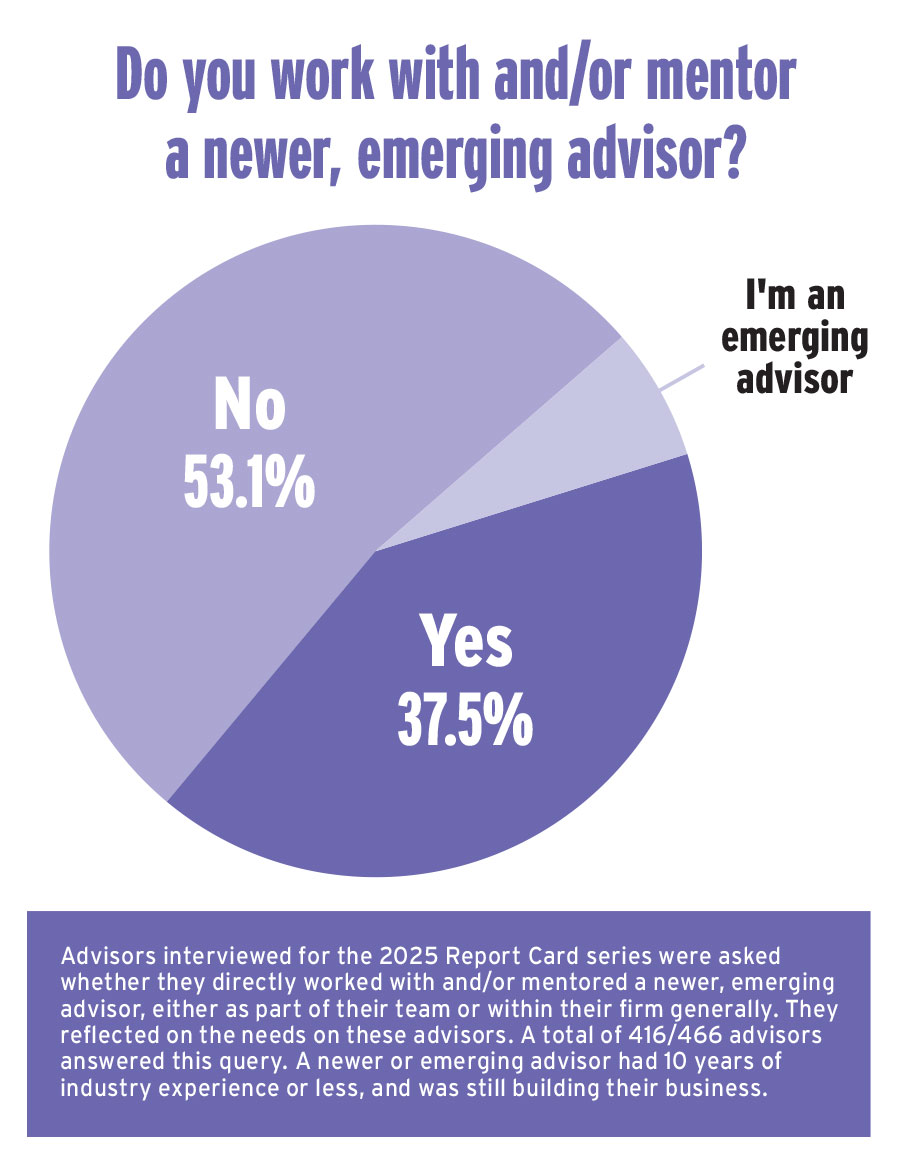

That’s tough for newer advisors who are looking for collaboration and peer-learning opportunities, especially since only about one-third (37.5%) of all respondents said they worked alongside or guided a newer advisor. (See pie chart.)

It wasn’t surprising, then, that just 9.4% of advisors in our sample described themselves as a developing advisor in the book-building phase.

“Many mature dealer advisors just don’t have time to closely guide their peers, even if it’s one of their goals,” said IE’s research editor Katie Keir. “It’s a shame because there’s so much experience to draw from. The average age of these advisors is over 50 and most have worked for 20-plus years.”

Several in this mature group understood how crucial a team can be for a rookie.

“They need mentorship [and] someone to work with,” said an advisor in British Columbia with Investia Financial Services Inc. “It’s pretty much impossible to start on your own.”

“Join a team and learn that way. Otherwise you can’t survive,” said a Manulife Wealth Inc. advisor in Ontario.

Help wanted

New advisors generally agreed with their senior colleagues on what they needed to learn — client communication skills and business management basics, for example. But there was real frustration when it came to getting help.

“Senior colleagues should be available to support us,” said an advisor in Ontario with CI Assante Wealth Management. “We should be coming together and helping each other become better advisors.”

Others have been lucky enough to make connections: “My one friend has been in the industry [for a long time] and we share a lot of ideas. We share the same assistant,” said a Sterling Mutuals Inc. advisor.

Adopting the business-owner role was the biggest obstacle for an advisor in Ontario with Desjardins Financial Security Investments Inc. (DFS Investments). “My experience prior to this was on the retail banking side and switching over meant I need[ed] a business mindset. My mentor helped me a lot with this.”

J. Lynne Stewart, a strategic business coach and consultant suggests new advisors won’t find success immediately. “New advisors are probably a legitimate five years in before they create those efficiencies,” she added. (No external sources were given access to IE’s specific research results, as Report Card results are kept confidential until publication.)

In the absence of organic collaboration with senior advisors, newer professionals need options. And at least some industry leaders recognize that.

Richard McIntyre, president and CEO of Manulife Wealth, said his firm revamped and relaunched its Wealth Advisor Development Program in January 2025. The two-year program teaches emerging advisors how to design and run their practice, and deliver high-quality advice.

New in-person bootcamp seminars are on offer, too, for advisors who want more guidance.

“We also have a lot of study groups,” McIntyre added, and through that “we see a lot of mentoring between advisors.” Manulife Wealth had incalculable results for the “business development & marketing support” category in 2025; it was rated 5.7 for “advisor education & development.”

Louis DeConinck, president at Investia Financial Services, draws a distinction between financial-advice mentoring — which he feels should be directed by advisors’ peers — and training on a firm’s tools.

“We’re going to make sure that we teach them [newer advisors] how to maximize the business, maximize the tools and have an easy business process so [that] we can [help] grow your business,” he said. The firm was rated 6.0 and 7.0 respectively for the business development and advisor education categories.

Doce Tomic, chairman and president at Worldsource Wealth Management Inc. said the firm’s approach will change in the next six to 12 months, making life easier for new advisors.

“We don’t have as much of a formalized program in place,” he said. But DFS Investments does and, “We’ll be leveraging that.” This development stems from Desjardins Group’s purchase of the firm in 2023.

Worldsource Wealth was rated 7.3 and 8.3 for the business development and education categories.

DFS Investments confirmed it’s “working closely” with Worldsource on this.

“As a dealer with multiple distribution networks, [we’re] full of young professional advisors,” said Rachel Simard, who recently became senior vice-president, partner networks at Desjardins Group.

There are already mentorships between Desjardins advisors who are collaborating on book transitions, plus there’s rookie training on personal branding and marketing. DFS Investments was rated 7.7 and 8.4 in the business development and education categories.

So, while the business development category was again one of the lowest-rated for average performance by dealer firms (its 2025 average was 7.6, only slightly up from 7.4 a year ago), there’s reason for optimism.

For now, though, the dealer space is tough on newcomers.

“It’s a very competitive industry,” Stewart said, where opportunities for growth and success are uneven, and where a push for new advisor training is required.

Click image for full-size chart

Click image for full-size chart

This article appears in the September 2025 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.