Staying ahead of the changes

As the end of the tax year approaches, advisors can help their clients by alerting them to potential savings in their taxes owed. These strategies…

- By: Jim Middlemiss

- October 12, 2016 November 9, 2019

- 23:00

As the end of the tax year approaches, advisors can help their clients by alerting them to potential savings in their taxes owed. These strategies…

The CRA is marching Canadians toward filing their taxes online for convenience and efficiency. But with that convenience comes vulnerability. How can your clients protect…

The pursuit of tax evaders and avoiders is ramping up around the world. Canada has several new measures and programs to track offshore accounts, including…

Three of the Atlantic provinces, hobbled by debt and population losses, resorted to tax hikes in their latest budgets

Clients can designate three main types of beneficiaries for their TFSAs: a successor holder a named beneficiary or an estate. Each type is subject to…

While tax exemptions that apply to some permanent life insurance policies will be tightened up next year, advisors insist insurance will remain a valuable tax-planning…

Hillary Clinton and Donald Trump have completely divergent proposals on how to deal with U.S. estate taxes. Here's what to keep in mind for your…

The Internal Revenue Service now extends its reach to Canadian mutual funds held by American citizens who live in Canada. Know the rules so you…

Skyrocketing home prices in Vancouver and Toronto are attracting the attention of the CRA, which is boosting its surveillance of the higher-value transactions to look…

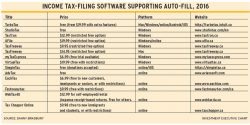

The 2016 tax-filing deadline may seem far off, but filing an annual income tax return is a task your clients should be mulling over during…

The new Canada child benefit, introduced this past summer, replaces the Canada child tax benefit and the universal child care benefit. The CCB can be…

Investors will no longer be able to switch from one fund to another within these structures without potential tax liability, but tax strategies such as…

While the Harper government was a strong proponent of tax credits, many experts suggest that these credits cost Canada more than they are worth because…

Numerous changes are in the works to make the tax code more coherent while making the pursuit of tax evaders and closing the so-called "tax…

An advisor's 55th birthday and 25th anniversary in the business inspires questions about the development of a succession plan. The best advice combines the benefits…

Many advisors have noted that making the transition from building an initial client base to taking their book to the next level can be difficult.…

Debbie Hartzman, an advisor with Professional Investments Inc. in Kingston, Ont., has a diverse business background. Since entering the financial advisory business 22 years ago,…

For clients who will be away for extended periods, there are several issues they should consider, such as U.S. tax laws, travel insurance and home…

Rosemary McCracken's third Pat Tierney mystery delivers an entertaining read with familiar themes: Muddled estates, messy records and the value of sharp questions

Controlling spending, reducing debt and increasing savings can help your clients reach their goals. And when clients see the results of their efforts, they will…

Strength training is particularly effective in improving brain function, according to new research. And forget cramming: Sleep, if timed correctly, can help you learn more…

By failing to implement a succession plan, you may be neglecting your responsibilities to your clients. Here are steps you can take to ensure the…

Files stored on your computers can be lost through hardware failures or software faults. Either way, you have options for an attempt to recover your…

By cultivating relationships with accountants, Nicholas Hounsell has learned that building a business means networking - and much more. Planning and client communication are core…

Commuting by car, the way that 80% of Canadians get to their place of work, can be bad for your health. And the longer your…