On average, participants in this year’s Advisors’ Report Card rated the collective importance of their technology-suite tools between 8.8 and 9.2 out of 10, indicating how crucial these tools are for their daily work. That’s not exactly headline news, but the results are notable given those same advisors rated their tools’ performance less consistently — across the brokerage, dealer and retail bank spaces, the 2025 collective performance results in the digital area ranged from 7.9 to 9.2 on average.

The top-rated technology area, “support for remote system access & transactions” received a 9.2 for collective performance, exactly matching its importance average for 2025 and reflecting how wealth firms have proactively been supporting advisors’ need to work from anywhere since the pandemic.

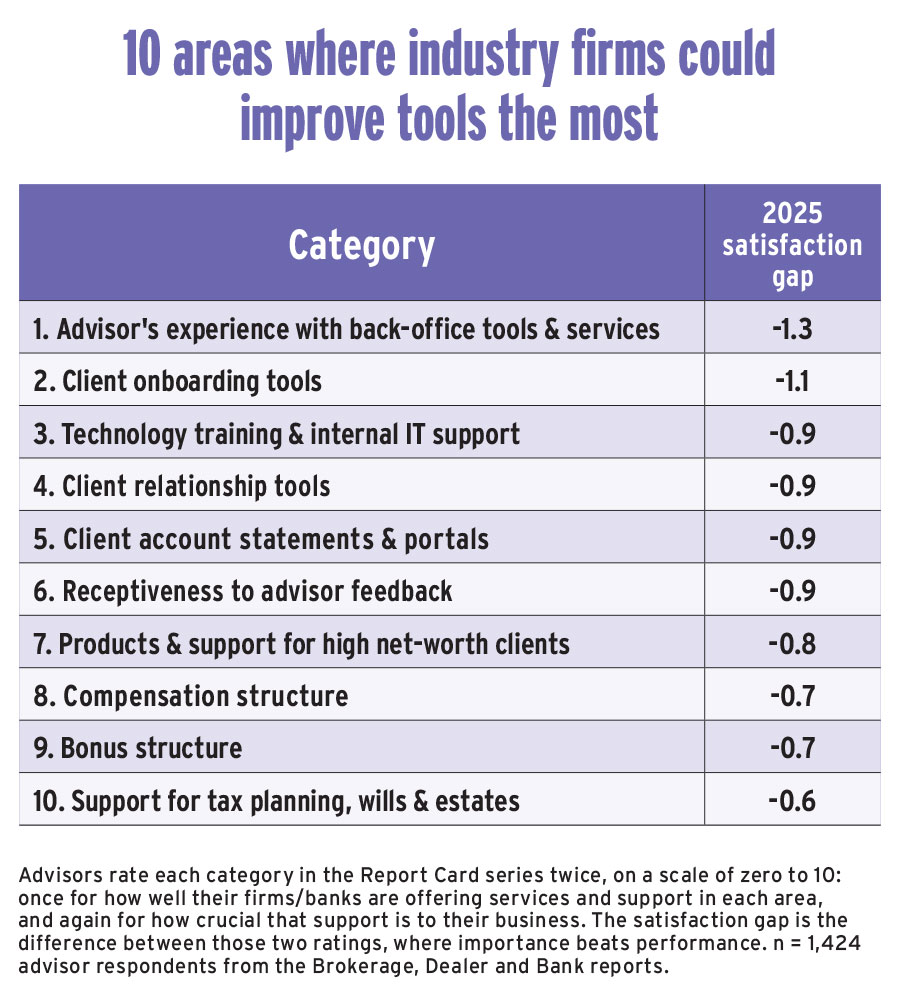

In contrast, the lowest-rated technology categories across the three channels were “client account statements & portals” and “advisor’s experience with back-office tools & services,” both rated 7.9 and trailing their importance averages by a significant margin (0.5 or more).Despite millions of dollars in ongoing investment, the tech stack across wealth firms has remained a stubborn source of contention.

Advisors in the Report Cards often share frustrations with interoperability gaps, miscommunication during the rollout phase for new tools, and insufficient training and support. The 2024 Advisors’ Report Card and those that preceded it also revealed large gaps between advisors’ expectations and their tools’ performance. These gaps and glitches all contribute to implementation misfires.

In fairness, technology rollouts are notoriously complicated, particularly in the wealth management industry. To get further insight, Investment Executive spoke to two software vendors to learn how practice management technology firms design, implement and support the technology they deliver. Conquest Planning Inc. provides an enterprise financial advice platform with a presence in Canada, the U.S. and U.K., while Envestnet Inc. specializes in wealth management technology with facilities in the U.S., U.K., India and Australia.

What the people want

There were advisors surveyed for the 2025 Report Cards who complained that some software they’re provided doesn’t play well with the rest of their tools.

“It’s creating a world of extra work,” said a retail bank advisor in the Prairies. “We have to reinput our comments and do [repetitve] work.”

A retail bank advisor in Quebec said, “There is room for improvement. Our system is archaic. [The] CRM takes a lot of clicks to select several elements that are not grouped together.”

Before a vendor customizes software for a wealth management firm, it must understand that wealth firm’s business and what an advisor’s day looks like, said Ken Lotocki, chief product officer with Conquest Planning.

Software developers conduct journey mapping, shadowing an advisor to see how they use technology day-to-day from logon to logoff, Lotocki said.

Observing what advisors click on and the order of operations helps inform software developers on how to optimize an advisor’s workflow, said Anuj Gupta, head of sales engineering with Envestnet. Involving advisors also makes them feel heard.

Communicating expectations

Vendors expect the firms they serve to clearly communicate their expectations, Lotocki said. “When there’s a breakdown in communication … that could potentially lead to issues down the road.”

A business requirements document is key, Lotocki added.

Once the vendor knows what the average advisor’s front-end experience is like and what a wealth firm wants to achieve, it can start designing the implementation, Gupta said.

Getting multiple tools to work together isn’t easy, though. Vendors look for common datapoints like client names. But each tool could have a different definition of what a household is, Gupta said.

“Those are really critical things that have to be thought through,” he explained. “There’s a lot of complexity that has to go in to really make that … seamless for the advisor, so you don’t end up having to manually connect households together.”

When it comes to a rollout, there were also advisors surveyed in the Report Cards who expressed frustration with the communication received beforehand about new digital features and training.

“I think it could be better in terms of how they roll out technology and training. For example, [there was an] additional feature in our CRM that wasn’t communicated to us,” said a dealer advisor in Ontario.

“[There’s] no formal training on any tech. They implement it without showing advisors how to use it,” said an Ontario brokerage investment advisor.

Firms of different sizes roll out new software differently. Smaller firms are usually more willing to learn as they go while larger firms might use a phased approach, Lotocki said. In larger firms, user acceptance testing is designed to ensure workable connections to a firm’s other software and back office.

A pilot rollout could include one geographical region, one business segment or a select group of advisors, Lotocki added.

A phased approach gives the vendor and the wealth firm time to acclimatize advisors to the new technology, Gupta said. “Where you run into problems is if, all of a sudden, tomorrow your entire world is changing. You were trading this way yesterday and [now] you’re trading another way tomorrow. That never goes well.”

The vendor can offer demo areas and sandboxes for advisors to try out the new software in advance and provide them with transparency on what future workflows will look like, Gupta added. Firms should also consider what else is going on in the advisor’s life and avoid, for example, making changes during tax season.

Getting advisors on board

After rollout night, the vendor is still on the hook to help train advisors on how to use a new tool and provide ongoing support, in collaboration with the receiving firm. It’s a huge proof point — getting this process right sets the tone for what is fundamentally a change-management project.

“They’re very good; 80% of the individuals at the help desk are knowledgeable. They know exactly what the problem is and solve it quickly,” said a satisfied brokerage investment advisor in the Prairies, about the support they’ve received in the “technology training & internal IT support” category. But advisor reviews aren’t always so positive.

One investment advisor with a brokerage in Atlantic Canada had been moved to Salesforce and called that “a mistake.” They felt their previous client management tool had included “everything,” even though “Salesforce seemingly is the way of the future.”

Resistance to change is human nature, and it can be hard for advisors to alter how they work, Lotocki said.

“They’ll get into it if you can prove that it adds value to their day,” Lotocki added.

Firms should look for “champions,” Gupta said. These are advisors who are seen as leaders among peers and can influence colleagues to accept change.

“Lean on those advocates to either control or be part of the messaging when you do a broader rollout conference,” Gupta said. “Get them on panels and have them talk about their experiences to have a very structured feedback loop.”

Technical support for smaller wealth firms could be done directly by the software company, while larger firms take a train-the-trainer approach with their vendor, Lotocki said. If an advisor has a question that a firm staffer can’t answer, they escalate the matter to a vendor expert.

In the longer term, the wealth firm and the tech vendor will meet at pre-agreed intervals to address questions about certain features and plan the product roadmap.

“It’s an opportunity for us to say, ‘We’re adding this new feature to the application, do you want to use it?’” Lotocki said. “The project might be done and implemented, but there are always ways to continue to help our partners.”

Click image for full-size chart

This article appears in the November 2025 issue of Investment Executive. Read the digital edition or read the articles online.