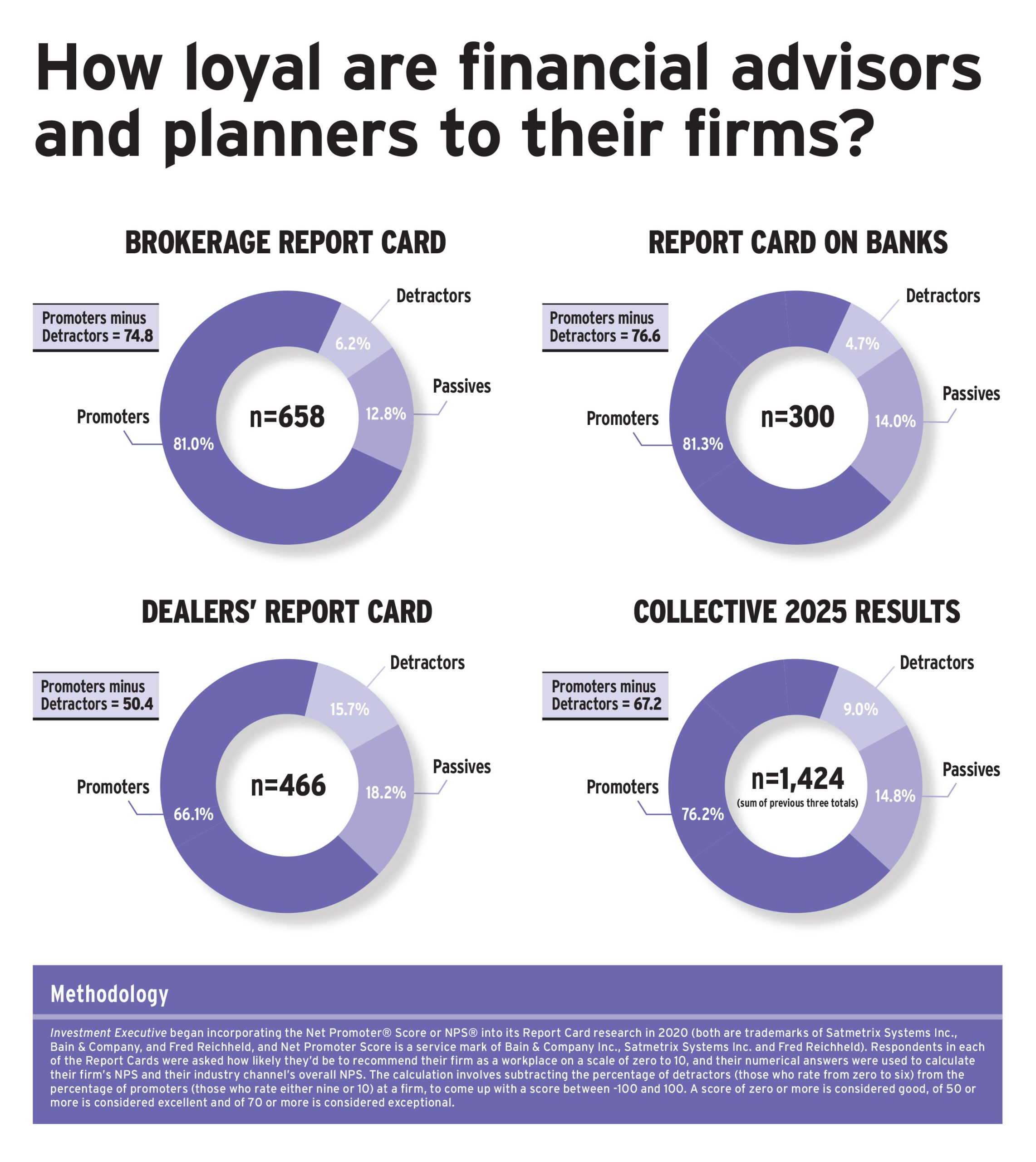

In each of its 2025 Report Cards, Investment Executive asked financial advisors and planners how likely they would be to recommend their firms or banks to other professionals, on a scale of zero to 10 (with 10 being most likely). Those recommendations were used to determine each firm’s Net Promoter Score (NPS) as well as the collective NPS for each industry channel — full methodology for the NPS calculation is included in the visual below.

In 2025, each of the brokerage, dealer and retail bank channels garnered “excellent” scores, meaning results of 50 or more (on a scale of –100 to 100) that signal strong advisor loyalty. The brokerage channel had a collective NPS of 74.8, while the dealer channel received a score of 50.4 and the retail bank channel received 76.7. (See the charts below for a depiction.)

Looking back one year, those results compared with 65.1 for the brokerage firms, 55.6 for the dealer firms, and 60.5 for the Big Six’s retail-bank divisions in the 2024 Report Card series.

So, two of the three channels saw a notable increase in their score, while the dealer space saw a dip in advisor loyalty due to a rise in the percentages of advisors who were either neutral on or critical of their firms (those who gave a rating of seven or eight, remaining passive, and those who gave zero to six, who wouldn’t recommend their firm).

Advisors and planners weighed multiple factors in their responses. They considered how inviting the culture was at their firms and banks, and whether these companies focused on advisor independence and the client. The quality of a firm’s digital tools and business development support also mattered.

This selection of confidential verbatims highlight where firms were succeeding and, conversely, leaving gaps.

Brokerage advisor feedback

“We don’t have a rigid structure; there is a lot of freedom. [My] firm seems to attract people who like to do their own thing, and I like that.” – Brokerage advisor in Ontario.

“Independence is the No. 1 principle at [my] firm. Family values are evident.” – Brokerage advisor in Alberta.

“I [have been asked] to move to other firms. I ask how my clients would be better off, and no [approaching] firm has given me a proper answer.” – Brokerage advisor with a bank-owned firm in Alberta.

“[I like] the new management. The people that work around [them] are great listeners. They put a lot their effort in so that you’re happy to work for them.” – Brokerage advisor with a bank-owned firm in Quebec.

“They [my firm] does so much. They listen and [have] built a good firm that is advisor- and client-focused. They’re nimble enough to make [impactful] decisions.” – Brokerage advisor in Alberta.

“We have our struggles just like everyone else. We struggle with implementing technology and the client experience is sub-standard.” – Brokerage advisor with a bank-owned firm in Atlantic Canada.

“My branch manager [and their] the team are very supportive. But there is a lack of direction at head office. We feel left out here.” – Brokerage advisor in Alberta.

Dealers’ advisor feedback

“[My] firm is very open. We get all of the support we need. [We have] high-quality advisor [colleagues] with certain degrees and credentials, so the advisor community is very strong.” – Dealer advisor with a full-service firm in Ontario.

“It’s a great place to work. I don’t have many, many managers hanging over my head. I’m free to [run] my own business and that’s why I choose to work here over the financial institutions [the big banks].” – Dealer advisor with a full-service firm in the Prairies.

“[We’re] multicultural, so you will see a lot of diversity here. We have [advisors from] all walks of life, cultures.” – Dealer advisor with a mutual fund firm in Ontario.

“Their [my firm’s] tech offering is far superior. […] Their leadership group is forward-thinking and keeps on improving tech. They allow full independence.” – Dealer advisor with a mutual fund firm in British Columbia.

“I think the structure and the focus [of my firm] are aligned with where the industry is going, and the support is there especially [for] those transitioning their practice.” – Dealer advisor with a full-service firm in Alberta.

“Right now, there are a lot of question marks. [There’s] change without a lot of notice and consideration. It’s hard to recommend a firm when you can’t really do that with confidence.” – Dealer advisor with a full-service firm in B.C.

“We’re currently looking at changing firms. […] Back-office [work] takes a lot of time and staff power to get anything done or communicated.” – Dealer advisor with a full-service firm in the Prairies.

Bank advisor feedback

“It’s a great client-centric place to be involved with. We’re all very responsible and responsive, [and are] very willing to help anyone.” – Retail branch advisor in Alberta.

“I’m extremely happy. [There’s a] positive environment; it’s a place you can grow in.” – Retail branch advisor in Ontario.

“[My bank is] very team-oriented. We aren’t competing for the same clients. Everyone is looking to work together to assist the clients.” – Also a retail branch advisor in Ontario.

“No bank is perfect but, as an overall offering, it’s one of the best companies to work for. I’ve been with [my bank] for [many] years.” – Retail branch advisor in B.C.

“People who work here enjoy what they do. In the financial planning world, there is potential make a lot of money [and] enjoy what you’re doing.” – Also a retail branch advisor in Ontario.

“An entry level role at the bank [level] is now one of the hardest jobs to be successful at. The requirements and expectations are overwhelming,” so recommending to young advisors is tough. – Retail branch advisor in the Prairies

“The main retail products aren’t different compared to other banks, [but] I do like our investment options for clients. We have easy-to-use our apps. We have pretty good technology and everyone is decently paid. [The bank also] does a lot of nice things for the community.” – Also a retail branch advisor in Ontario.

Click the image below for a full-size version.

Disclaimer: Net Promoter, Net Promoter System, Net Promoter Score, and NPS are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.