The global response to the Covid-19 outbreak will degrade government finances around the world and lead to record sovereign downgrades, says Fitch Ratings.

In a new report, the rating agency noted that governments and central banks around the world have taken steps to combat the fallout from the pandemic.

“Much of the burden of the coronavirus policy response is on sovereigns,” it said.

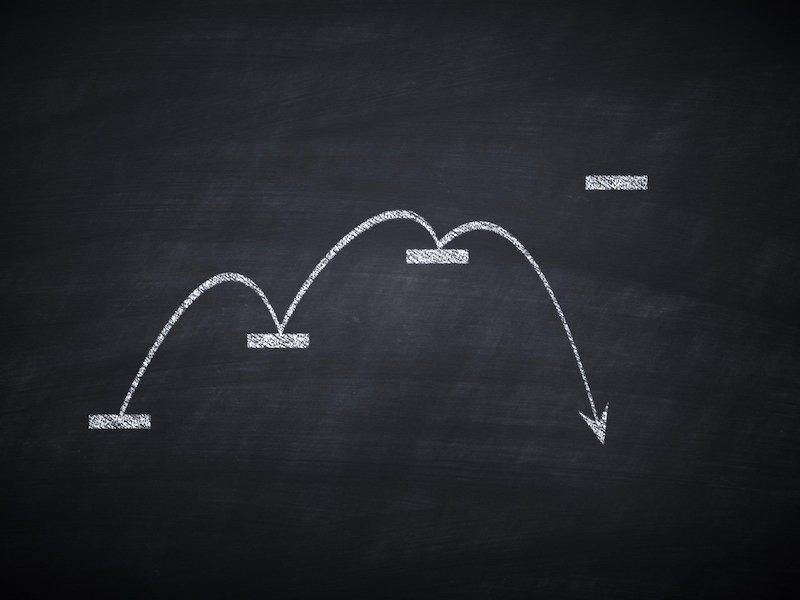

In fact, for the first time, Fitch forecasted that “nearly all rated sovereigns will experience an annual fiscal deterioration.”

Governments will face larger deficits or smaller surpluses in 2020, and government debt levels will increase in almost all countries, it said.

In turn, this is putting “significant pressure” on sovereign ratings, Fitch said.

“We expect there to be a record number of sovereign downgrades in 2020,” it noted.

For the financial sector, while many of the measures to shore up market liquidity and to support both households and businesses “are positive for financial stability,” Fitch said, “the capital, asset quality and profitability of most financial institutions will still be weakened by pandemic-related stress in the medium term and long term.”

In the broader corporate sector, Fitch said, government support programs “will mitigate some short-term downward pressures on corporate ratings to the extent that they solve immediate liquidity concerns, particularly among speculative-grade issuers.”

It added: “Incremental loans are likely to have the largest hangover effect on post-pandemic corporate credit profiles.”

In the structured finance market, Fitch said, loan forbearance for both households and small businesses “is the most impactful policy measure” and that this has been used in all countries with an active securitization market.

“Loan forbearance will help reduce ultimate losses on securitized assets,” Fitch said, “but will inevitably delay the recognition of losses caused by coronavirus-related economic disruption in many markets.”