Women own an increasingly large portion of the world’s wealth.

In the U.S. alone, women currently control about $11 trillion in assets, or about 31% of the country’s total, according to McKinsey & Co. Moreover, Boston Consulting Group has found that women are adding $5 trillion to the wealth pool globally every year, and future growth is expected to accelerate.

So, it’s no wonder that wealth management firms around the globe are scrambling to adapt their marketing strategies and product offerings to attract female investors.

This is long overdue.

Studies have shown that women make good investors. What’s more, a study released by Fidelity Investments in 2021 found that investment accounts controlled by women outperformed those controlled by men by an average of 40 basis points over a 10-year period.

Yet the same study found that only 9% of women thought they made better investors than men.

I’ve seen women’s financial insecurity firsthand. Many women tell me that, in meetings with financial advisors, they feel “talked down to” or even ignored if they are with their spouse. It’s no wonder that approximately 70% of women change advisors following the death of their husband.

Insecurity coupled with risk aversion can affect returns. For example, female clients often express more aversion to equity exposure than men in our initial discussions, and often feel guilty spending the money they have.

Fortunately, this changes with education and regular conversations about market risk and portfolio management strategies.

Women in couples

I’ve found that in couples, women often leave the job of investing to the man and, at most, manage the family budget.

Over the years, I have worked hard to get women to attend financial meetings with their partner, and to engage in conversations about money. Regardless of relationship status, these types of conversations allow women to shape their financial futures and dreams. For women with life partners, it’s important for them to be present for discussions regarding how family finances should be invested and in which long-term financial and retirement goals are defined.

Another reason I strongly encourage women to participate in all family conversations about money is because the consequences of not doing so can be dire, especially in the case of a marriage breakdown. For example, 74% of women discover negative financial surprises after a divorce or death of their spouse, according to research by UBS.

Solutions

I make investor education, especially for women, an integral part of my practice.

My female clients are interested in attending educational webinars to become more familiar with the market and ETF investing. Prior to the pandemic, I also held seminars. I make portfolio reviews an educational opportunity as well.

I also find that having primarily ETF-based portfolio models makes it easy to explain why “time in the market” and not “timing the market” is so effective with these products. The futility of trying to “beat the market” is a simple concept to explain — and one that women easily understand, since they are more likely to be “buy and hold” investors.

When women have a good understanding of risk and the basic principles of investment strategy, they can make financial decisions just as well, if not better than men.

I also structure my meetings to facilitate education. Some strategies include:

- Asking questions specifically of the less-engaged or less money-savvy spouse

- Explaining the long-term benefits of both spouses being involved in the couple’s financial affairs

- Explaining the financial issues frequently encountered by women, such as the effects of maternity leave on retirement planning and increased longevity

- Organizing a one-on-one meeting with the more hesitant spouse if necessary

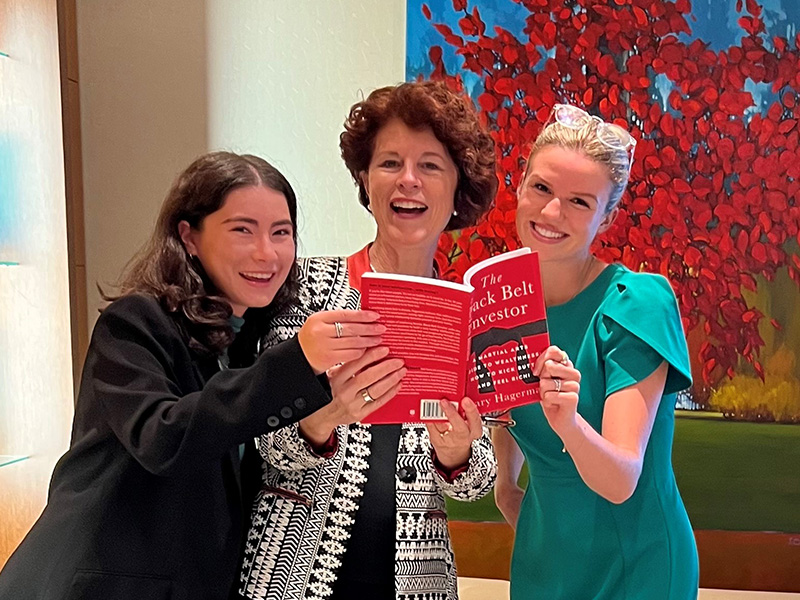

- Providing clients with a copy of my book, The Black Belt Investor, which outlines my investment philosophy and provides guidance for having conversations about money with loved ones

I am optimistic for the future. According to the Pew Research Center, the share of millennial women with a bachelor’s degree is now higher than that of men – a reversal from the Silent Generation and baby boomers. Gen X women were the first to outpace men in terms of education, with a three-percentage-point advantage over Gen X men in 2001.

Education is power. As our industry wakes up to the force of the female investor, she will play a bigger and bigger role in shaping the financial products that come to market, including ETFs.