Pension plan or tax?

While the proposed Ontario Retirement Pension Plan is receiving some nods, critics argue that mandatory contributions may hurt employers

- By: Catherine Harris

- November 7, 2014 November 6, 2019

- 00:00

While the proposed Ontario Retirement Pension Plan is receiving some nods, critics argue that mandatory contributions may hurt employers

Investing statistics consistently show that continuing to hold equities during the long decades of retirement - with an eye to prudence - is a better…

Make sure clients over the age of 65 take steps to trigger the pension income credit. The often overlooked credit can present tax-planning opportunities

RRSP season can bring on a hectic schedule of client meetings, late nights and other obligations. If you aren’t prepared, you could be left feeling…

Even though Canadian equities markets are highly concentrated in a few sectors - and small compared with other markets - many clients remain uneasy about…

Canadian clients who spend significant amounts of time outside the country every year risk losing their health benefits, as well as possibly facing negative tax…

Tax rules allow for inadvertent overcontributions to a client's RRSP, which can grow tax-free for decades. But there are strict limits on the amount -…

Clients worried about outliving their money can receive steady income, but these products are not all the same - some comparison shopping is recommended. And…

There are a plethora of fixed-income ETFs, ranging from index trackers to more specialized products, that offer benefits such as liquidity and low management fees…

To offset inflation within an annuity, some insurers offer an indexing option, in which the payments that a client receives increase over time. But this…

The assumption that a retired client should withdraw 4% from his or her portfolio annually is losing credibility among advisors and economists

More Canadians are retiring with debt than ever before. Although this situation is not ideal, it can make sense for some clients - but only…

There are many errors that clients make while planning for their retirement. Many are related to their finances - including poor cash-flow planning and taking…

Although bond funds can be unpredictable, and generally perform less well than equities, careful selection and an eye on factors such as interest rates and…

There are various strategies that you can employ to ensure that clients' retirement savings last longer - and that they pay less taxes in the…

For many clients, working while collecting government and pension benefits is an appropriate solution to an income shortfall

Four ways to demonstrate your value to clients

Just 15 minutes can increase your profile with clients, prospects and COIs

In this week’s Ruta’s Rules, Jim Ruta, insurance industry consultant and managing partner, InforcePRO, explains the downside of selling yourself life insurance. He gives tips…

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, explains that Air Canada can teach advisors a lot about how to make top clients…

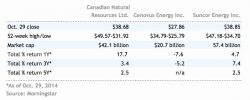

The managers discuss large-cap strategies in non-bank financials, energy, industrials and telecommunications.

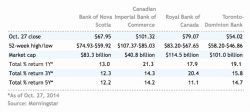

In part two of the roundtable, the managers share their views on Canada’s major banks and their top management.

Three managers discuss the current volatility in the Canadian equity market and how it's affecting their outlook for various sectors and specific companies.

In this week’s Ruta’s Rules, Jim Ruta, insurance industry consultant and managing partner, InforcePRO, gives nine tips on how to perform cold calls, and explains…

In this week’s Gaining Altitude, Dan Richards, CEO, Client Insights, gives advisors three main tips about how to get quoted in your local newspaper and…