Looking for global connections

Portfolio managers give a nod to export-oriented South Korea-based consumer-products firms

- By: Beatrice Paez

- January 15, 2017 November 9, 2019

- 00:45

Portfolio managers give a nod to export-oriented South Korea-based consumer-products firms

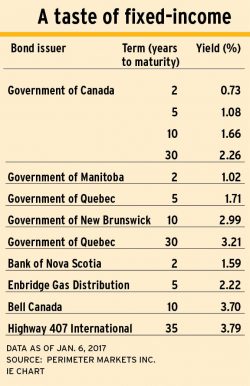

Rising interest rates spell the end of the three-decade bond bull market. Now, protecting income and avoiding capital loss is the essential strategy

Stocks of high-technology companies are particularly exposed to changing winds in U.S. trade policy, but some ripe investment opportunities can be found in the coming…

Optimism is high that tax cuts, public spending and less regulation will prime the U.S. economy's pump. But with U.S. employment and debt already high,…

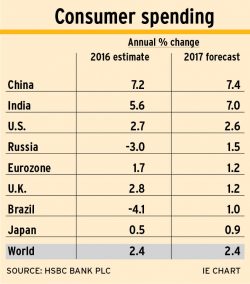

As economic growth continues to improve around the globe, the consumer discretionary category is likely to present an expanded range of opportunities, with retail revenue…

And less than half of Canadian investors say their advisor is trustworthy and honest

Part three of a global equity roundtable

Part two of global equity roundtable

In the first instalment of a three-part global equity roundtable, three mutual fund managers explain how they’re positioning their portfolios for potentially stormy market conditions…

High-income individuals and their advisors also prefer mutual funds to stocks, seg funds or ETFs

Bhupinder Anand, managing director, Anand Associates, discusses his perspective on the aftermath of the U.K.’s 2013 Retail Distribution Review, which caused an exodus of investment…

Although the provinces have not moved yet on the effort to see the creation of an SRO for advisors, clients could help tip the scale…

The creation of an FSRA in Ontario and the rapid pace of regulatory change occurring on the investment side of the business has big implications…

A question frequently asked by clients who face imminent retirement is: “Will my money last?” A proper response from a financial advisor requires examining several…

The newly updated mortality tables mean that the taxable portion of annuity payouts will increase for many clients. However, annuities purchased before the end of…

Some top advisors explain how they are navigating the difficult, sometimes delicate task of persuading older clients to reduce expectations while finding low-risk ways to…

Retirees with comfortable nest eggs held outside of registered funds may want to consider setting up a systemic withdrawal plan, which allows the client to…

Playing the low-rate gameThe irony for many disciplined savers is that after a lifetime of nurturing their nest eggs, they may find spending in retirement…

Clients who put off receiving CPP and OAS payments can reduce their longevity risk. These clients will need other sources of income to bridge the…

Advisors suggest clients' portfolios should hold two to three years' worth of withdrawals in liquid or guaranteed investments. Opinions vary on the percentage of the…