Financial advisors surveyed for this year’s Dealers’ Report Card appear to be increasingly pleased with their firms’ compensation packages, which reflects the rebounding strength in equities markets and the resultant higher level of assets to manage.

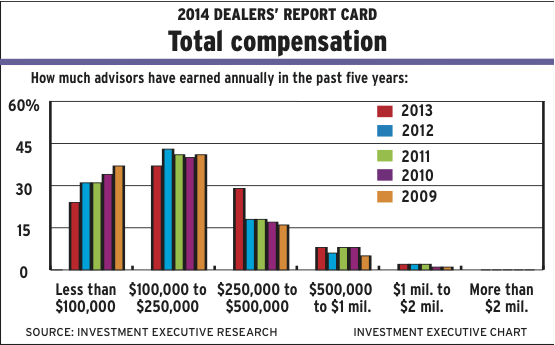

Average assets under management (AUM) among advisors has increased to $36.5 million, up from $27.8 million last year and $23.7 million in 2012. This substantial growth in AUM appears to have resulted in greater take-home pay for advisors, with the percentage of those who earned more than $250,000 a year rising to 39.4% from 26.7% last year, while the percentage of advisors earning less than that amount dropped to 60.6%, down from 73.2% last year.

Overall, advisors gave their dealer firms a higher average performance rating in the “firm’s total compensation” category, at 8.3 compared with 8.0 in 2013. In general, advisors praised their firm if its compensation regime was clear, transparent, fair and allowed them to serve their clients and grow their business to the best of their ability.

However, the overall average importance rating advisors gave compensation this year not only rose to 9.0 from 8.5 last year, it’s now higher than the overall performance average by 0.7 of a point, which reveals that even though firms are making progress, a gap remains between what advisors expect from their firm and what is actually being delivered.

One area of concern among advisors was the ever-increasing costs related to running their practices.

“It’s very expensive to work in this industry,” says an advisor in Atlantic Canada with Winnipeg-based Investors Group Inc. “With technology costs and [Mutual Fund Dealers Association of Canada] fees, it costs $1,000 a month [just to operate].”

In addition, some advisors made note of what they perceived as the troublesome downloading of fees.

“They ding us for everything,” says an advisor in Ontario with Toronto-based HollisWealth Inc. “It sucks out [money from] my bottom line.”

Overall, though, advisors with many dealer firms appeared to be relatively happy with their compensation schemes.

For example, advisors with Montreal-based Peak Financial Group, which received a category-high rating of 9.0, up notably from 8.2 last year, praised their firm’s grid-based compensation structure for its transparency and fairness.

“This firm doesn’t deduct excessive fees for bells and whistles,” says a Peak advisor in Quebec. “It gets out of your way so you can do your job. You get to decide how to spend your money.”

The consistency of the compensation structure probably is a primary factor in why Peak advisors continue to rate their firm highly in terms of compensation relative to other firms, says Robert Frances, Peak’s president and CEO.

“[The compensation structure] is very competitive,” he says. “We haven’t cut [payouts] in the past few years, whereas many of our competitors did in light of issues with falling revenue and what not.”

Advisors with Windsor, Ont.-based Sterling Mutuals Inc. also rated their firm highly in the category, at 8.8, thanks to a compensation structure that they felt is straightforward and puts the focus on helping the independent advisor. Sterling Mutuals operates on an 80/20 advisor/dealer split, with an annual cap of $18,500 on the dealer’s share of the split, plus a flat fee charged to recoup the costs of the services that the firm provides.

“Once you pay [the flat fee] off,” says a Sterling Mutuals advisor in British Columbia, “it’s all profit.”

Meanwhile, advisors with Oakville, Ont.-based Manulife Securities said the firm’s competitive compensation structure – combined with the strength of the brand and a business model that stresses advisor independence – gives them the flexibility they need.

“We have very good compensation and a good firm,” says a Manulife Securities advisor in Atlantic Canada. “They leave you alone to run your business.”

The reason for this, says Rick Annaert, president and CEO of Manulife Securities, is: “We’ve always wanted to be as independent as possible, as transparent as possible, and to pay out the maximum possible [to advisors].”

Similarly, advisors with Markham, Ont.-based Worldsource Wealth Management Inc. say the firm’s compensation model provides them with competitive pay and ensures their independence.

“The fee model is fair and transparent,” says a Worldsource advisor in Ontario, “with most of the money going to the advisors.”

Feelings among advisors with Toronto-based HollisWealth Inc. were mixed. Some lauded the firm’s payout levels; others took issue with rising costs.

“The pay grid is competitive,” says a HollisWealth advisor in Ontario, “although we pay for a lot of things ourselves.”

HollisWealth executives said the firm reviews the compensation structure annually and that any potential changes this year would depend on that review.

Advisors with Toronto-based Assante Wealth Management (Canada) Ltd. felt much the same. Many described their firm’s compensation package as fair; others took issue with fees rising in relation to payout levels.

“Many of the costs taken at the corporate level are pushed down to the advisor but without a matching increase in advisor percentage,” says an Assante advisor in B.C. “We took a haircut during the recession, and the payout was never improved upon since.”

But Steve Donald, Assante’s president, is adamant that the firm’s payout grid is competitive, describing it in the low- to mid-80% range. And rather than increasing the payout, he adds, the focus now will be to reinvest in the business.

“The growth that we have experienced – any incremental earnings that we’re getting – we’re reinvesting back into the channel,” Donald says, “to try to grow [our firm] even further and set us apart from some of the firms that might not be able to deal with the evolving environment [in the industry] as effectively.”

Advisors with Richmond Hill, Ont.-based Global Maxfin Investments Inc. said that they also are concerned about rising fees affecting their bottom line. However, they continue to appreciate that the firm gives them the option of paying a desk fee or splitting commissions with the firm.

Bruce Day, Global Maxfin’s president, says that one of the main strengths of the firm’s grid-based regime is that it’s easier for advisors to earn at the top rate.

“We may not pay [at a higher rate] on the grid [than other firms],” Day says, “but advisors hit targets for higher payout earlier. So, in fact, they [ultimately] get a higher payout.”

© 2014 Investment Executive. All rights reserved.