Receptiveness to feedback is key

Not only do advisors want access to management, they also want their leaders to make changes based on advisors' suggestions

- By: Fiona Collie

- April 24, 2015 November 9, 2019

- 09:00

Not only do advisors want access to management, they also want their leaders to make changes based on advisors' suggestions

Most advisors favour having non-producing branch managers, but there are some who say the old approach still has value

Whether or not advisors are satisfied with their firms' offerings, several brokerages are bringing in more specialists and making major steps to improve the support…

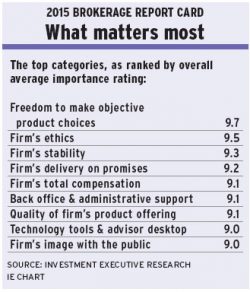

How advisors rated their firms

Many advisors say their firms can't always be counted on to follow through on their promises

Some advisors clamour for their firms to make greater efforts so that their brands become better known among the public

Technology woes continue

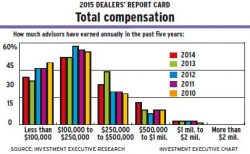

There are great differences among advisors regarding the changes their firms have made to their compensation structures

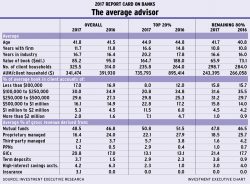

Advisors across the board have seen remarkable growth in their books of business, productivity, client assets and take-home pay. Beneath these headline numbers, there are…

Although advisors reported some good news, in that their books of business rose to an all-time high yet again, they also want their firms to…

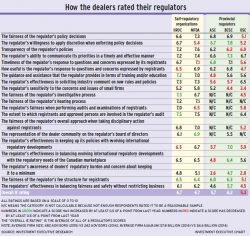

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, outline the key findings of the 2015 Regulators’ Report Card. Overall evaluations of…

Almost two-thirds of survey participants are opposed to a whistleblower program that pays insiders for tips

Almost three-quarters of survey participants say the costs and effort needed to be compliant with CRM2 are significant

The Ontario Securities Commission has taken a major hit for its lack of sensitivity and responsiveness to the investment industry

Compliance officers (COs) and senior executives from a cross-section of firms in the investment industry shared their thoughts about the regulators that oversee their businesses…

Survey participants question whether regulators should focus so much on developments outside of Canada

IIROC and the MFDA have advisory committees, regional councils and policy roundtables in place through which to receive feedback

COs and company executives already were reeling from regulatory pressures — and new rules have only added to that burden

Most survey participants would like to pay less in regulatory fees, but realize regulators need resources to operate

Pablo Fuchs, senior editor at Investment Executive, and Clare O’Hara, staff writer, discuss key findings from the 2014 Advisors’ Report Card.

For the most part, firms are on the ball in helping their advisors deal with the major regulatory changes that are taking place in the…

It's been a great year for advisors, as they are enjoying an all-time high in the average book of business while their firms continue to…

Powered by surging stock markets, advisors see gains in key metrics

Advisors across all channels of the financial services sector are adamant that their firms are providing independence, a positive work environment and stability. Yet, these…