Dealer firms and their financial advisors are on the way back up after a tumultuous couple of years. That’s evident not only in the rebound in financial advisors’ books of business but also in the increased ratings advisors have bestowed upon their firms in this year’s Dealers’ Report Card.

Last year, advisors with dealer firms saw a modest 6.3% increase in the average size of their books, to $21.9 million from $20.6 million the year prior. That rate of growth has more than doubled to 13.2%, as the average book rose to $24.8 million this year.

In addition, more advisors felt encouraged about their firms: only two of the 12 firms in the 2011 Dealers’ Report Card saw a significant (more than half a point) drop in several ratings. That’s in stark contrast to the six of 13 firms that saw their ratings decline by a similar margin a year ago.

Chart: How many advisors would recommend their firms?

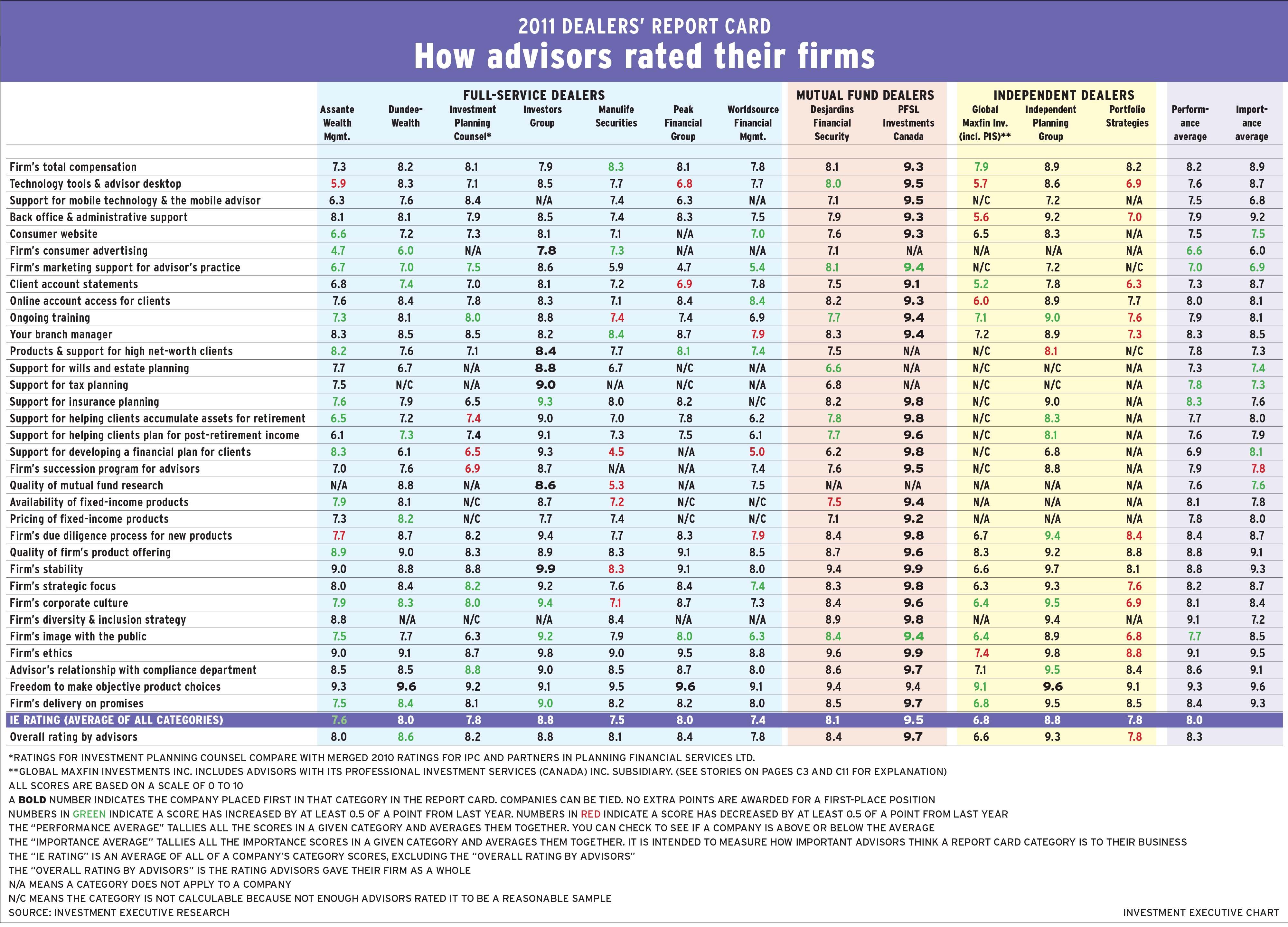

Overall morale was up, as Investment Executive researchers Sanam Islam, Olivia Li, Ayah Victoria McKhail and Yumi Otagaki discovered when they spoke with 517 advisors at the 12 dealer firms across Canada, including full-service dealers, mutual fund dealers and independent dealers. Advisors were asked to provide performance and importance ratings for 33 categories on a scale of zero to 10, with zero meaning “poor” or “unimportant,” and 10 meaning “excellent” or “critically important.” Individual ratings were then averaged for each category, both firmwide and Report Card-wide.

Two categories were added to this year’s survey: “Support for mobile technology and the mobile advisor” and “firm’s diversity and inclusion strategy.” The “IE rating” is the average rating for all categories for each firm; the “overall rating by advisors” was an additional question on how advisors rated their firms overall.

Last year, many firms saw their ratings drop significantly in key areas such as “firm’s corporate culture,” “firm’s image with the public,” and “firm’s marketing support for advisor’s practice.”

However, those same categories saw some of the biggest improvements this year. In fact, half of the firms saw significantly better ratings in corporate culture, with advisors using words such as “collegial” and “family-like” to describe their head offices.

Says an advisor in Ontario with Ottawa-based Independent Planning Group Inc. : “There is a great team spirit. It makes all the difference in the world.”

A positive outlook also surrounded Toronto-based Assante Wealth Management (Canada) Ltd. , which saw ratings increase by half a point or more in 13 of the 32 categories that applied to the firm. In addition, its IE rating rose by a similar margin. That’s a big difference from last year, in which the firm’s ratings fell by half a point or more in 19 of the 30 categories that applied to the firm. Notably, Assante’s corporate culture rating rose to 7.9 from 6.8 last year.

“We’re valued and are taken into consideration,” says an Assante advisor in Atlantic Canada. “The company is willing to change for our needs and our clients.”

One firm that usually doesn’t disappoint on corporate culture is Mississauga, Ont.-based PFSL Investments Canada Ltd. It has continually outperformed in this area.

“All the people at our firm have integrity and have no hidden agendas,” says a PFSL advisor in Ontario. “If you don’t have a good corporate culture, you have nothing.”

Fostering inclusivity and transparency is a key factor; many PFSL advisors who rated their firm highly in corporate culture did so because of its open-door atmosphere.

“We always involve [advisors] in our decisions,” says Jeff Dumanski, PFSL’s president and chief marketing officer. “We can deliver on what they want, in addition to hitting all our objectives on growth.”

Not surprising, advisors feel better when their interests are aligned with those of their firm’s. In last year’s survey, many advisors were disappointed in their “firm’s strategic focus” — five of the 13 firms in the survey saw their ratings decline by half a point or more in the category. This year, only one firm saw a significant decrease.

However, advisors had more feedback in terms of strategic focus when their firms were going through structural changes, such as a merger or acquisition. For example, Richmond Hill, Ont.-based Global Maxfin Investment Inc. has been working to integrate Calgary-based Professional Investment Services (Canada) Inc. since acquiring that firm in late 2009.

As a result, IE decided to include both groups of advisors — those who ply their trade with the PIS subsidiary and those who had been with Global Maxfin prior to the acquisition — under the Global Maxfin banner in both the 2010 and 2011 Dealers’ Report Cards. This decision was also based on advisors’ comments, as they operate under the same management, compliance and back-office systems.

However, Global Maxfin president Bruce Day is adamant that the two firms be considered separate entities: “They are very different firms because we have different structures. For example, we have a flat-fee structure in PIS that is not available in [Global Maxfin].”

Although the compensation structure indicates a division between Global Maxfin advisors on each side of the operation, other areas have been fully integrated. For example, Global Maxfin advisors with PIS, who were formerly on the Univeris Corp. back-office platform, were transferred onto Global Maxfin’s existing Winfund Software Corp. platform in 2010.

“We’ve now moved everyone onto Winfund,” Day says. “So, [all advisors are using] the same back office now.”

Although Global Maxfin advisors with PIS who were surveyed felt the firm has kept their former firm’s entrepreneurial nature intact, they had some concerns, pointing to technology and compliance issues.

And some Global Maxfin advisors who had been with the firm before the PIS acquisition had concerns about their company’s strategic focus. Says one such advisor in Ontario: “[Global Maxfin] has other business with RESPs, so that extra stream takes [the firm’s] focus away from mutual funds.”

However, some advisors on both sides of the operation were pleased with management’s accessibility and sensed an improving corporate culture.

“They listen to what I say,” says a pre-acquisition Global Maxfin advisor in British Columbia. “They are flexible and realistic.”

Adds a Global Maxfin advisor with PIS in Alberta: “It’s not unlike PIS, so we didn’t change much; we still have access to the top. It’s not uncommon for me to call the CEO three times a week to talk.”

Such access to management means a lot to advisors — especially when it comes to helping them build their businesses. This year, half of the firms surveyed for the Dealers’ Report Card saw their marketing support rating increase by half a point or more. (See story on page C12.)

Mississauga-based Investment Planning Counsel saw its rating in the category increase to 7.5 from a combined average of 4.9 for IPC and Regina-based Partners in Planning Financial Group Ltd. , a firm it acquired late last year.

“Our firm is very dedicated to independent advisors and helping them build a business around great client experiences,” says IPC president Chris Reynolds, noting that the firm has a marketing team that gives one-on-one feedback, from designing brochures to websites.

It’s something IPC advisors with PIP are enthusiastic about. “It looks like there’s lots of support,” says an IPC advisor with PIP in Ontario. “It’s one of the most important things for PIP advisors, because that was [PIP’s] weakness.”

Satisfied advisors at seven firms also gave their dealers significantly higher ratings in public image. Notably, PFSL saw its public image rating rise to 9.4 from 8.0 last year. (PFSL was a former subsidiary of Citigroup Inc.; its advisors were unhappy with the image the parent firm had presented during the financial crisis. This past year, PFSL went public, separating itself from Citigroup.)

“Our firm does well without Citigroup,” says a PFSL advisor in Ontario. “Our stock’s price is good, and I don’t have to worry about [Citigroup going into] bankruptcy. [Being a listed company] gives credibility to the firm, and our name is now known among the public.”

Another firm that saw dramatic improvement in public image was Montreal-based Peak Financial Group, whose rating rose to 8.0 from 6.7 in 2010.

“In Quebec, [public image is] very strong,” says a Peak advisor in Ontario, noting that the firm still has work to do outside its home province. “In Ontario, it isn’t as well known.”

Many colleagues agree — and that concern doesn’t escape Robert Frances, Peak’s president and CEO: “The main reason Peak is well known in Quebec is not because we advertise; it’s because we made some pretty big acquisitions in Quebec, so everyone noticed. So, if ever there are big acquisitions to make out West, we’ll gladly make them — and then everyone will know us.” IE