Financial advisors surveyed for this year’s Report Card on Banks and Credit Unions are continuing to ride the wave that was set in motion in last year’s survey, reporting, on average, higher paycheques, improved book sizes and wealthier clients. As a result, the ratings for most firms have stayed fairly positive.

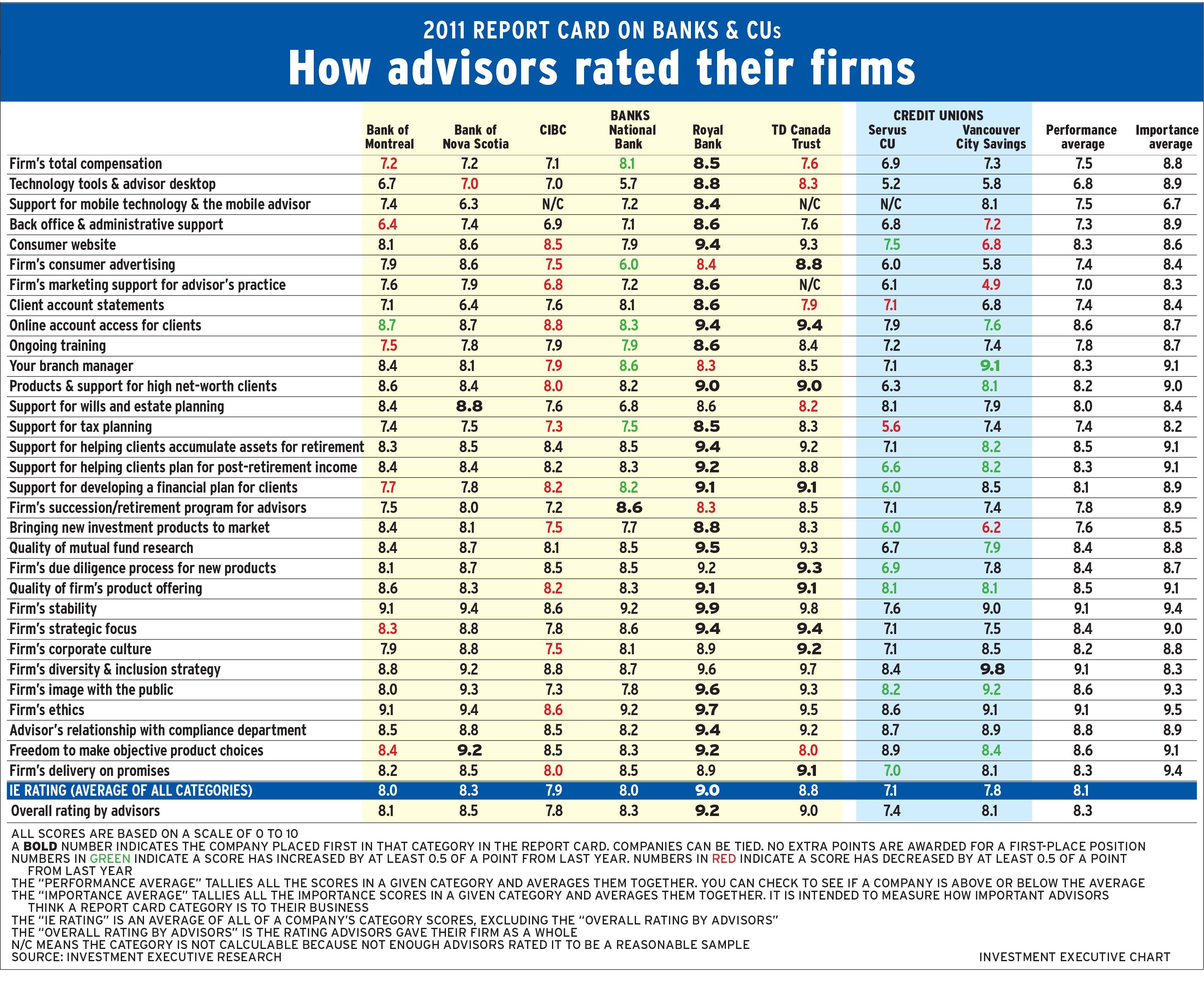

Investment Executive researchers Sanam Islam, Iris Leung and Yumi Otagaki spoke with 275 advisors at the Big Six banks and two credit unions; they were asked to provide an overall rating of their firm, as well as two ratings for each of the other 31 categories in the survey — one for the firm’s performance and the other measuring how important that category is to their businesses. (Two new categories — “support for mobile technology and the mobile advisor” and “firm’s diversity and inclusion strategy” — were added this year.)

Both sets of ratings were on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.” The “IE rating” gives the average of all categories for each firm, while the “overall rating by advisors” is the average of how advisors rated their firms out of 10.

Not surprising, Toronto-based Royal Bank of Canada and TD Canada Trust continue to excel. RBC had the top ratings in 23 of the 31 categories in the survey — including “firm’s strategic focus,” “firm’s stability,” and “firm’s image with the public” — as well as the top IE and overall advisor ratings.

TD placed first in nine categories, including a tie with RBC in the strategic focus category. TD received the survey-best rating of 9.1 for “firm’s delivery of promises” — an area that has remained of utmost importance to advisors year after year.

“[TD] set up the expectation that compliance and due diligence is an important aspect,” says a TD advisor in Ontario. “They promised support services and to [learn from our mistakes] if we do something wrong. They’ve kept all those promises.”

Gaining ground this year in delivery on promises was Edmonton-based Servus Credit Union Ltd. — the only firm that saw its rating in that category increase by half a point or more. Although Servus’s 7.0 rating is a far cry from the importance rating of 9.4 advisors bestowed on the category on average, Servus advisors are patiently awaiting developments.

“We only became [this] credit union on Nov. 1, 2008,” says a Servus advisor in Alberta. “I’d say they’ve been developing well and [have] turned us into a very strong financial services institution.”

Servus has come a long way since the 2008 merger of Community Savings Credit Union of Red Deer, Alta., Com-mon Wealth Credit Union of Lloydminster, Alta., and Servus Credit Union of Edmonton. The expanded firm has embarked on a five-year plan to ensure a smooth amalgamation for advisors.

Although advisors across the deposit-taking channel expect their firms to deliver on their promises, most are happy when their firms have strong financial standing, leadership and corporate integrity. Top overall importance ratings were given to “firm’s ethics” (9.5) and “firm’s stability” (9.4). These ratings were closely mirrored by overall performance ratings of 9.1 for both categories.

“The positive aspect is our reputation,” says an advisor in Alberta with Toronto-based Bank of Nova Scotia. “People trust us.”

When it comes to ethics, says an advisor in Ontario with Toronto-based Bank of Montreal, “Every staff member does intense regulatory training every year on ethics and compliance.”

Each year, BMO directors, bank employees and advisors are required to complete an online questionnaire testing their knowledge of BMO’s code of conduct.

However, the story isn’t quite as rosy at some other firms. Advisors with Toronto-based Canadian Imperial Bank of Commerce, rated their firm lower by half a point or more in 13 categories, including the firm’s ethics and “firm’s corporate culture.”

Management turnover seemed to be one of the reasons behind those results. Says a CIBC advisor in Ontario: “[W]e lost the big players in strategy.”

Adds a colleague in the same province: “The leadership team is disoriented.”

Earlier this spring, Sonia Baxendale, senior executive vice president of retail markets, left the bank. She was replaced by chief financial officer David Williamson, who, in turn, was replaced by Kevin Glass. Senior executive vice president Victor Dodig was named group head of wealth management.

CIBC advisors also complained about their payout and pressure on making sales. “There has been a change in compensation and direction,” says a CIBC advisor in Ontario. “The position is not as prestigious; it seems that whomever can open more bank accounts can have my job; and promises have not been delivered two years in a row.” IE