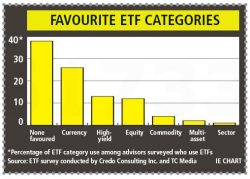

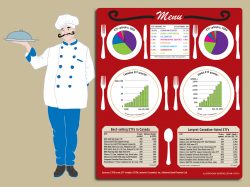

Advisors embrace exchange-traded funds

Hugh Murphy, managing director of Credo Consulting, discusses the results of a recent survey of how advisors are using exchange-traded funds. The survey was conducted…

- By: Hugh Murphy

- April 28, 2015 November 9, 2019

- 08:50