Despite the strong growth in exchange-traded fund (ETF) assets, financial advisors are only beginning to get in on the action, with many advisors using ETFs in only a small percentage of their businesses – if at all – according to the results of a recent survey.

As ETFs rapidly grow in popularity, however, the survey results suggest that advisors are taking notice, and they intend to boost their use of these products substantially within the next two years.

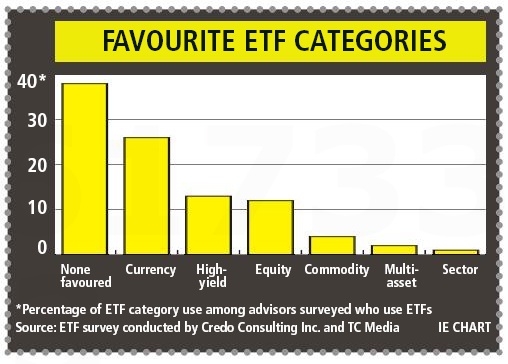

The research was conducted by Toronto-based Credo Consulting Inc. in partnership with TC Media’s Investment Group in February and March 2015. The survey polled financial advisors who read Investment Executive and its Montreal-based sister newspaper, Finance et Investissement, both of which are publications in TC Media’s Investment Group.

Among the 227 advisors who completed the survey, 123 use ETFs and 104 do not. Advisors appear to perceive licensing as one of the biggest barriers to ETF adoption, with 34% of survey respondents who do not use ETFs saying the main reason for that is that they do not hold the appropriate licence. Because advisors are not required to hold a securities licence to sell ETFs, however, this may reflect lack of understanding of licensing rules, or the fact that most mutual fund dealers do not facilitate advisor access to the products.

Other reasons that survey respondents commonly cited for not using ETFs include: having access to enough other products (29%); not trusting ETFs to deliver what they say they will (17%); and the perception that ETFs are not transparent enough (12%).

“Once you get past the whole licensing issue, it becomes a matter of trust and transparency,” says Hugh Murphy, managing director of Credo Consulting. “These are clear issues for financial advisors. If you don’t know what the money is going into, you’re not putting the money there.”

Improving education and awareness is key in getting more advisors to embrace ETFs. Although the industry has worked hard to develop its education resources, the survey results suggest that advisors may not be taking the time to access those resources: 18% of survey respondents who don’t use ETFs said they don’t understand these products well enough to put clients’ money into them.

“[The Canadian ETF Association (CETFA)] has some material on our website, and a lot of the ETF providers have some great material,” says Pat Dunwoody, executive director of CETFA in Toronto. “But I don’t know if a lot of advisors have truly looked into [ETF products] in more depth.”

Compensation models also present a barrier for some advisors. Although some product providers offer ETFs that pay ongoing commissions and trailer fees – and more than one-third of advisors surveyed said they use these ETFs – a majority of survey respondents employ ETFs in a fee-based capacity.

“The standard business model in Canada is commission-based,” says Dunwoody. “As [use of] the fee model increases, we believe so will sales of ETFs, because they logically fit into that model.”

Among the survey respondents who use ETFs, the products comprise a limited component of their business: 61% of survey respondents derive 10% or less of their gross revenue from ETFs; and 40% said ETFs comprise less than 5% of revenue.

However, the survey results suggest that ETF usage is on the rise among advisors. Specifically, the survey respondents who use ETFs said the percentage of client assets in their book of business held in ETFs has risen to 18% from 9%, on average, in the past two years. Furthermore, advisors expect that percentage to rise to an average of 26% in two years. The respondents also reported a similar upward trend in the percentage of their clients who are invested in ETFs.

“Among those advisors who are using ETFs,” says Murphy, “there’s definitely interest in continuing to use them -and in making them a larger piece of their business.”

Industry players concur with this upward trend. “Advisor usage of ETFs is probably the fastest-growing segment of the market for us right now,” says Kevin Gopaul, senior vice president and chief investment officer with BMO Asset Management Inc.

© 2015 Investment Executive. All rights reserved.