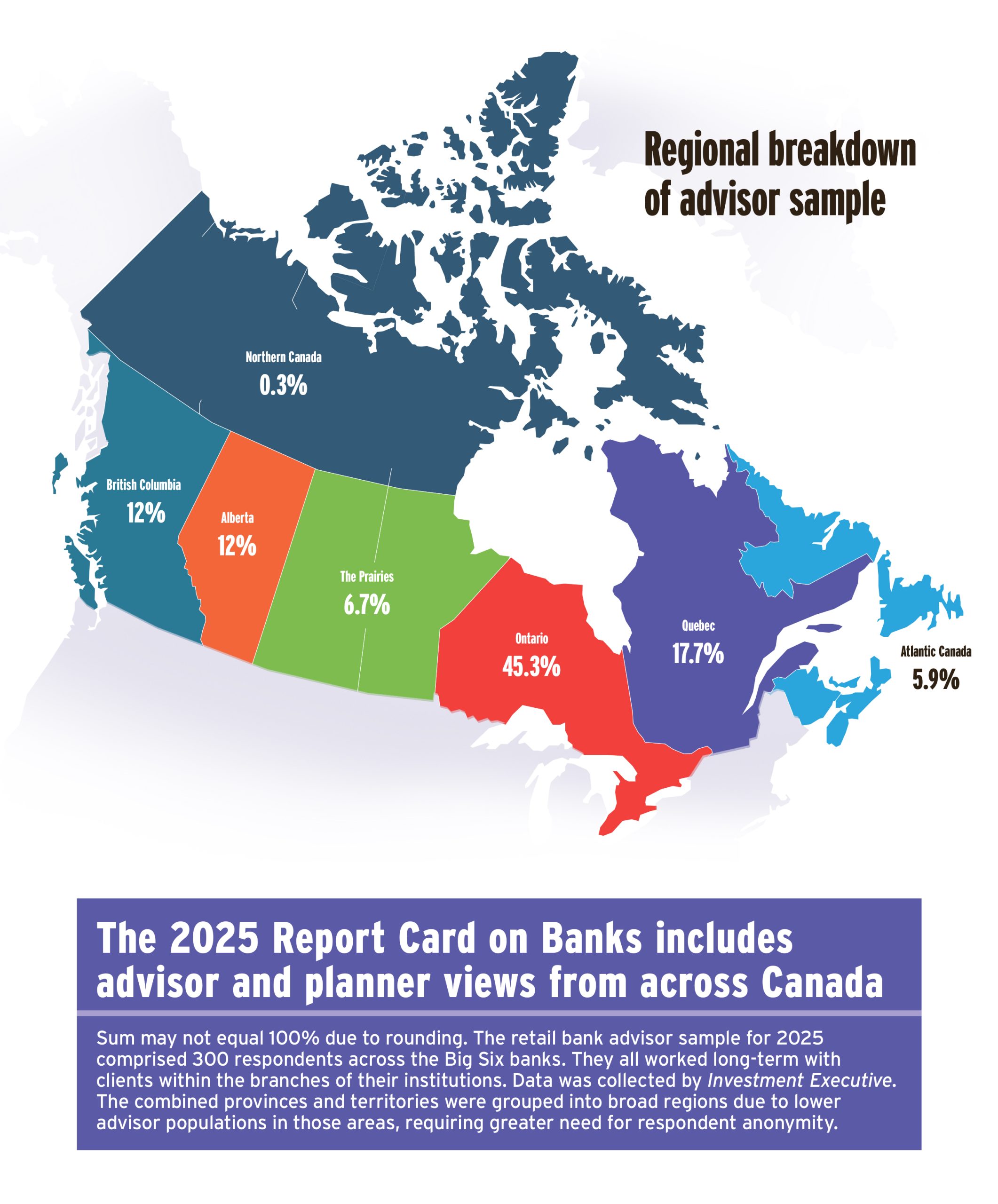

Research for the 2025 Report Card on Banks by Investment Executive (IE) was conducted by six research journalists: Sangjun (John) Han, Roland Inacay, Diane Lalonde, Ciara Lalor-Lindo, Alisha Mughal and Sai Tamanna Sharma. They collectively interviewed 300 financial advisors and planners from all over Canada and across the Big Six’s retail-banking divisions. The six businesses assessed were Bank of Montreal’s BMO Financial Planning division, Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce’s CIBC Imperial Service division, National Bank of Canada, Royal Bank of Canada’s RBC Financial Planning division and Toronto-Dominion Bank’s TD Wealth Financial Planning division.

Data was predominantly collected via telephone interviews (web surveying was used minimally and only for half of the banks). The surveys were conducted between May 5 and June 20. All respondents were registered, full-time advisors who at minimum had their mutual fund licence. They’d all worked with their bank for at least one year and had worked in the financial services industry for at least three, and were all focused on building long-term client relationships.

Advisor and planner participants provided two ratings each for their banks’ support systems and services, across 22 categories: one rating for performance, considering how well their bank’s retail bank division was helping them serve clients; and the other for importance, sharing how crucial each category or support area was to them personally. Both ratings were provided on a scale of zero to 10 — a rating of zero meant “very poor” or “unimportant,” while a rating of 10 signified “excellent” or “critically important.” Advisors were asked to provide ratings only for services and systems they had used directly.

For each bank, the ratings have been aggregated into average results for each of the 22 categories. A significant change compared with 2024 requires a year-over-year shift by half a point or more in a firm’s category rating. That margin also applies to: a bank’s IE rating (the average of all of a bank’s category ratings), and the overall 2025 performance and importance averages (both benchmarks are a tally of all the banks’ ratings by advisors and planners in a given category). The performance average benchmarks banks’ individual ratings, while the importance average indicates how important the average retail bank advisor feels a category is to their business and work.

Another metric used, the satisfaction gap or surplus, is defined as the difference between a category’s overall performance and importance averages. Where importance is higher and the average advisor or planner wants more support, a satisfaction gap is identified.

The Report Card series isn’t an awards program or contest and isn’t a ranking exercise. It doesn’t base a bank or advisor’s inclusion or results on sales activity, revenue or assets. The project is editorial-driven research that aggregates opinion- and experience-based data, using a rigorous methodology.

Some category names in 2025 were edited for clarity, without affecting year-over-year comparisons. One area was materially edited compared with past years: the “freedom to make product choices” category is now called “ability to make suitable product choices” — this new focus better reflects that retail bank advisors and planners don’t have the same autonomy as other industry professionals, given they’re restricted to selling in-house bank product.

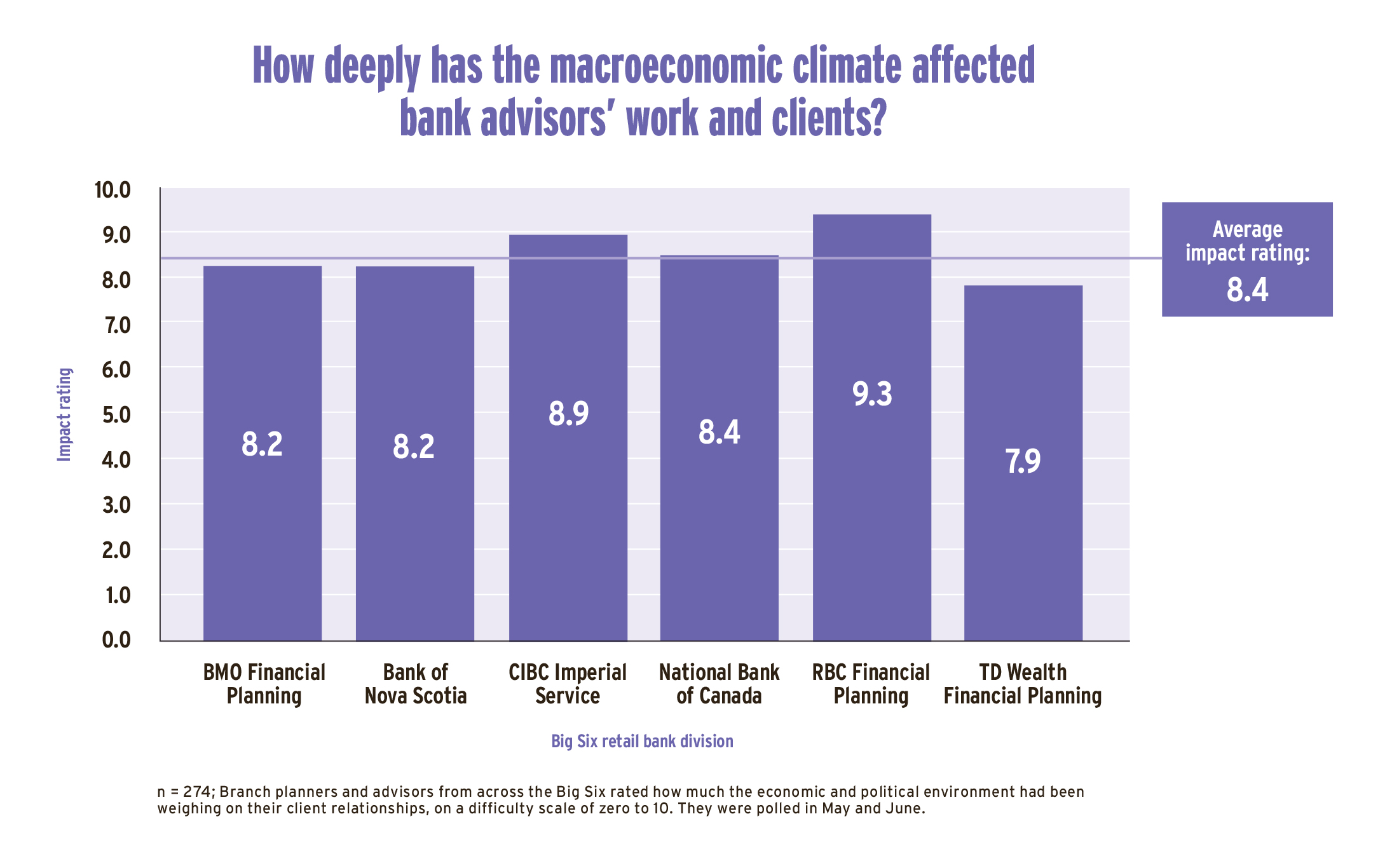

Advisors were also asked four supplemental questions, alongside confidential queries about their individual business details. They were asked: 1) Of the six groups of categories included in the Report Card, which group or area was most important to them personally when it came to their business and the support offered by their bank; 2) Whether their bank had, within the past year, invested in tools or technology to help them save time by automating repetitive everyday tasks (see pie chart called “Are the big banks offering time-saving tools to branch planners?,” below); 3) How deeply the current macroeconomic and investment environment was impacting their day-to-day work and conversations with clients (see chart called “How deeply has the macroeconomic climate affected bank advisors’ work and clients?,” below); and 4) Whether they were aware of and/or concerned about the regulatory review of retail-bank sales practices within Canada’s Big Five banks.

Click image for full-size chart