What sets Bank of Montreal’s (BMO) ETFs business apart is that ETFs are at the core of the bank’s approach to investment products, not secondary to mutual funds.

That’s the message from Kevin Gopaul, chief investment officer and head of ETFs with BMO Asset Management Inc. (BMOAM) in Toronto. “There are other firms that are being dragged into the ring now – kicking and screaming, but they’re in,” he says. “[Our ETFs business] is part of our DNA.”

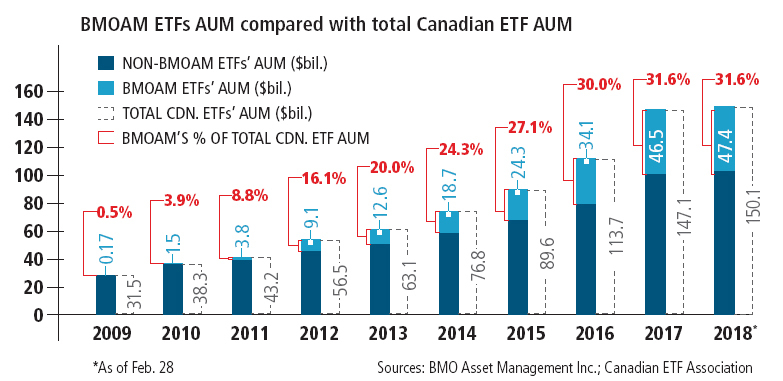

Since launching with just four ETFs in 2009, BMOAM has built a leading position in the Canadian marketplace and now offers a lineup of 81 ETFs. The firm had $47.4 billion in assets under management (AUM) as of Feb. 28, placing it second only to BlackRock Asset Management Canada Ltd. ($59.1 billion in AUM) and well ahead of third-place Vanguard Investments Canada Inc. ($14.8 billion in AUM).

Much of the reason for BMOAM’s strong lead, Gopaul says, goes back to the bank’s early decision not to allow worries about cannibalizing its mutual fund lineup detract from its goal of developing a full lineup of ETFs. That decision included a commitment to teaching clients about the ins and outs of ETFs.

“Even though these [ETF] products have been around for more than two decades,” Gopaul says, “we spent a lot of time educating individuals on what they are, how you can use them and how you can gain comfort around them.”

For example, BMOAM’s push to spread the word about ETFs has resonated with its institutional clients, including pension plans. Those huge pools used to represent a tiny part of BMOAM’s ETF business, but have accounted for some 30% of asset flows over the past three years, Gopaul says.

Having an experienced portfolio-management team focused on ETFs and accessible to investors who have questions or issues, combined with a robust infrastructure to support the ETFs business, also contributed to BMOAM’s ETF growth, he adds: “We have no subadvisory [team]; nothing else globally. All of the people, all of the technology – everything – was built in-house.”

Mutual funds also are part of BMOAM’s ETF growth strategy. BMOAM’s ETFs, as well as ETFs from third-party providers, have significant presence within many BMO-branded mutual funds. By delivering ETFs in a mutual fund wrapper, ETFs become easily accessible to financial advisors who lack access to an ETF trading platform – mostly advisors licensed by the Mutual Fund Dealers Association of Canada. “Other ETF providers say, ‘ETFs only; mutual funds are terrible’,” Gopaul says. “And we say, ‘No, [advisors] have been buying mutual funds for the past 25 years. How can we say they’re terrible products? Here’s a way to use both products together’.”

BMOAM ensures it reaches clients through another ETF distribution system as well: automated wealth-management platforms (a.k.a. robo- advisors) – both SmartFolio (BMO’s own robo-advisor, launched in 2016) and other robo-advisors. Although such services are a relatively small section of the ETF distribution market, they’re likely to grow, Gopaul says: “There’s this demand for more and more technology-based advice, and the robo-advisors are going to serve a growing part of our investment landscape.”

BMOAM focuses strongly on fixed-income ETFs, including both broad and narrowly focused Canadian, U.S., and global bond products. That permits advisors to express a precise fixed-income viewpoint that balances a client’s portfolio yield with his or her risk profile, says Gopaul: “Volatility is coming back now, and there’s going to be more demand there.”

BMOAM’s lineup of ETFs covers the waterfront, says Rudy Luukko, investment funds and personal finance editor at Morningstar Canada. These ETFs range from mainstream products, such as BMO Aggregate Bond Index and BMO S&P 500 Index, to narrowly focused ETFs such as short-, mid- and long-term provincial bond ETFs. “[BMOAM’s lineup] really amounts to being a universe of ETFs unto itself,” he says.

BMOAM also built a comprehensive lineup of ETFs that use covered-call strategies. These funds offer some protection against market volatility, but with a limited degree of growth potential. The firm has almost $6 billion in total ETF AUM held in covered-call strategies. Says Gopaul: “We’re becoming one of the biggest providers in the world of these strategies.”

Aside from the covered-call products, BMOAM’s focus remains primarily on ETFs that use passive index strategies, Luukko says: “One area in which BMO is not as active as others is in what I call ‘fully actively managed strategies,’ which are not driven by rules-based methodologies, but by the choices of their portfolio managers.”

That could change. Gopaul says that as advisors continue to shift their books toward ETFs and away from mutual funds, actively managed ETFs will become a more compelling option for his firm. “While [active ETF portfolio management] is not something everyone thought about two years ago, or even last year,” he says, “I am definitely considering actively managed ETF strategies now.”

BMOAM also is looking at adding more narrowly focused ETFs with specific methodologies, such as those built around particular industries. In March, the firm added a communications ETF to its lineup.

“There is demand for more thematic strategies, and more precise thematic strategies, which is a function of having very strong bull markets for a long time,” Gopaul says. “People are looking for more ways to express their risk appetite.”

Despite BMOAM’s strong presence in the Canadian ETF marketplace, the firm will have to remain on its toes, both in the breadth of its products and the pricing of passive products, to keep up with competitors, whether those are giants such as BlackRock or newer competitors such as Royal Bank of Canada and Toronto-Dominion Bank, Luukko says: “Getting in early has been advantageous to BMO, but that is not an enduring advantage. Competition is intense in the industry.”