As tax time rolls around again, your clients soon will be asking for advice on the best way to file their tax returns. Canada’s tax system is moving toward digital filing. In 2014, only 22% of taxpayers filed their returns manually, the old paper-based way. That’s down from 25% the year before. Canadians are embracing electronic filing in spite of the cybersecurity hiccup that the Canada Revenue Agency (CRA) experienced last April, in which an attacker stole 900 social insurance numbers from the CRA’s website using the Heartbleed computer bug. That event caused the agency to shut down its systems temporarily.

Filing tax returns electronically can save significant amounts of time, especially for those clients who are allergic to paperwork. Not only do clients not have to mail a paper return, but the return does not have to be entered manually into a computer at the CRA, which reduces the chance of error at the agency’s end. The digital method also speeds up the issuing of refunds, according to the CRA, which says refunds can arrive in as little as eight business days.

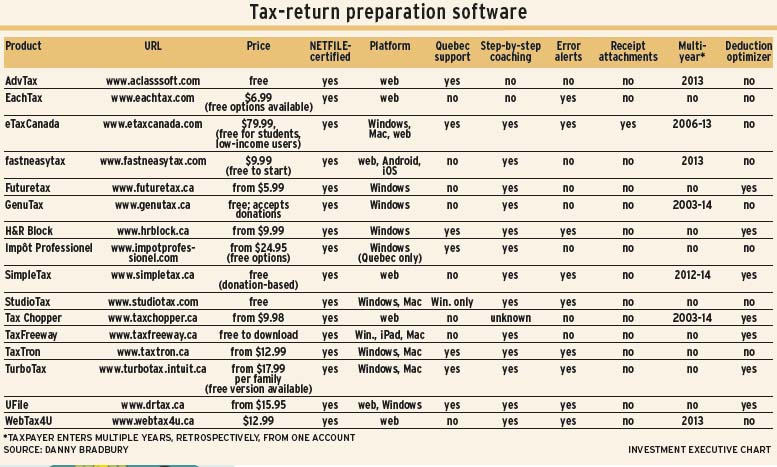

People like the convenience of online filing, and they can choose from among a variety of software products to help them prepare their tax forms. Here are some product features that you might consider when advising your clients on suitable software:

– Platform support. One of the most basic questions to ask a client is what hardware and software system they use. Windows users should consider which version of the operating system they use (the latest being version 10), while Mac users will need to look for software that supports their own OSX operating system.

The alternative is simply to file using an online system. EachTax, provided by Xinfo Technology Inc. is a web-based application that allows clients to file without downloading or installing software. Online systems can be far cheaper than buying and installing software. EachTax charges $6.99 for the first tax return, and $3.99 for each subsequent return. EachTax also is free for new customers, new immigrants and seniors over age 70, regardless of income.

– Step-by-step coaching. Are your clients averse to paperwork? For many clients, filling out forms is like pulling teeth, which is why many have an accountant do it for them in the first place. Some software will make it easier for DIY taxpayers by taking them through a step-by-step coaching process that explains exactly what is needed. eTaxCanada, provided by Phanku Software Corp., uses a coaching process that reminds clients of the documents and tax slips that they need at each stage.

Some clients might look for a mixture of coaching-based hand-holding and forms flexibility. TaxFreeway, provided by Entropy Technology Ltd., claims to be the only tax-filing software that lets users work in coaching and form modes simultaneously, flipping between the two.

– Error checking. Step-by-step coaching can be helpful for newbies with little experience in filling out tax forms. Error checking is another useful feature for newcomers and seasoned personal taxpayers alike. Even for an experienced filer, tax forms can be complex and lead to errors. Error-checking features can catch common mistakes, such as failing to fill out critical fields or perhaps claiming certain tax credits twice.

Error checking in tax-return software can be more of an art than a science because inaccuracies and inconsistencies can be introduced in so many ways. So, the level and quality of error checking may vary among packages. One thing to look for here may be an accuracy guarantee. Intuit Canada ULC’s TurboTax (formerly QuickTax) offers to pay any penalties incurred by its users due to calculation errors in its software. Backing up error-checking claims probably gives clients more confidence that the software will do what it claims.

– Netfile-certified. This feature is the big one. Software must be certified by the CRA to work with its electronic tax-filing system, NETFILE. In the past, tax-return preparation software would still have to export a document in “.tax” format, which then had to be uploaded manually by the taxpayer via NETFILE. Now, the CRA is allowing software products to submit returns automatically within the software, essentially making the filing process a push-button operation. Clients who are not tech-savvy should consider software that offers this feature.

– Receipt attachments. The CRA requires clients to mail in documents such as T4 slips and receipts supporting their tax information when sending in their tax returns manually. The agency does not require these items to be attached when using NETFILE, but taxpayers may be asked for the receipts later, especially if any aggregated amounts seem higher than average. Some software applications offer taxpayers the chance to submit all of their receipts electronically along with their tax return, attaching the receipts automatically to the tax return. This feature can help conscientious taxpayers stay one step ahead of any requests from the CRA. The feature also can enable taxpayers to get refunds more quickly and reduce the risk of negative reassessments by the CRA, which will disregard some claims if adequate information is not provided.

– Filing in Quebec. The province of Quebec requires taxpayers to fill out a separate provincial tax return. When recommending software to clients resident in Quebec, be sure that the software allows for this function. Some products, such as EachTax, specifically state that they don’t support filing in Quebec; others, such as H&R Block Canada Inc.’s filing software, do. Impôt Professionel supports Quebec filing only and is designed specifically for francophone users, making it particularly attractive to Québécois taxpayers.

– Self-employment income. Self-employed clients have special requirements that may include items such as rental property income, foreign income and pension splitting, as well as business expenses. These clients may find it worthwhile to invest in more full-featured software that can support these and other scenarios.

– Free or paid? Everybody loves a bargain. Some companies offer downloadable, paid solutions with sophisticated features designed for individuals with more complex tax requirements. Software providers frequently offer free versions with scaled-down feature sets. For example, TurboTax is available for purchase, but there also is a free version called TurboTax Free Forms available this year, which offers fewer features.

– Multi-year support. Most financial advisors probably have at least one client who has been less than organized in his or her paperwork and now owes the CRA historical tax filings. The longer these clients wait, the more stressful and daunting the situation becomes. If you can help these clients clear up their backlog and simplify the tax-filing process, you can become a problem-solver in these clients’ eyes.

Software that can support multiple years of filings in one go will be important to clients with back taxes to file. GenuTax, provided by GenuSource Consulting Inc. (and happens to be free), will support the production and filing of tax returns dating back to 2003.

– Deduction optimization. Some tax-filing products specifically search for deduction opportunities on behalf of users. TurboTax claims to scour more than 400 deductions in a bid to squeeze every last cent into a refund. Some clients may find it difficult to consider every deduction without accounting advice, and this kind of automated searching may give clients peace of mind. TurboTax also provides a “refund ticker,” which shows a running tally of the estimated refund based on the deductions chosen.

Filing taxes is never any client’s favourite hobby, but if you can guide your clients toward a painless, successful outcome, you can gain their trust and respect.

© 2015 Investment Executive. All rights reserved.