Editor’s note: At the Canadian small-cap roundtable, it became evident that there’s much more to this market segment than resources stocks. In today’s second instalment of this week’s coverage, the managers’ discussion turned to financial services companies that they hold.

This three-part series began on Monday and concludes on Friday.

The panellists:

Martin Ferguson, director and portfolio manager at Calgary-based Mawer Investment Management Ltd. His mandates include Mawer New Canada and BMO Enterprise, both of which are closed to new investors. His discipline is to buy wealth-creating companies at a discount to their intrinsic value.

Ted Whitehead, senior managing director and senior portfolio manager at Manulife Asset Management. A growth manager, Whitehead’s responsibilities include Manulife Growth Opportunities.

Stephen Arpin, vice-president and portfolio manager at Beutel, Goodman & Co. Ltd. A value manager, Arpin’s responsibilities include Beutel Goodman Small Cap, which he co-manages with William Otton.

Scott Carscallen, vice-president and portfolio manager at Mackenzie Investments. A value manager, Carscallen is responsible for Mackenzie Canadian Small Cap Value and Mackenzie Canadian Small Cap Value Class.

Q: We have discussed Canadian small-cap valuations relative to those of big-caps. What about individual small-cap stocks?

Carscallen: On a note of caution, the stock charts of high-quality companies are starting to go straight up. There’s no room for error in terms of delivering the expected earnings growth. Investors are pricing in high expectations. There is a risk of multiple contraction in some of the names. The most compelling values now are in the energy space. That’s been hit the hardest.

Arpin: At the end of December, the energy weight in the BMO Index was 16% and materials represented 26.2%.

Ferguson: The BMO Small Cap Index’s energy sector produced a negative 26.82% return in 2014. The materials sector had a negative return of 0.96% last year. All other sectors were positive. The index as a whole had a negative return of 0.09%. There is a bifurcated small-cap market, with the resources down. As they fell, investors gravitated to the other sectors.

Carscallen: In the materials sector, gold stocks, which are a big weight in this sector, were almost flat in 2014.

Arpin: I think that some of the larger Canadian gold stocks that have underperformed have been pushed down into the small-cap index. This might help to explain this index’s high weighting in gold stocks.

Carscallen: Crucial to our discussion is that with energy under pressure, companies that had any kind of exposure to the oil and gas space or any exposure to the Alberta economy, also got hit.

Arpin: The financials, for example, are under pressure.

Ferguson: One of my holdings is Canadian Western Bank (TSX:CWB) and it did get hurt.

Arpin: Equitable Group Inc. (TSX:EQB) also got hurt.

Carscallen: AutoCanada Inc. (TSX:ACQ), an auto dealership, also got hit. Some of the construction companies such as Aecon Group Inc. (TSX:ARE) also came under selling pressure.

Q: Does this provide an opportunity?

Ferguson: The oil price has turned. We have yet to achieve equilibrium between the demand and supply of oil. Until we do, there is more speculation than opportunity.

Carscallen: Some of the companies that have some exposure to energy have exposure to businesses outside of energy. This might hopefully help to shelter the pain. There might be an opportunity in some of these names. I see this in the industrials. I also consider that some higher-quality energy-services companies offer opportunities. Examples are Secure Energy Services Inc. (TSX:SES) and Newalta Corp. (TSX:NAL). They do waste management for the oil industry and it’s a fairly stable business. I own Secure and Newalta.

Ferguson: Canadian Energy Services & Technology Corp. (TSX:CEU) would fit into this category too. I own this stock as well as Secure and Newalta.

Whitehead: I recently bought Secure. I participated in its bought-deal equity financing.

Carscallen: Historically, when the energy sector does turn from a trough, you can get significant returns. We’ve been adding to high-quality names at the margin.

Ferguson: We’ve also been adding around the edges.

Whitehead: We’re also adding at the margin. It’s a good time to upgrade.

Arpin: We also have been adding to energy holdings at the margin. Valuations of these stocks are better than in the past. But we’re going to need some improvement in commodity prices for the investments to really work.

Q: Each of you uses a different definition of small-caps? Also, please specify the number of names in your portfolios.

Ferguson: To enter the Mawer small-cap portfolio, a company needs a market capitalization of 75% or less of the BMO Small Cap Index limit. This translates into a current market-cap limit of $1.5 billion versus the BMO limit of $2.1 billion. Mawer’s small-cap portfolios have 50 names.

Carscallen: I only buy companies that are generating revenues and cash flows. The market-capitalization range is roughly $200 million up to $2.1 billion. I do have flexibility to go into the mid-cap space, which I define as $2.1 billion up to $7.5 billion. I do not have a heavy exposure there. I currently have 64 names in the Mackenzie portfolio.

Whitehead: I apply quantitative analysis, looking for positive earnings surprises, positive estimate revisions and stock-price momentum. This is followed by fundamental analysis. The Manulife fund has small-to-mid-cap holdings. The fund currently has 62 names and 53% in small-caps, which I define as market cap of less than $2 billion. We have around 10% in U.S. stocks.

Arpin: The Beutel Goodman fund follows MSCI guidelines and invests in securities that are ranked at the bottom 15% of the cumulative float-adjusted market capitalization of all TSX-listed stocks at time of purchase. This translates into a limit of $3.5 billion to $4 billion. The fund has 41 names.

Q: I would like to start talking about the main sectors in the Canadian small-cap universe. You have said that there has been fallout from the low oil price on sectors such as financials and industrials. Can we begin with financials? This sector represented 16.4% in the BMO Small Cap Index at the end of December?

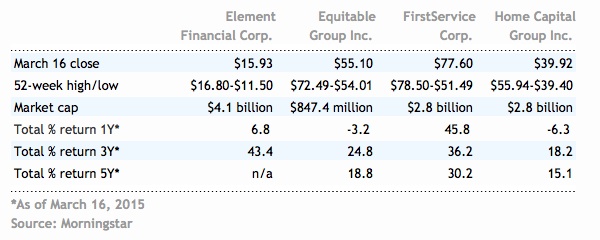

Arpin: Beutel Goodman Small Cap currently has 24.4% of the portfolio in financials. It’s the largest sector weight. The biggest holding in this sector is Equitable Group, which is 6% of the portfolio. It is interesting in terms of its valuation. We have added to Equitable. Another holding in the fund is Intact Financial Corp. (TSX:IFC), which we have trimmed recently. Other holdings are InnVest REIT (TSX:INN.UN), which we have had for one year, Industrial Alliance Insurance & Financial Services Inc. (TSX:IAG) and FirstService Corp. (TSX:FSV). The latter two names are long-term holdings.

Whitehead: Manulife Growth Opportunities has 12% in financials. The biggest holding in this sector is Element Financial Corp. (TSX:EFN), a major leasing company in Canada. It is a top-10 holding. What I like about it is its strong exposure to the U.S. market. Another holding is Home Capital Group Inc. (TSX:HCG). It is reasonably valued. I have not been adding to it. The fund also has a holding in Callidus Capital Corp. (TSX:CBL), which does distressed lending. (This was an initial public offering in April 2014.)

Carscallen: Mackenzie Canadian Small Cap Value has 15% in financials. The largest holding is Element. The second largest holding is Equitable.

Ferguson: The Mawer Canadian small-cap portfolio has more than 27% in financials. It is the largest sector weight. The portfolio has 16 different names in this sector. My largest holding is Home Capital. Like others around the table, I also own Equitable, Element and FirstService. Other large weights include Altus Group Ltd. (TSX:AIF), which provides advisory services to the real-estate industry.

I also own Canadian Western Bank. There is concern among investors that its western Canadian energy exposure will be a challenge. The bank has proven over the years to be well run and conservative. No doubt there will be some negative impact on the bank from the low energy prices. But we think that the bank can handle this and will do well longer-term.

This three-part series began on Monday and concludes on Friday.