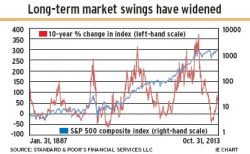

Investors say market volatility is the “new normal”

Canada's main stock market index has remained very similar in composition since the global financial crisis hit in 2008

Financials poised to perform well in 2014

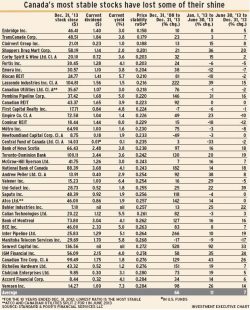

There is cause for concern, as a group of Canadian stocks with top price stability are dropping in terms of relative strength

Bearish sentiment on the Canadian dollar up dramatically

But perhaps not so great for fixed-income

Earnings growth among S&P/TSX composite index companies forecast to be 13% in 2014

Conservative investors nearing retirement would be prime candidates for this equity investment strategy

There's ample evidence that market swings have become wider since 2000, with higher bull-market highs and lower bear-market lows

U.S multinationals should see strong profit growth