The portion held by the U.S. technology sector also continues to grow

Two companies in the P&C sector are worth a look. These firms' prospects are good and the shares are reasonably priced

The industry is continuing to endure a severe downturn

Canadian equities look relatively cheap based on PE ratios

The changes will have the greatest impact on retail business, restaurants and airlines

The drop in the loonie vs the U.S. greenback is saving the day, as are cost-cutting, margin expansion and major acquisitions

Stable consumer demand in the U.S. and Europe, as well as just-in-time delivery, may boost revenue in this industry while protecting against competition from offshore producers

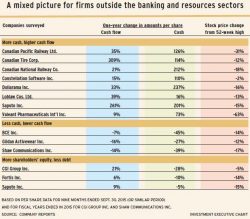

With banks and oil companies facing headwinds, firms in other sectors may hold more promise for investment returns

Weaker fixed-income returns forecast for Canada through 2019

Low oil prices raise default risk