CIRO is waiting for CRA’s feedback to move ahead, while CRA says the matter falls outside its scope

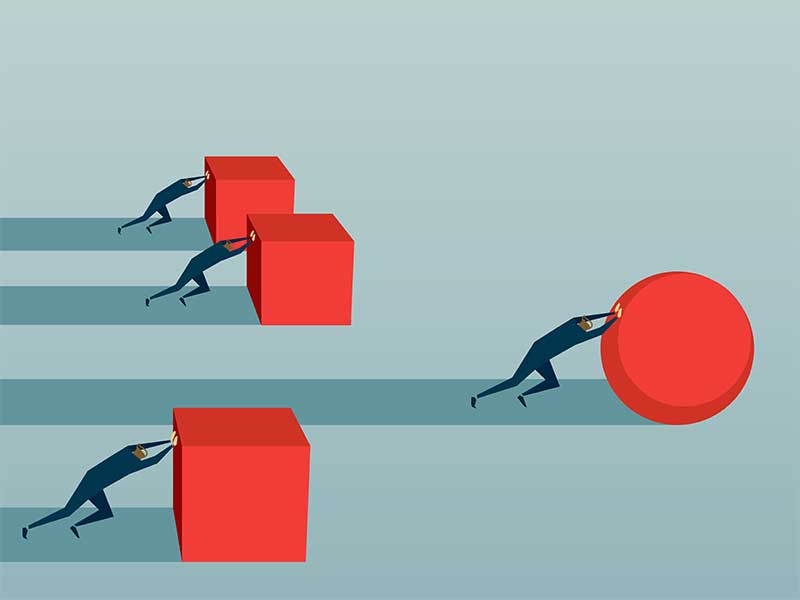

SRO crafting model to allow reps to use personal corporations

Alleged damages were suffered by a family corporation, not in personal capacity, court finds

SRO details its policy priorities for fiscal 2026

Proposal would give executors more time to implement loss carryback strategy

SRO integration and investor protection also on the agenda

Taxpayers have been given too little time to plan next steps, CBA-CPA joint committee says

Industry divided on, investor advocates opposed to, reforms

SRO consults on options for resolving long-standing regulatory disparity

The Canadian Investment Regulatory Organization has a lot more work to do, says Andrew Kriegler, inaugural president and CEO