Canadians earning between about $160,000 and $227,500 will, on average, save about $257 a year

The government introduced a motion Monday to raise the basic personal income-tax exemption to $15,000

Canadians are advised to keep track of their TFSA withdrawals and contributions themselves

Contribution room accumulates beginning in the year in which a person turns 18

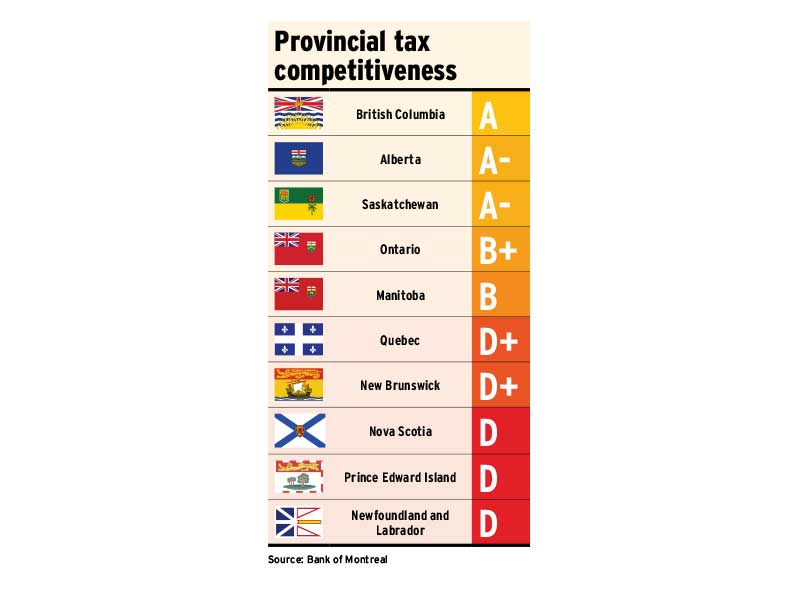

There have been cuts this year, but high government debt loads are likely to prevent a tax-cut bonanza

NDP leader Jagmeet Singh listed the party’s “super wealth tax” as a top priority for supporting a minority government

The addition marks the company's first move outside of saving and investing

StatsCan reports the average income of Canada's top 1% of taxpayers rose by 8.5%

Cut would apply to the lowest income bracket

If cross-border clients meet the strict requirements and comply, they'll pay no U.S. tax