CRM2, with its focus on enhancing the investment costs to clients, is transforming advisors' traditional revenue model

Most advisors say they already have transformed their businesses in anticipation of CRM2, but others say the new regulatory regime is bound to be disruptive

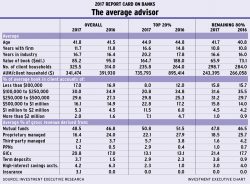

Although advisors are continuing to see significant growth in their books of business, their practices are undergoing a seismic transformation as a result of new regulatory initiatives

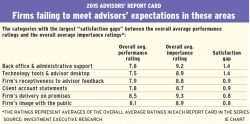

Work remains to be done to improve firms' communication efforts with their advisors

A significant percentage of advisors recommended their firm, but a close look reveals that this usually comes with stipulations

Technology is often a source of dissatisfaction, but some firms have found the right formula

Despite multiple complaints across the board, advisors with certain firms say that having strong relationships and competent and proactive staff are key to success with the back office

Advisors hope the new CRM2 reporting requirements will end their pervasive - and persistent - dissatisfaction with client account statements

Advisors are focusing on building their businesses and growing their assets under management at a time when not only has recent economic and financial performance been poor, but the risks to the outlook appear to be clustered on the negative side

Pablo Fuchs, senior editor at Investment Executive, and Clare O’Hara, staff writer, discuss key findings from the 2014 Advisors’ Report Card.