Immediate demands and a "sea of email" can force you to focus on short-term issues. Taking time every week to reflect on your practice from a big-picture perspective can help you position your business for growth

Rising interest rates and reduced regulation may create options for U.S. banks that exploit niche markets and M&A strategies

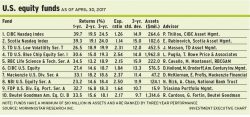

Study shows shortterm performance is unpredictable

The U.S. economy is perking up and consumer confidence is increasing

It’s tougher to trade bonds these days. Liquidity has dried up, the result of reforms that began in the fall-out of the 2008-09 global financial crisis. The lack of liquidity has expanded spreads and reduced yields on fresh, heavily traded bonds. For the vast mountain of old bonds and small bond issues that seldom trade, […]

A key factor in the growth of small business is public markets. But they need support to expand and grow

Editorial

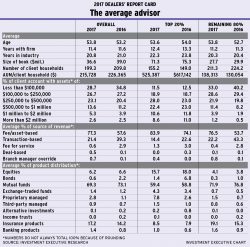

The emergence of new competitors, such as robo-advisors, combined with the impact of increased regulation and shifts at both the client level and within the advisor population, have led to a drop in average AUM and productivity

Toronto-based Fidelity Investments Canada ULC has launched a new fixed-income mutual fund. Fidelity Multi-Sector Bond Fund seeks to provide unitholders with a steady flow of income and potential capital gains. The fund works toward this goal by investing in global issuers across a variety of fixed-income subsectors, including government bonds, corporate bonds, high-yield bonds and […]

Toronto-based Excel Funds Management Inc. has launched its first ETFs. Excel Global Balanced Asset Allocation ETF and Excel Global Growth Asset Allocation ETF began trading on the Toronto Stock Exchange (TSX) in May. The investment objective of Excel Global Balanced Asset Allocation ETF is to achieve an annual return of 2.5% more than the Bank […]