Costs facing kids weigh on boomers

The expenses of weddings and child care are top of mind

- By: Tessie Sanci

- July 28, 2016 November 9, 2019

- 23:50

The expenses of weddings and child care are top of mind

TC Media/Credo survey shows that life insurance is less popular with certain groups

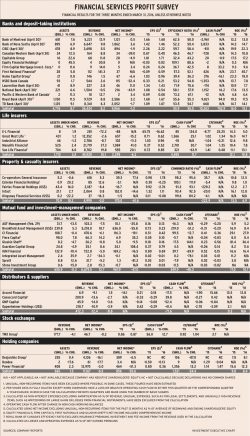

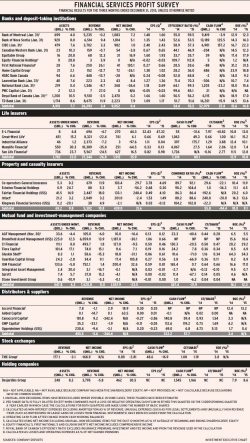

Low oil prices have taken a toll, with diversified firms faring better than those with fewer revenue streams

The Common Reporting Standard will require firms to identify clients who are tax residents of foreign countries

Advisors from other banks show interest in jumping ship

Financial Horizons Inc. plans to become a full-service financial services institution

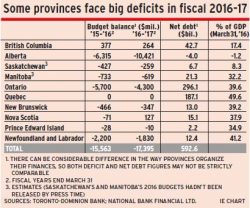

The oil shock is hitting producer provinces hard. But in B.C., the lower C$ and population growth are driving prosperity

A new firm aims to find the right fit between fee-only advisors and clients. But FAIR Canada wants more oversight

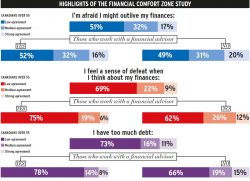

Recent TC Media/Credo consumer survey finds that personal relationships greatly deepen the bonds that form with advisors, including a willingness to provide referrals

Tax accountants and lawyers could be the subject of heightened scrutiny from the Canada Revenue Agency (CRA), as the tax authority joins its global peers…

Robo-advisors may be relative newcomers to Canada’s financial services sector, but these firms are beginning to offer expanded slates of specialized investment products. Recently, for…

Upgrading technology systems is expensive, but continuing to use outdated tech could present big risks for financial services firms

Alberta has the luxury to run deficits Newfoundfland and Labrador already has significant debt

Canada’s equities markets have been transformed over the past couple of years, with the launch of new trading venues and novel execution models. Now, regulators…

Many of your older clients fear outliving their nest eggs in retirement

Most firms welcome more transparency, but many are concerned about rule clarity and documentation

DBRS, a Canadian institution for 40 years, is now U.S.-owned, run out of New York and on an expansion drive. But the new head of…

New disclosure rules may be here, but there is still lack of agreement on how investment risks should be measured

The new rules that have opened the exempt market to retail investors also offer enhanced investor protection

The big banks are starting to feel pain as a result of low oil prices and may have to cut dividends or raise more capital

Rule changes create opportunities, but they may not be available or suitable

The allegation that so-called "active portfolio managers" are simply hugging the index is not new, but becoming increasingly important

Canadian regulators levied much more in monetary penalties and ordered more disgorgement and compensation in 2015

A large proportion of middle-income Canadians nearing retirement are at risk of sliding into poverty. And this problem is expected to balloon in the coming…