Growing desire for responsible investing

RI is being held back by various factors, but advisors who offer the strategy could see significant growth in their books

- By: Paul Brent

- October 31, 2016 October 30, 2019

- 23:55

RI is being held back by various factors, but advisors who offer the strategy could see significant growth in their books

New research found that reducing regulatory requirements for small firms also reduces market quality

The Montreal-based bank is part of a national trend to reduce branches and offer more advice and digital services

Product consolidation and increasing assets are on the agenda for Bernard Letendre, new president at Manulife Investments

B.C. credit unions say they are a vital service and should not face the removal of a long-standing preferential tax rate

New CSA report states that more work needs to be done by issuers to welcome women to their boards and into executive suites

The firm is raising $60 million to recruit 30 to 40 advisors who have well-established relationships with demanding clients

We’ve all seen the bumper sticker that reads: “I’m spending my kids’ inheritance.” It’s funny, right? Think again, states Toronto-based HomEquity Bank. According to the…

Financial services firms may have to set up their dispute-resolution process "in a much more formal way"

The discussion about bringing new blood into professional organizations has amplified as more advisors retire

Research found that there's lots of room for advisors to grow their business among high net-worth consumers

Lack of global growth and a pause in the rise of interest rates are fuelling a gold bull market that's likely to continue for some…

Report recommends the creation of a "regulatory sandbox" in Canada that gives fintech firms the freedom to experiment

National Bank is intent on increasing its high net-worth business, with a strong focus on clients rather than managing fund products

With interest rates down for the count, an overweighted position in fixed-income just won't do the job for retirees

A first in Canada for advisors, a settlement has resulted in the implementation of an overtime pay policy for trainees

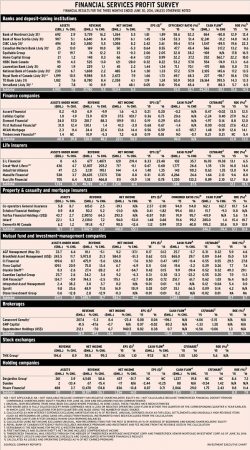

Concerns about economic growth and the impact of Alberta's wildfires meant more than half the firms had lower earnings in Q2

Updated laws provide more options to verify a client's identity, but also make monitoring more accounts necessary

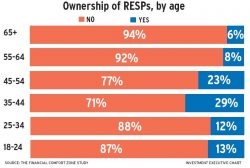

Few older Canadians contribute to RESPs, but they are gaining the attention of this group as a way to help grandchildren

Seasoned securities lawyer Paul Bourque has taken the helm at IFIC during a turbulent period of regulatory change and rising competitive pressures

With almost 1,200 Canadians set to retire each day for the next 15 to 20 years, wealth decumulation – rather than wealth accumulation – will…

A new firm fights for room in a hot marketplace

Although St. Catharines, Ont.-based Meridian Credit Union (CU) will make its national mark with a new online bank, financial advisors will play an important role…

Gaelen Morphet's style is very much in line with Sentry's brand of investment management

Taking over the daily operations of Peak Financial Group from Robert Frances represents an opportunity for the experienced Doré