After five years of sustained market volatility and non-existent investment returns, financial advisors are doing a better job of engaging with their clients, as well as providing value that extends beyond market performance, according to the results of this year’s version of the annual The Economics of Loyalty survey.

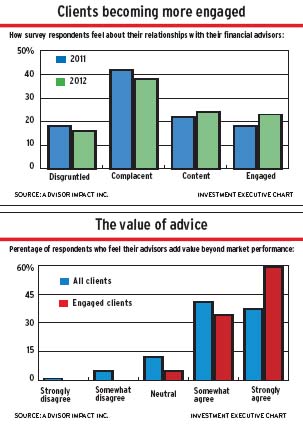

The survey, which was commissioned by the Investment Industry Association of Canada (IIAC) and conducted by Advisor Impact Inc. (both based in Toronto), notes that roughly one in four (23%) of the 1,018 investors surveyed between Oct. 3 and 22, 2012, consider themselves to be fully “engaged,” up from 18% in last year’s survey.

(Engaged clients are investors who are active participants in the markets and who are more receptive to services traditionally offered by an advisor, such as investment advice. “Client engagement” is an important metric that advisors can use for evaluating the quality of their relationships with their clients.)

Overall, levels of client engagement have increased since 2010, creating a strong base of deeply engaged clients, says Julie Littlechild, president of Advisor Impact: “While engagement is a naturally low number, the upward trend is a very positive indicator.”

Ian Russell, president and CEO of the IIAC, says that engaging with clients is a goal to which all advisors should aspire, one that can be readily accomplished: “Canadians’ relationships with their advisors are characterized by feelings of confidence, clarity and control. We believe that when clients feel confident and in control, it drives a deeper sense of engagement.”

Nevertheless, Littlechild admits, there are areas in which advisors can improve: “We have work to do in enhancing the value proposition, which begins with helping clients to understand and appreciate fully the value that is being delivered above and beyond market performance.”

That said, advisors wouldn’t be beginning to improve in this way from a standing start, as clients increasingly are seeing their advisor as a driver of value.

The survey found that more than three in four clients (77%) agree that their advisor adds value above and beyond market performance. That is a notable increase from last year, when only 59% of clients shared that opinion. Furthermore, the most recent survey found that almost two-thirds (63%) of clients feel they receive high value relative to fees paid.

The survey report notes the striking difference in how “engaged clients” are likely to view the value of their relationship with their advisors to be separate from their investment returns. For example, almost 20% more engaged clients rate the value provided by their advisors as “high” or “very high” relative to fees paid.

Moreover, engaged clients are more likely to work with an advisor who provides multi-generational wealth planning, Littlechild says: “By understanding the drivers of engagement, we can understand the drivers of value.”

In this post-financial crisis world, many advisors have had to step up their game to show clients that value is best defined beyond simple market returns, says April-Lynn Levitt, a coach with The Personal Coach, in Calgary.

As more advisors become comprehensive wealth managers, she says, advisors’ value comes down to their ability to help clients plan for life’s expected and unexpected events. This means paying attention to clients’ long-term financial goals, as well as offering services such as insurance planning and debt management.

“It’s really tough to justify your value,” Levitt says, “if you aren’t doing these sort of things these days.”

Although the survey’s findings lend credence to the broader value of advice narrative that has become increasingly prevalent in the advisory channel, it also notes how instrumental engaged clients are to the referral process.

For example, the survey found that the relatively small swatch of engaged clients provide almost all referrals made to advisors. Furthermore, the findings dispel the myth that advisors who ask directly for referrals from clients are successful in getting them.

“These insights have profound implications for the referral process,” the survey report says. “[It] suggests that traditional approaches that assume clients refer because they are asked by their advisor simply don’t work.”

Nevertheless, the statistics show that advisors appear slightly more comfortable in asking their “engaged” clients for referrals.

Instead, almost 70% of clients say they would volunteer a referral if they felt it would help a friend, the report says. As well, 36% of survey respondents say a friend, family member or colleague referred them to their current advisor in the first place. This helps to underscore the role of friends and family in the referral process and in generating new business for advisors.

“I continue to be surprised by the percentage of clients who say they have provided a referral,” Littlechild says. “The data show that when a client is engaged, [he or she] provided an average of two referrals over the past 12 months. That potential is staggering.”

The report also sheds light on other areas that can be particularly relevant for advisors. The survey found that:

– 25% of clients say they have provided a referral to their advisor in the past 12 months;

– 62% of engaged clients have a written financial plan, vs only 44% for all clients;

– 41% of survey respondents feel their advisors have “a lot” or “complete” control over their investment returns;

– the three most prominent “organic growth opportunities” for advisors in the future are: long-term care insurance, estate planning and trust services.

The survey also confirmed a trend that analysts of the advisory channel have long noted: developing trusted relationships with your clients is the foundation for building a successful practice.

For example, 84% of client respondents – or about five out of every six – say they trust their advisor. This is the first year this metric has been measured. Furthermore, 88% of clients are likely to continue working with their financial advisor. (In contrast, only 32% of investors surveyed overall trust the financial services industry as a whole.)

This survey underscores a much broader industry change in how advisors need to approach their businesses, says Sara Gilbert, founder of Strategist in Montreal: “During the ’90s, we used to set one advisor apart from the other based on the products they offered: one had more new issues or inventory than the other. But that isn’t always the case anymore.”

In particular, over the past five years, the advisory channel has experienced significant changes, Gilbert says. Gone are the days when discussions about products were king; they have since been replaced by the quality of the relationship that advisors build with their clients.

“Baby boomers who used to have many different accounts across the Street now just want one trusted advisor to take care of everything,” Gilbert says. “That’s why trusting relationships have to be so strong.”

© 2013 Investment Executive. All rights reserved.