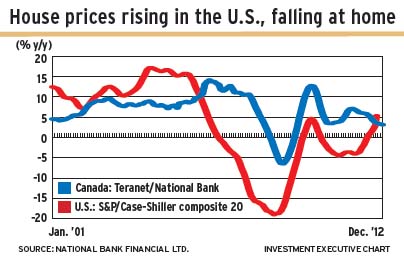

CANADIAN AND U.S. HOUSING markets continue to move in opposite directions. That’s expected to continue, although no one anticipates that the plunge in Canadian house prices will mirror that which occurred in the U.S. between 2007 and 2009.

Most Canadian economists expect domestic house prices to drop by 5%-10% over the next two to three years. U.S. house prices fell by 31% between March 2007 and May 2009.

House prices in Canada declined for the fourth month in a row in December and were only 3.1% above prices a year earlier, according to the Teranet/National Bank composite house price index.

In contrast, the S&P/Case-Shiller composite 20 home price index indicates that U.S. house prices have been increasing since February 2012 and were 5.5% higher year-over-year in November, the latest data available for that index.

Prices dropped in Canada’s three big cities in December and were already 2% below year-earlier levels in the overheated Vancouver market. However, prices were still up by 6.3% for the same period in Toronto (its condominium market is considered overheated) and up by 3% in Montreal.

House sales have been declining in Canada since May, with an average drop of 12.5%. They were down by 21.3% in Toronto, down by 20.2% in Vancouver and down by 16.8% in Montreal.

The only major city in which sales were higher in December than in April was Ottawa, which had a 2% increase. Nevertheless, Ottawa had a slight decline of 0.1% in house prices in December, and its average price level was only 2.6% above the level seen a year earlier.

© 2013 Investment Executive. All rights reserved.