Insurance: Balance is needed

Insurers need to to create products that appeal to younger clients

- By: Megan Harman

- March 1, 2014 October 19, 2019

- 00:00

Insurers need to to create products that appeal to younger clients

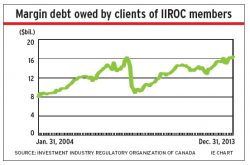

Advisors must inform their clients about the risks of borrowing

Reaction to Ontario's initiative reveals big differences of opinion

Equities, balanced funds more popular

Insurance industry players question “one size fits all” approach

Complying with domestic regime

Strong growth anticipated in professional and financial services

Some experts contend the budget will not contain costly initiatives

Only B.C. and Ontario have committed to the national initiative

Hefty retention bonuses now come with vested stock options

OSC mystery shoppers seek “investor experience”

But perhaps not so great for fixed-income

Outperformers have a large “active share” in their portfolios

Expansion of the U.S. economy should help Canadian exporters

IIROC’s proposals spell out its plan for its version of the CRM 2 rules

Mawer’s Martin Ferguson is willing to own a big part of a company

But the proposal to change enforcement rules has its critics

Tool filters clients’ online news

Regulators have uncovered problems in how fund firms rate risk

Firms are shelling out a pretty penny to get top financial advisors

High household debt, weak economy also affecting insurance sales

Feds targetting a range of tax loopholes

Proposals to update disciplinary system worry advisor groups

Some provinces want to strengthen the existing system

Amid tough times for firms, Richardson GMP buys Macquarie