For some time, policy-makers have been worried about rising household debt levels in Canada. Borrowing for the purposes of investing appears to be following that trend, too, with margin debt now at record levels. Regulators also are increasingly concerned about suitability and disclosure when investors play with borrowed money.

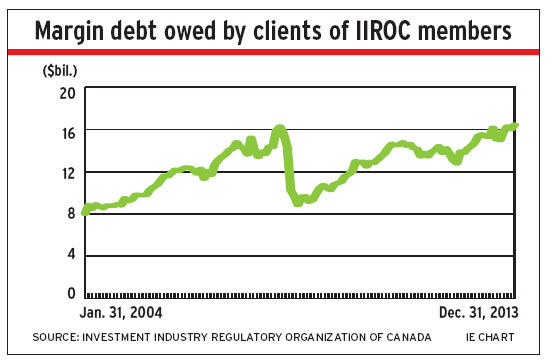

The latest data from the Investment Industry Regulatory Organization of Canada (IIROC) show that client margin debt reached a record level of $16.4 billion at the end of 2013. This amount surpasses the previous high of $16.3 billion, which was recorded immediately before the global financial crisis took hold in July 2008.

Margin debt levels plunged in the immediate aftermath of that crisis. By the time the crisis had passed its peak in November 2008, client margin debt had dropped to less than $10 billion. Now, amid relentless growth in household debt and the robust market recovery, client margin debt is back to those pre-crisis levels.

At the same time, IIROC reports that its compliance staff is uncovering a growing number of cases of investors using inappropriate leverage strategies, although there’s no particular theme to the improper strategies.

“Each situation we’ve come across is different,” says Paul Riccardi, senior vice president, enforcement, member policy and registration, with IIROC.

Those situations include various suitability issues, he adds, from the magnitude of the leverage being used to the types of securities that clients are borrowing to invest in and the overall risk profile of the investors. In some cases, more than one of these factors is present.

In addition to suitability issues, IIROC’s staff have seen disclosure problems in which clients are not being provided with sufficient information to understand the risks associated with leverage strategies or the details of their debt-servicing obligations.

IIROC, having observed these and other issues in its conduct compliance work, is issuing new guidance in an effort to help firms and reps comply with their suitability and supervisory obligations.

The new guidance emphasizes the obligations that dealers and financial advisors have when leverage strategies are recommended to retail investors – or when they discover that a client is pursuing this sort of strategy on his or her own.

For advisors, the focus is on suitability and disclosure. Suitability obligations have been heightened with the introduction of the first phase of the client relationship model reforms. With those reforms, the obligation to ensure suitability includes not only that a specific product must be appropriate but also that the order type, trading strategy and method of financing a trade (recommended or not) also is suitable for the client.

In addition to ensuring suitability, clients must be fully apprised of the potential risks – and benefits – of borrowing to invest. This requirement includes ensuring that clients understand the greater risk of investing with borrowed money, that leveraged investment strategies can lead to far larger losses and that the client will be expected to repay an investment loan, even when the value of the resulting investment declines.

For dealers, the guidance sets out the minimum controls that firms should adopt to identify and properly supervise leverage strategies.

This becomes trickier when the client’s loan is provided by a third party. The use of so-called “off-book” loans poses additional risks. For example, there could be a threat that margin limits may be breached and that the dealer firm may not be fully aware of the client’s circumstances or strategy, which undermines the dealer’s ability to supervise the account.

IIROC expects firms to have controls in place that are designed to limit these risks by flagging any accounts that are using off-book loans recommended by an advisor, so that the dealer firm can ensure these accounts are being supervised properly.

IIROC also expects firms to have controls in place that are intended to detect the use of undisclosed off-book loans, in which a client secures a loan on his or her own, without the advice or knowledge of the rep or the dealer, and who may even deny it when asked.

The regulator concedes that undisclosed, off-book loans can be tough to police and that dealer firms aren’t expected to have an “expansive compliance framework” in place specifically to ferret out these situations.

However, IIROC’s position is that dealers and reps cannot ignore these situations when they do learn about them or where they see “red flags” indicating that a client may be secretly borrowing to invest. The regulator’s guidance spells out best practices for identifying these signs.

IIROC’s guidance also notes that additional obligations are triggered in situations in which dealers or reps have referral arrangements in place to facilitate off-book loans. Among other things, those arrangements must be set out in a written agreement, and upfront written disclosure of the terms of the arrangement must be provided to clients.

Recommended or not, the use of off-book loans is a particular focus for IIROC. The regulator indicates that its business conduct compliance department will be focusing on the use of leveraged strategies in its dealer exams and specifically will be scrutinizing situations in which off-book lending is being recommended in an effort to ensure that both reps and dealers are living up to their regulatory obligations.

Although it’s difficult to estimate just how much leveraged investing activity is taking place with the aid of off-book loans, Riccardi says, IIROC does know that the practice has been “more prevalent than in the past. That’s why we have issued this guidance.”

At the same time, the regulator has issued a bulletin for clients outlining the factors they should consider when considering a leverage strategy, including the importance of disclosing any investment-loan arrangement to their advisor.

© 2014 Investment Executive. All rights reserved.