Canadian small-and mid-capitalization equities were riding high this year until this past autumn’s market correction, when these equities were sideswiped by concerns about valuations and tumbling commodities prices. Yet, portfolio managers of Canadian small- and mid-cap equity funds argue that because stocks look more attractive now, the asset class will prevail.

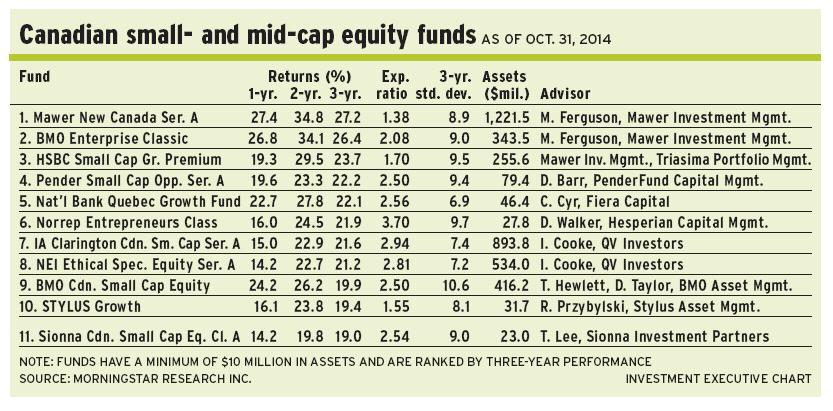

“There is so much uncertainty in the market that any kind of news will drive stocks up or down. It doesn’t help that valuations were looking more lofty before the recent downturn,” says Teresa Lee, managing director with Toronto-based Sionna Investment Managers Inc. and portfolio manager of Sionna Canadian Small-Cap Equity Fund. “But valuations are getting down to more attractive levels than they have been over the year.”

Small-cap valuations moved up during 2014, and the traditional discount to Canadian large-cap stocks narrowed to about 20%, says Lee. Recent volatility has widened that discount to about 25%-30%, based on a price-to-book value basis. “That’s pretty attractive,” says Lee, who, barring a repeat of the 2008 global financial crisis, does not anticipate further significant widening of the discount.

The most vulnerable sector in the small-cap universe is energy stocks, which have been hit by slumping demand for oil and geopolitical tensions in the Middle East and between Russia and Ukraine.

“We take the long-term view and believe that crude oil prices will revert back to their marginal cost of production, which is about US$90-US$95 a barrel. Long term, all commodities revert back to their marginal cost of production,” says Lee, noting that prices inevitably rise when producers cut production in response to low prices.

Energy-based company issues comprise about 20% of the benchmark BMO Nesbitt Burns Canadian small-cap index.

The small-cap asset class generally suffers from the perception of being riskier than large-caps, yet small-caps do not drop any further than the broader market, Lee adds: “When there are fears about global growth, the market becomes more risk-averse and the first asset class to get sold off is small-caps – even though [the justification for that strategy] is not reflected in the fundamentals.”

Lee, a bottom-up value investor, has been taking advantage of market volatility and spending some cash, which now represents 5% of the Sionna fund’s assets under management (AUM) vs 10% earlier this year. “You sell the names that have done well,” Lee says, “and buy those that have been irrationally sold off.”

From a sectoral viewpoint, Lee has about 30% of the Sionna fund’s AUM in financials, 18% in energy, 16% in consumer discretionary, 13% in industrials, with smaller weightings in materials and information technology (IT).

Running a fund with 43 names, Lee likes firms such as Calian Technologies Ltd., which operates two distinct businesses: staffing for government agencies and ground-based equipment for monitoring satellites.

Calian has bought some health-and engineering-services firms, which Lee believes should boost the bottom line when the firm’s clients’ spending picks up. Calian stock is trading at about $18.60 a share, or 12.3 times earnings, and pays a 6% dividend. There is no stated target.

sharing the view about uncertainty being at the root of the equities markets’ malaise is Tyler Hewlett, vice president with Toronto-based BMO Asset Management Inc., and lead portfolio manager of BMO Canadian Small Cap Equity Fund (formerly BMO Special Equity Fund). He works with David Taylor, associate portfolio manager at BMO.

“Small-cap markets don’t take well to uncertainty,” says Hewlett, adding that a stronger U.S. dollar and weaker data from Europe have been troubling markets. “Until last summer, growth stocks had been trading at a premium. That meant that the returns were going to come from earnings rather than from multiple expansion. Returns for the past two years had been strong because we had a combination of the two.”

Hewlett believes that the direction of the equities markets depends upon the possibility of the U.S. Federal Reserve Board raising interest rates: “If we’re heading into a weak environment, it will probably mean a lower probability of monetary tightening. On the other hand, if it looks like the economy is OK and the recent economic data that we’ve seen are just blips, then the market needs to understand what kind of environment we’re going into so we can make assumptions.”

Although Hewlett is reluctant to comment on the small-cap asset class as a whole, he is especially cautious about the materials and energy sectors because of the difficulty of predicting where commodities prices are going.

“Energy was very strong early in the year, but very weak of late. What you think about the Canadian market, as a whole, depends on those two sectors,” says Hewlett. “But we’re still positive on the non-resources areas, such as [IT}, financials and industrials.”

About 20% of the BMO fund’s AUM is in financials, 16% is in industrials, 16% is in IT, 15% is in energy, with smaller weightings in sectors such as materials.

“In general, valuations are more attractive,” Hewlett says, “but we’re not at the level we saw two years ago, when there was much more uncertainty. Those days are gone.”

Hewlett, a bottom-up investor running a portfolio with 55 holdings, likes firms such as Callidus Capital Corp., which provides short-term bridge loans to companies in distress.

“[Callidus’s] management has a track record of success in dealing with these types of companies,” says Hewlett, noting that Callidus has a loss ratio of almost zero.

Callidus stock is trading at about $20.40 a share, or about 23 times forward earnings. Hewlett has a $30 share price target within 12 to 18 months.

It’s time for the markets to pause, even though the fundamentals remain solid, says Dave Barr, chief investment officer with Vancouver-based PenderFund Capital Management Ltd. and portfolio manager of Pender Small Cap Opportunities Fund.

“Businesses are actually growing their revenue and earnings,” he says. “At the individual company level, things are going well. But the market is valued on two things: earnings and the multiple people are willing to pay.”

Indeed, Barr notes, investor skittishness was apparent over the summer, as he frequently was asked when a pullback would occur, despite the rising markets: “A lot of people were waiting for a pullback, so it became a self-fulfilling prophecy. I think we’re having a bit of a breather here.”

Barr, like his peers, says that valuations have been trimmed – and he has been taking advantage of the lower prices: “We don’t know where markets are going. But over the past decade, the S&P 500 composite index went up at an average annual compound rate of 6%. Coincidentally, the earnings per share growth also was 6%. Over a long period, the market will give you the underlying economic growth.”

Barr, an investor who seeks companies that can increase their earnings at a faster rate than the S&P 500, adds: “We’ve been building positions in companies that are trading at closer to their 52-week lows than their 52-week highs. We’ve been focusing on cheap companies that will be successful 18 to 36 months out.”

From a strategic viewpoint, Barr has reduced cash to about 13% of the Pender fund’s AUM vs more than 20% earlier this year. The fund also holds 40% in IT, 15% in health care, 8% in financials, 6% in energy, with smaller weightings in sectors such as 5% in industrials.

One of the top holdings in the 35-name Pender fund’s portfolio is Absolute Software Corp., which offers so-called “discovery solutions” for laptop owners.

“If your laptop gets stolen, another computer can log into a central server and find out where your laptop is located,” says Barr.

A longtime holding, Absolute’s stock is trading at about $7 a share, or about 10 times 2015 cash flow. Based on better sales and marketing execution under new senior management, Barr has a target of $12-$15 within 12 to 18 months.

© 2014 Investment Executive. All rights reserved.