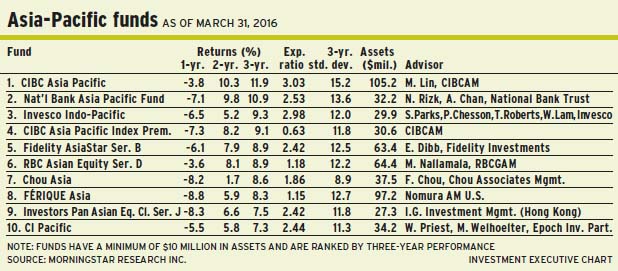

ASIA-PACIFIC EQUITIES HAVE been struggling, weighed down by worries of China’s slowing economic growth and its impact on the country’s trading partners in the region. Portfolio managers are divided: some remain generally upbeat, focusing on better valuations; others are cautious, especially about China.

“Definitely, China’s slowing growth has an impact on the region,” says Eileen Dibb, portfolio manager with FMR LLC (a.k.a. Fidelity Investments Asset Management) in Smithfield, R.I., who oversees Fidelity AsiaStar Fund. “China is a big economy, and more than 50% of Asian economies are export-oriented. A lot of that goes to China. That’s a big issue when China’s growth slows substantially.”

The prospect of more interest rate hikes in the U.S. is not a genuine concern, adds Dibb, noting that markets such as Indonesia and the Philippines have begun to rebound lately.

Yet, markets such as Shanghai now are extremely cheap, says Dibb, adding that its stocks are trading at about 1.1 times book value. “You are at one of the cheapest points in the Chinese market in the past 10 years. Growth is obviously slowing, and there are some expectations that [China’s authorities] will take excess capacity out of certain industries. That could mean a slight hit to employment and some worries about non-performing loans in China, which could be a factor. But we haven’t seen much of that yet. “

The cheapness of markets such as Shanghai is attributable to speculative retail investors who bailed out last winter, when sky-high valuations collapsed. Today, the picture is entirely different. “I don’t believe [China] is a place you need to flee from. When you’re on 1.1 times book value, that’s not saying it’s a bubble.”

However, Dibb is cautious about saying the worst is behind us: “The Chinese and Hong Kong property could be seeing signs of life. And emerging markets have seen a rebound year-to-date. As long as the region is not a disaster, we have good opportunities to invest.”

Dibb, a bottom-up, “growth at a reasonable price” investor, has allocated about 43% of the Fidelity fund’s assets under management (AUM) to Japan, which is slightly higher than the benchmark MSCI AC Asia Pacific total return index. There also is 22% in Greater China (which includes Hong Kong), 8.5% in South Korea and smaller weightings in India and Australia.

On a sectoral basis, there is about 20.5% each in consumer discretionary and financials, 15% in information technology and 13.5% in health care.

One favourite name in a portfolio with about 110 stocks is Hong Kong-listed Shenzho International Group Holdings Ltd., which makes clothing for brands such as Nike. Shenzho stock trades at HK$41.55 ($6.50) a share and pays a 1.5% dividend.

China’s rate of growth inevitably must slow, thanks in part to the so-called “law of large numbers,” says Mark Lin, vice president at CIBC Asset Management Inc. in Montreal and portfolio manager of CIBC Asia Pacific Fund.

“The bigger you grow, the harder it is to maintain a historical growth rate,” Lin says. “So, China will be slowing from here. First, because China is the second-largest economy in the world. Second, it can’t sustain its growth because the [size of the] workforce is decelerating quickly, thanks to the one-child policy.”

Meanwhile, as average income rises to about US$7,000 a year per capita, China is losing its low labour-cost advantage to other countries. “Some manufacturing is going to places such as Mexico, thanks to the North American Free Trade Agreement,” Lin says. In addition, air and water pollution have worsened to the point that they are affecting health and, ultimately, industrial production.

Finally, Lin believes that China is starting to reach the upper limit of leverage in the economy: “Credit growth is faster than gross domestic product growth – about twice the speed of the economy.” And bubbles come to an end, Lin argues, pointing to the U.S., which went through a dramatic deleveraging process after the 2008-09 global financial crisis, and to Europe, which began a similar exercise after its 2011 crisis.

“So, we’re early in the deleverage cycle [in China],” Lin says, “but late in the credit-expansion stage. After expansion comes contraction, which hasn’t happened yet. But it’s next, and can be very painful.”

Although China’s authorities could implement policy measures, such as lowering interest rates, Lin argues, borrowing is reaching very high levels, some of which is hidden within the so-called “shadow banking” system.

“This needs to be worked out,” Lin says. “And it could be painful.”

Although Lin is a bottom-up investor, he is cautious on China and has gradually reduced the CIBC fund’s exposure to China since mid-2015. Instead, he has shifted assets into Japan, which accounts for 52.7% of the CIBC fund’s AUM, followed by 26.7% in Australasia, 15% in emerging Asia (primarily China) and 5.8% in Hong Kong. From a sectoral standpoint, consumer-defensive names dominate, with 31.1% of AUM, followed by health care (25.6%), information technology (IT; 16%) and smaller weightings in sectors such as financials and industrials.

A top holding in the 38-name CIBC fund is Australia-based CSL Ltd., the world’s second-largest maker of blood plasma. “Life expectancy is growing around the world and that plays well into a long-term thesis,” Lin says.

CSL stock is trading at about A$101.45 ($95.40) a share. Although CSL trades at about 24 times earnings, Lin argues that it is expected to see 15% earnings per share growth.

China’s slowing economy is one thing, but lower risk appetite for Asian equities and continuing flows of funds out of Asian equities markets also are factors, says Mayur Nallamala, senior portfolio manager and head of Asian equities with RBC Global Asset Management Ltd. in Hong Kong and portfolio manager of RBC Asian Equity Fund.

“If we compare now to a year ago,” he says, “Asian market participants appear to have much less faith in the governments’ ability to handle this situation, probably the most acute in China.” Moreover, he adds, the correction in the Shanghai market, due in part to policy missteps, has yet to run its course – more volatility is anticipated.

Nallamala says it’s too early to say the worst is over: “The sluggish outlook for global growth and renewed concerns regarding the unstable state of China’s economy have led to sustained weakness in Asian equities, and currency markets over the past year have not really changed at all. China still has the challenging task of balancing real economic growth with capital control and exchange rates. We think the macro risks remain to the downside.”

However, the news is not all grim. Some parts of Asia look more promising and have been focused on implementing major reforms, and equities markets are likely to reward meaningful progress. “India and Indonesia are good examples,” Nallamala says.

From a valuation standpoint, Nallamala maintains that Asian equities are trading at valuations similar to past five-year median levels or above. “Markets that look relatively expensive in our model are Indonesia and India. Conversely, Taiwan and Hong Kong appear to be the most undervalued,” Nallamala says, adding that factors that can change this view include consensus earnings outlooks and capital inflows that are determined by risk appetite.

Nallamala, a bottom-up investor who is mindful of macroeconomic trends and developments, as well as benchmark weights, has allocated about 43% of the RBC fund’s AUM to Japan: “While that market will remain volatile in the short term, quality companies that have room for significant improvement in areas ranging from balance-sheet management to corporate governance will continue to provide long-term shareholder returns.”

Other countries’ weights include 11.6% in China, 9.1% in Australia, 8.8% in India and smaller holdings in markets such as South Korea. The top three sectors are financials (22.4%), IT (18%) and consumer discretionary (17.6%).

A holding in the 125-name RBC fund is HengAn International Group Co. Ltd., China’s leading personal-hygiene paper manufacturer.

“[HengAn] has successfully built its sanitary napkin business in the past several years through strong product development and marketing,” Nallamala says, adding that the firm has repeated that success in disposable diapers.

HengAn, listed on the Hong Kong stock exchange, is trading at about HK$67.30 ($10.50) a share. There is no stated target.

© 2016 Investment Executive. All rights reserved.