This article appears in the Mid-November 2020 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

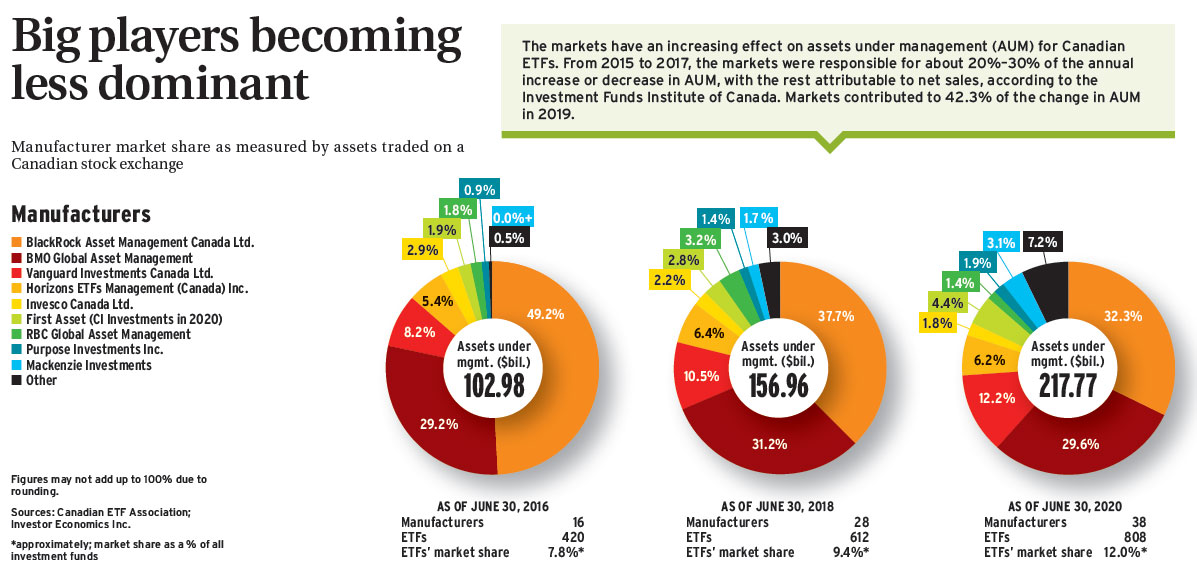

The ETF market has diversified significantly in recent years. Inflows and assets under management have increased, propelled by interest from both retail and institutional investors. The number of ETF manufacturers also has increased, reducing the dominance of the largest players

Big players becoming less dominant

Manufacturer market share as measured by assets traded on a Canadian stock exchange

Click image for full-size chart

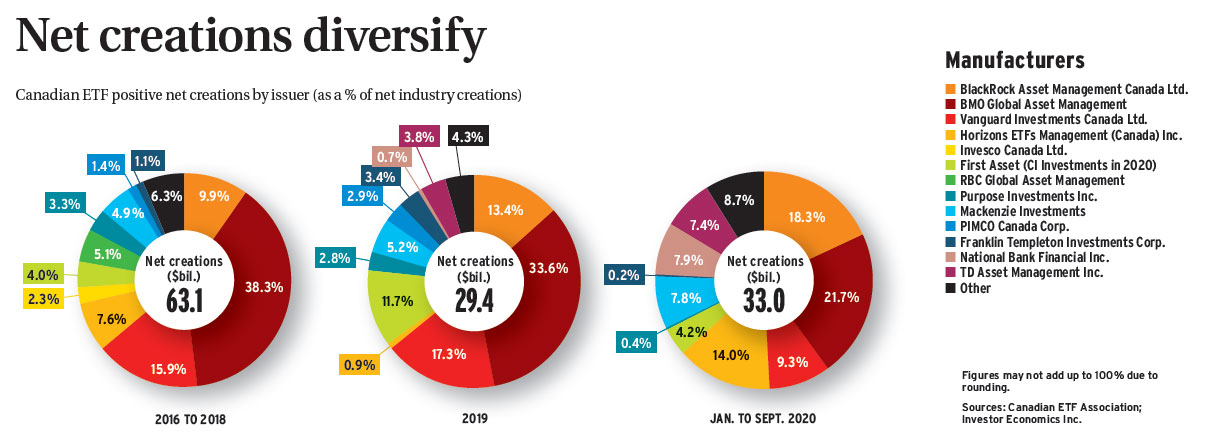

Net creations diversify

Canadian ETF positive net creations by issuer (as a % of net industry creations)

Click image for full-size chart

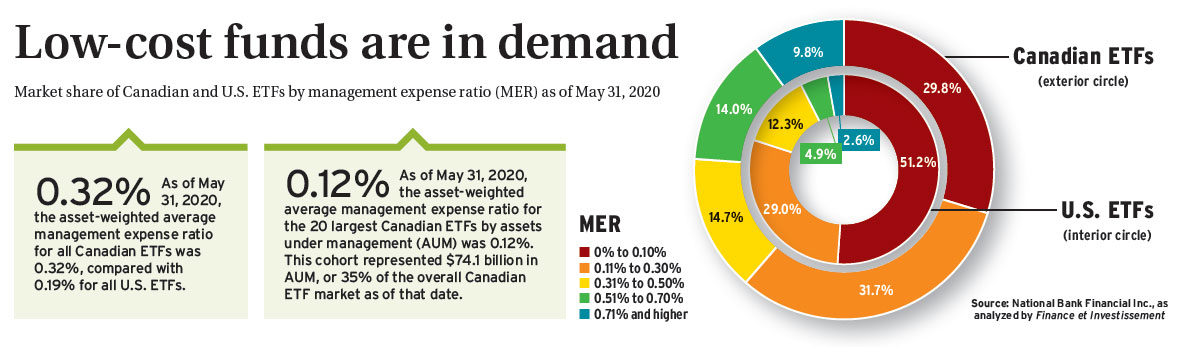

Low-cost funds are in demand

Market share of Canadian and U.S. ETFs by management expense ratio (MER) as of May 31, 2020

Click image for full-size chart

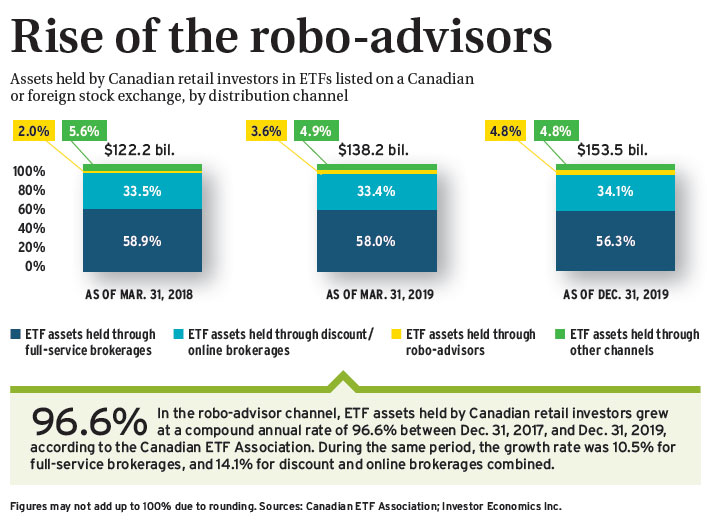

Rise of the robo-advisors

Assets held by Canadian retail investors in ETFs listed on a Canadian or foreign stock exchange, by distribution channel

Click image for full-size chart

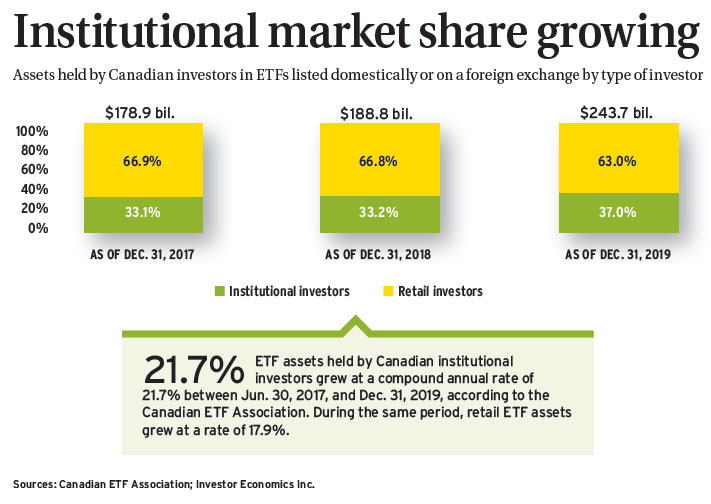

Institutional market share growing

Assets held by Canadian investors in ETFs listed domestically or on a foreign exchange by type of investor

Click image for full-size chart

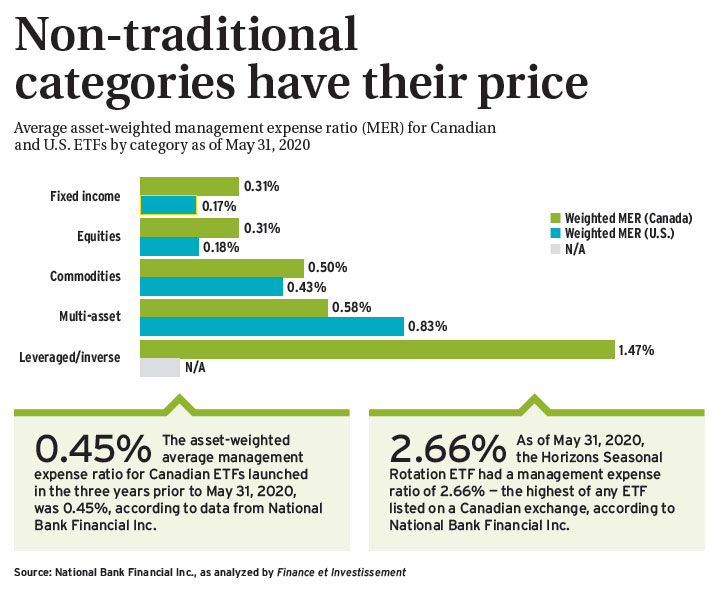

Non-traditional categories have their price

Average asset-weighted management expense ratio (MER) for Canadian and U.S. ETFs by category as of May 31, 2020

Click image for full-size chart