This article appears in the January 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert: Stephen G. Scatterty, president and investment advisor with Insch Wealth Management/Worldsource Financial Management in Newcastle, Ont.

The philosophy: Scatterty uses software based on modern portfolio theory to help guide portfolio construction. When constructing portfolios for clients with more than $1 million in investable assets, he typically relies on the expertise of private wealth investment managers to add alternative assets such as private equity, real estate and infrastructure investments.

The allocation:

- 10% to the Centurion Apartment Real Estate Investment Trust, a private REIT with a target return of between 7% and 12%, which is currently paying a dividend of about 4.25%.

- 10% to the Connor Clark & Lunn (CC&L) Infrastructure Portfolio, a globally diversified portfolio with holdings in privately owned alternative and renewable energy assets across Canada and in South America.

- 10% to the CC&L Private Capital Real Estate Portfolio, a portfolio diversified by sector and tenant type that aims for a sustainable income stream and attractive long-term growth.

- 10% to the CC&L Private Loan Portfolio, which aims to provide yields that are more stable and attractive than those from bonds, as well as improved diversification.

- 10% to the CC&L Multi-Strategy Fund, which invests in a complementary set of absolute return strategies to provide diversified sources of return.

- 18% to the Guardian Directed Equity Path ETF (TSX: GDEP).

- 12% to the Guardian Directed Premium Yield ETF (TSX: GDPY).

The two Guardian ETFs hold globally diversified income and equities securities, with an overlay of derivative strategies for downside protection. - 20% to the Dixon Mitchell Canadian Balanced Pool, which comprises 60% equities and 40% fixed income. This discretionary portfolio is designed to provide moderate income and reasonable growth over the long term, with lower volatility.

Scatterty said his goal is to “build an investment strategy structured in a similar manner to many pension plans, without necessarily having single-manager risk.” He also is “looking beyond traditional stock and bond portfolios to provide greater diversification and better risk-adjusted rates of return.”

- 100% to the Fidelity Global Balanced Portfolio, which has an allocation of 70% to stocks and 30% to bonds.

Scatterty suggested that Emma, who is a new investor, should “avoid a negative first experience.” He therefore recommended a low- to medium-risk portfolio with a solid performance track record and a strong long-term growth profile.

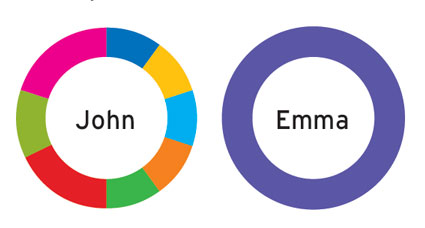

The expert: John Kason, portfolio manager with Fieldhouse Capital Management Inc. in Prince George, B.C.

The philosophy: Kason provides affluent families with pension-style portfolio management and a family office experience. He uses alternative assets and strategies in combination with global multi-manager teams to reduce correlation and provide risk-adjusted exposure to the entire market. Kason also aims for portfolios to adhere to environmental, social and governance (ESG) principles.

The allocation:

-

- 35% to alternative income, consisting of:

- 13% to the Capstone Mortgage Pool.

- 12% to the Trez Capital Yield Trust US.

- 10% to the Ninepoint Alternative Credit Opportunities Fund, to provide increased yield and diversification.

- 35% to alternative income, consisting of:

Kason said this combination of securities provides “income streams of 6% to 8% yearly with varying durations, liquidity, market sectors and well collateralized assets, along with short-term portfolio stability.”

- 5% to physical U.S.- and Canadian-dollar cash to provide “dry powder” for investment and emergencies, and to hedge against disruption of traditional banking and technology platforms.

-

- 15% to real assets, consisting of:

- 4% to the Starlight Private Global Real Estate Pool.

- 6% to the Starlight Private Global Infrastructure Fund.

- 15% to real assets, consisting of:

Both Starlight funds provide access to global public and private long-term assets that should perform well as needs for housing, renewable energy, telecommunications, public infrastructure, warehousing and data centres continue to rise.

- 3% to gold and silver bullion, to be stored personally, which will provide a small hedge against uncertain times and potential currency fluctuations.

- 2% to cryptocurrency, specifically Ethereum and Bitcoin, to provide diversification and new currency exposure. The cryptocurrency should be held in a hard wallet.

- 20% to global equities through the Montrusco Bolton Global Equity Fund, which has strong ESG oversight and a consistent investment process.

- 17% to Canadian equities through the Kingwest Canadian Equity Portfolio, which provides access to an actively managed and consistent Canadian portfolio with ESG compliance.

- 8% to strategic small-cap private equity through a 4% allocation to the Kensington Private Equity Fund and a 4% allocation to MMCAP Canadian Fund from Toronto-based Spartan Fund Management Inc. These funds provide long-term exposure to both event-driven market opportunities and frontier businesses with low correlation to broader markets.

- 100% to the ProShares Bitcoin Strategy ETF (NYSE Arca: BITO).

Assuming Bobbi has an existing portfolio of ETFs, Kason said, this investment should act as a “long-term portfolio diversifier.” In addition, he said, Bitcoin may potentially store value, as well as provide exposure to a disruptive technology and a new currency.