This article appears in the February 2022 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

The expert: Mark Taucar, portfolio manager and co-founder with Accilent Capital Management Inc. in Toronto.

The philosophy: Taucar is a discretionary portfolio manager who uses both tactical and strategic allocation to preserve capital and maximize opportunities. He builds portfolios that include strong regional diversification and comprise both public and private investments. Securities are selected based on quantitative factors.

The allocation:

Taucar recommends an overall allocation of 45% to fixed income assets, 29% to higher-growth equities and 26% to alternative investments.

Income-generating assets

-

- 10% to the iShares Core Canadian Short Term Bond Index ETF (TSX: XSB).

- 25% to preferred shares and defensive high-paying dividend equities, such as:

- the BMO Laddered Preferred Share Index ETF (TSX: ZPR), a diversified portfolio of rate-reset preferred shares

- BCE Inc. (TSX: BCE)

- Enbridge Inc. (TSX: ENB)

- Power Corp. of Canada (TSX: POW)

- Bank of Nova Scotia (TSX: BNS)

- Bank of Montreal (TSX: BMO)

- 10% to cash “to take advantage of drops in the market should a sell-off greater than 30% occur,” Taucar said.

Equities

- 9% to Canadian equities that exhibit strong dividend growth, lower price/earnings ratios, lower beta and lower earnings variability than the overall market. These include Maple Leaf Foods Inc. (TSX: MFI), Loblaw Cos. Ltd. (TSX: L), Metro Inc. (TSX: MRU) and Alimentation Couche-Tard Inc. (TSX : ATD).

- 10% to the iShares S&P 500 Value ETF (NYSE Arca: IVE), which invests in large U.S. companies that are potentially undervalued.

- 5% to the Vanguard FTSE Emerging Markets All Cap ETF (TSX: VEE).

- 5% to the BMO MSCI EAFE Index ETF (TSX: ZEA), which invests in developed-market equities, excluding Canada and the U.S.

Alternatives

- 5% to Rise Properties Trust, a private Canadian REIT specializing in the acquisition of underperforming apartment-rental communities in strong U.S. markets.

- 5% to Alignvest Student Housing REIT, which invests in

purpose-built student accommodation near major Canadian universities. - 6% weighting to gold-mining companies such as Barrick Gold Corp. (TSX: ABX), Kinross Gold Corp. (TSX: K), Agnico Eagle Mines Ltd. (TSX: AEM) and Wheaton Precious Metals Corp. (TSX: WPM).

- 10% to the BMO Covered Call Utilities ETF (TSX: ZWU) “to gain exposure to the higher income generated by the increased uncertainty in markets through covered-call writing,” Taucar said.

- 45% to the BMO Laddered Preferred Share Index ETF (TSX: ZPR), which had an annualized distribution yield of 4.64% as of Jan. 21 and comprises rate-reset preferred shares.

- 25% to ZWU, which had an annualized distribution yield of 7.48% as of Jan. 21.

- 30% to the Invesco Global Listed Private Equity ETF (NYSE Arca: PSP), which provides diversified exposure to private equity firms.

The experts: Andrew Feindel (left) and Kyle Richie, investment advisors with Richardson Wealth Ltd. in Toronto.

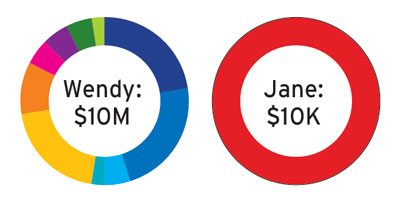

The scenario: Wendy, 60, received a $10-million inheritance. She wants unbiased advice on how to invest her windfall in a balanced portfolio, and to use a portion of that money to set up a family trust for her grandchildren for tax and asset protection.

The allocation:

Feindel and Richie recommend 52.5% in long-term assets, 30% in income assets, 10% to the family trust and 7.5% in secular themes.

Long-term assets

“For long-term assets, we used a combination of active managers and passive ideas,” Richie said:

- 22.5% to the Horizons S&P/TSX 60 Index ETF (TSX: HXT).

- 22.5% to the Horizons S&P 500 Index ETF (TSX: HXS).

- 5% to the Turtle Creek Equity Fund, which seeks to provide long-term capital growth by investing in public companies.

- 2.5% to the MMCAP Canadian Fund from Toronto-based Spartan Fund Management Inc., an opportunistic, event-driven fund for accredited investors that invests in small- to mid-sized corporations in Canada, the U.S. and elsewhere.

Fixed income assets

For short-term assets, the focus is on downside protection by using tactical ETFs and fixed-income solutions, emphasizing liquidity and tax efficiency:

- 20% to the Purpose Tactical Asset Allocation Fund (NEO: RTA).

- 10% to the Lysander-Canso Corporate Value Bond Fund.

Family trust

The trust structure includes income-generating ideas, such as active covered-call strategies in the financials and health-care spaces:

- 5% to the Evolve Global Healthcare Enhanced Yield ETF (TSX: LIFE), which applies a covered-call strategy on up to 33% of its portfolio.

- 5% to the Evolve Canadian Banks and Lifecos Enhanced Yield Index Fund (TSX: BANK), which provides exposure to the 10 largest Canadian banks and insurance companies.

Secular themes

“We have a conviction to long-term secular themes such as technology and health care, including disruptive technology such as cloud computing, fintech, cybersecurity, genomics, e-gaming, 5G, robotics and automation,” Richie said:

- 5% to the Evolve Innovation Index Fund (TSX: EDGE), which invests in global companies involved in disruptive innovation themes in several industries, including genomics.

- 2.5% to the Kensington Private Equity Fund, which is for accredited investors and primarily invests in North America.

The allocation:

- 100% to the Fidelity All-In-One Balanced ETF (NEO: FBAL), a global multi-asset ETF with a mix of about 59% equities, 39% systematic and actively managed fixed income ETFs, and 2% cryptocurrencies.

“It was determined that the client would not need access to her investment in the short term and that a one-ticket ETF solution offers diversification as well as potential long-term growth,” Feindel said.