Canadian fixed-income funds have garnered mid-single-digit returns so far this year, thanks to falling interest rates that are a byproduct of worries about slowing global economic growth and issues such as the outcome of the U.K.’s Brexit referendum.

Yet, with the benchmark 10-year Government of Canada bond yield hovering around 1%, and a complicating factor in the possibility of higher interest rates in the U.S. later this year, the question is: where do we go from here?

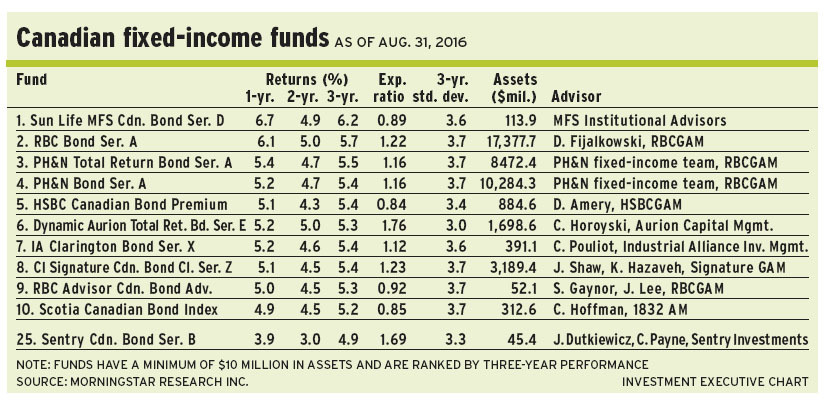

“This is the third year in a row when at the beginning of the year, the entire market expected higher interest rates and [U.S.] Federal Reserve [Board interest] rate hikes, and those expectations have been proven wrong – so far,” says Dagmara Fijalkowski, senior vice president and head of global fixed-income and currencies with Toronto-based RBC Global Asset Management (RBCGAM) and lead portfolio manager of RBC Bond Fund.

Inflation is slowly inching higher, adds Fijalkowski. Yet. bonds have rallied as Japan’s and Europe’s central banks have put quantitative easing programs into high gear. “Yields started coming down, even before Brexit. Brexit only pushed them a little lower.”

Fijalkowski argues that there has been a long-term global trend toward more savings, driven by an aging population combined with bond purchases by central banks – factors that only created more demand for assets.

“I don’t know for sure if [yields on]10-year Government of Canada bonds will go below 1% on a sustainable basis. But that is a probable scenario. We have to prepare for that eventuality.”

The risks on the horizon are mainly from outside North America, Fijalkowski notes, and run the gamut from potential failures in Italy’s banking system to worries about losses in China’s banks. Yet, there is a bigger issue: slowing global economic growth.

“No wonder interest rates are low, when you have a slowing [economic] growth trend. There are other factors, of course, but slowing global growth is not helping.”

Fijalkowski and her team do not manage the RBC fund based on interest rate or economic forecasts. Rather, they create several scenarios, based on multiple factors, then shape and adjust the portfolio. “Forecasting is a dangerous business,” Fijalkowski says.

About 44% of the RBC fund’s assets under management (AUM) is held in investment-grade corporate bonds, 39% is in provincial bonds, 6% is in Canada bonds, 5% is in high-yield bonds, 4% is in emerging-markets bonds and 2% is in cash. The average duration is 7.7 years, equivalent to that of the benchmark FTSE TMX Canada universe bond index.

The overweighted corporate bond exposure is driven by the extra 120 basis point (bps) yield that the sector offers over government bonds, says Marty Balch, vice president of RBCGAM and a member of the firm’s fixed-income and currencies team.

“All of our overweighted position in the Canadian market is in the one- to five-year maturity bucket,” says Balch. “If you have a longer-term time horizon, the chance of outperforming government bonds is more than 90%.”

Among the RBC fund’s top holdings is senior debt issued by Toronto-Dominion Bank, which yields about 100 bps over comparable-dated government bonds.

The benchmark 10-year Canada yield, which has ranged between 1% and 1.5% this year, could stay within this range for some time, says Christine Horoyski, senior vice president, fixed-income, with Toronto-based Aurion Capital Management Inc. (a unit of Bank of Nova Scotia) and portfolio manager of Dynamic Aurion Total Return Bond Fund.

“We have a backdrop of weaker growth and lower inflation than historically. And central banks, globally, continue to have an easy monetary policy,” says Horoyski. “The Bank of Canada is very much on hold. The 10-year benchmark is driven by global forces. As long as we have these global bond yields at these low levels, Canada continues to be an attractive alternative for global capital.” (Canada, with a credit rating of AAA, is attracting a lot of foreign buyers for its bonds.)

“Why are we sitting at 1%? The backdrop is not great. But a lot of foreign capital is coming into our market, especially from markets in which you see negative bond yields,” says Horoyski, noting that Japan and so-called “core Europe” have negative bond yields and the Bank of Canada does not use the quantitative easing policies used in those countries.”The next six to nine months should see a global backdrop of low or negative interest rates. The Canadian bond market will probably continue to trade within the current range.”

Risks include uncertainty about the U.S. presidential election, the potential devaluation of China’s currency and the potential for interest rate hikes in the U.S., Horoyski says: “But the positive is that global central banks are very supportive and aware of these risks and are using monetary policies as a way to hedge some of the risks.”

What is disturbing, however, is that many investors are not pricing in many of these risks, as shown by high equity multiples and low bond yields. Says Horoyski: “Investors [are] saying, ‘We have to take more risk to get more return.’ But they are not balancing the risk/return trade-off.”

Horoyski, who seeks to balance risks and opportunities, has allocated about 50% of the Dynamic fund’s AUM to investment-grade corporate bonds, 30% to provincial bonds, 15% to cash and floating-rate notes, and about 5% to federal bonds.

“Corporate markets are not very liquid,” says Horoyski, who expects total returns of about 3%-4% this year. “We run a very active and tactical fund, and adjust the interest rate sensitivity quite significantly based on volatility in the bond market. Overweighting the corporate exposure reduces our flexibility on that front, but we feel adequately compensated for that with the incremental yield.”

From an average duration standpoint, Horoyski is being conservative at five years.

On the corporate side, Horoyski likes U.S.-based names such as Apple Inc., which has a February 2026-dated bond that is yielding 2.3%. Another favourite is a Coca-Cola Co. bond that matures in June 2016 and yields 2.15%.

We possibly will see canadian bond yields go lower briefly over the next six to nine months, argues James Dutkiewicz, chief investment strategist with Toronto-based Sentry Investments Inc. and lead portfolio manager of Sentry Canadian Bond Fund. He works with Catherine Payne, portfolio manager at Sentry.

“But we will see a trading range. Over the past two years, we’ve noticed that periods in which yields back up are less frequent, shorter in duration and smaller in magnitude,” he says. “The 10-year benchmark yield may range around 1%, but dip down occasionally to 0.9%. It’s just a ‘lower for longer’ scenario.”

Dutkiewicz notes that there are about US$12 trillion of sovereign bonds with negative yields in the global bond market, and he argues that since the 2008-09 global financial crisis, central banks have been given licence by governments to use policies that previously were regarded as extraordinary.

“These actions are now considered normal. Even European and Japanese corporate bonds are trading at slight negative yields,” says Dutkiewicz. “Central banks are doing all these things to prevent a worse economic outcome. In my opinion, the actions of the central banks, year-after-year, contribute to the malaise.”

From a top-down perspective, the global economy is in sore need of a “cleansing” of excesses built up since 2008, Dutkiewicz says.

“Securities that should have been restructured have been made whole,” says Dutkiewicz, noting that other excesses include massive unfunded entitlements in the U.S. and significant debt growth in China.

He notes that Canada faces its own challenges in the form of excessive household debt, which has escalated dramatically.

Given all the challenges, Dutkiewicz describes his investment approach as “be nimble and humble,” and he is cautious about average portfolio duration.

Currently, the average duration is 7.3 years. The bulk of the Sentry fund’s AUM – about 60% – is in investment-grade corporate bonds, 27% is in Canada bonds and 12% is in provincial bonds.

Running a portfolio of about 60 corporate issuers, Payne likes names such as Restaurant Brands LLC (RB), which owns and operates high-profile brands such as Burger King and Tim Hortons Inc. RB’s so-called “callable” bond, rated BB and maturing in 2022, is yielding 4.5%.

© 2016 Investment Executive. All rights reserved.