Although financial advisors depend on their firms for many unique reasons, including specialized support services, there are some things that are more important to advisors and to their businesses than others, according to the results of Investment Executive’s annual Report Card series.

Advisors who participated in these surveys not only provided their firms a performance rating on a scale of zero to 10 in many categories, they also rated the importance of those categories on that same scale, with zero meaning “unimportant” and 10 meaning “critically important.” These importance ratings give a sense of what matters most to advisors and to their businesses.

In some cases, firms are meeting advisors’ expectations on what matters most, as is evident from the categories’ small “satisfaction gaps.” Conversely, the wide satisfaction gaps of other categories indicate that there are some areas in which firms are falling short. (A satisfaction gap is the difference between a category’s performance and importance ratings.)

This slideshow takes a closer look at the categories that received the highest overall average importance ratings in 2018; why advisors believe these categories are so important to them and their businesses; and how those ratings compared to their firm’s performance ratings since 2009.

-

Advisors’ Report Card 2018: What matters most to advisors

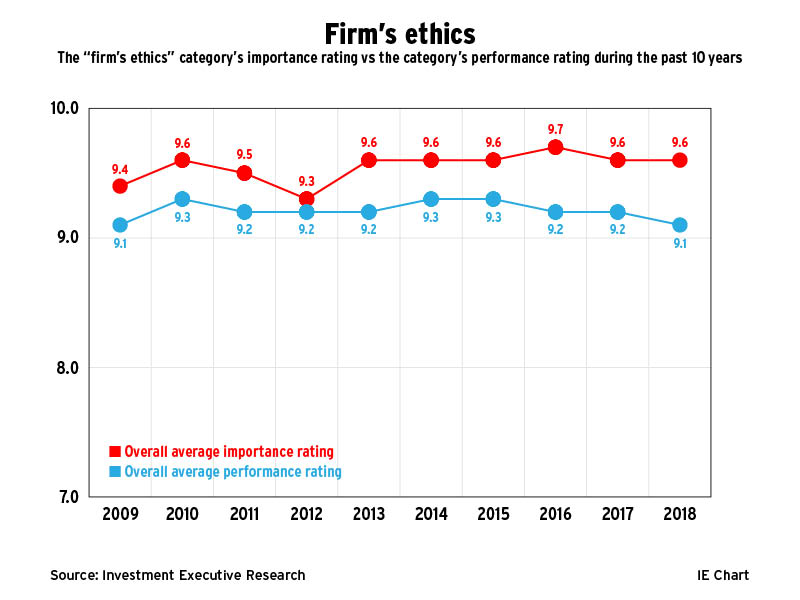

1. Firm’s ethics

A “firm’s ethics” is of utmost importance to advisors. In fact, the category has received one of the highest importance ratings during the past decade, with scores ranging from 9.3 to 9.7. This year, ethics was once again a top priority for advisors. Specifically, advisors cited their concern about what shady dealings at their firms, or among fellow advisors, could do to their business’s reputation. For the most part, firms are living up to advisors’ expectations as the category’s strong performance rating — ranging from 9.1 and 9.3 — during the past decade point out.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

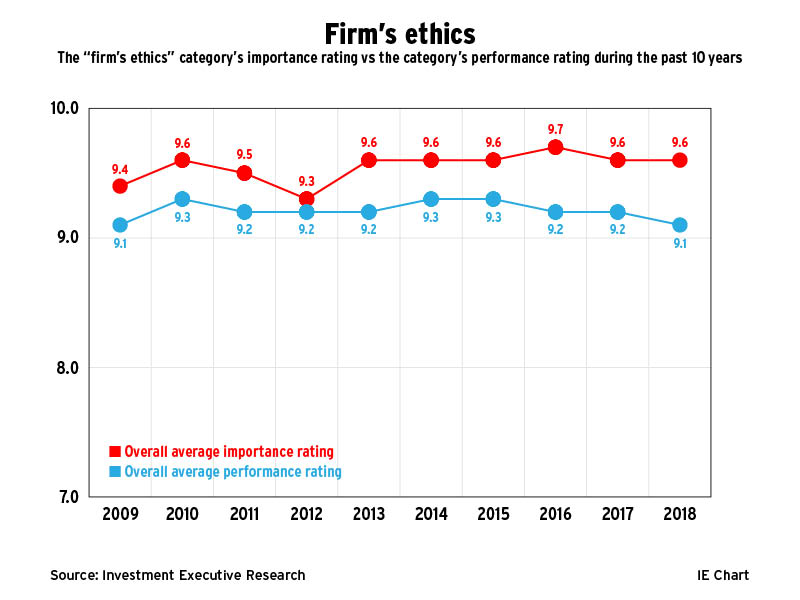

2. Freedom to make objective product choices

Advisors value having the freedom to select whatever products they wish for their clients. Indeed, advisors have given the “freedom to make objective product choices” category one of the top three importance ratings in the Report Card series during the past 10 years. Advisors often said that the freedom they have to sell whatever products they wish is one of the reasons they chose and continue to work for their firm. For the most part, firms are also meeting expectations in this area as advisors have awarded the category with a steady performance rating ranging between 8.9 and 9.1 since 2009.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

3. Firm’s stability

The “firm’s stability” category also has been among the categories to receive the highest importance ratings during the past decade. Furthermore, firms generally are meeting advisors’ expectations in this category as is evident from the category’s relatively small satisfaction gap over the years. Indeed, advisors rated the category’s importance at a 9.4 this year, saying that they appreciated their firm’s stable leadership and the strong financial backing of a parent company. The category’s performance rating also was fairly strong this year, at 8.9, although it does mark a decline from previous years because of firm-specific issues, such as acquisitions.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

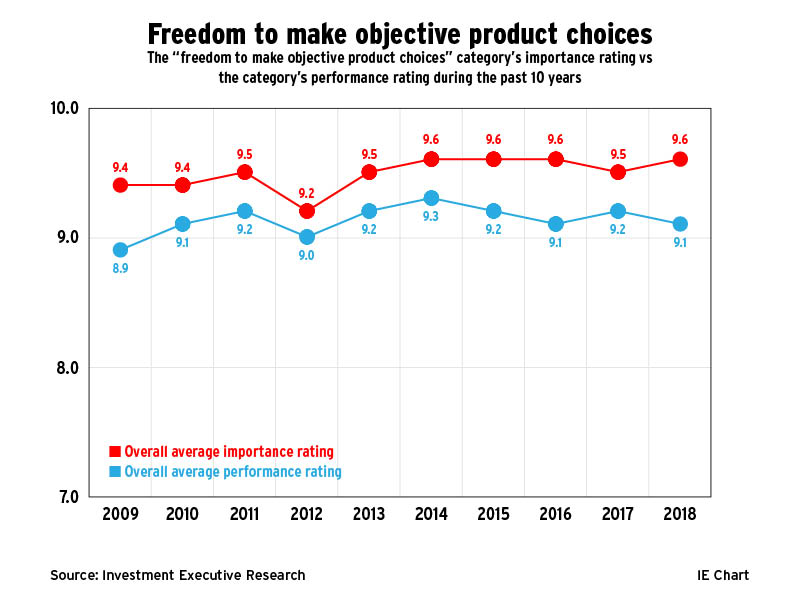

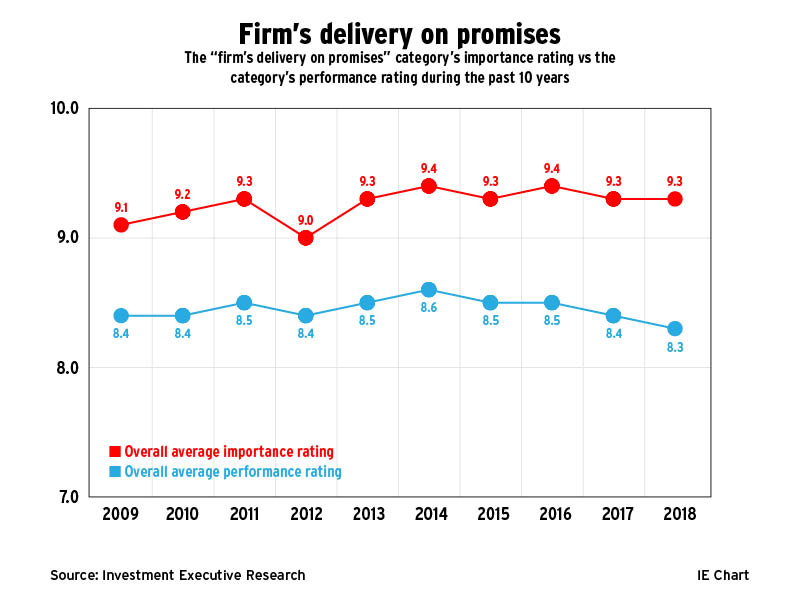

4. Firm’s delivery on promises

For advisors, having their firm’s management deliver on promises matters greatly. This sentiment is made clear by the 9.3 importance rating advisors gave the “firm’s delivery on promises category” this year. But while the category has posted strong importance ratings over the years, its satisfaction gap has remained stubbornly consistent. For example, although the category’s importance rating has remained at 9.0 or higher, its performance rating has ranged between 8.3 and 8.6. This year, the category had a satisfaction gap of a full point, with some advisors saying they were disappointed by continued delays related to technology upgrades or declines to their pay and benefits.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

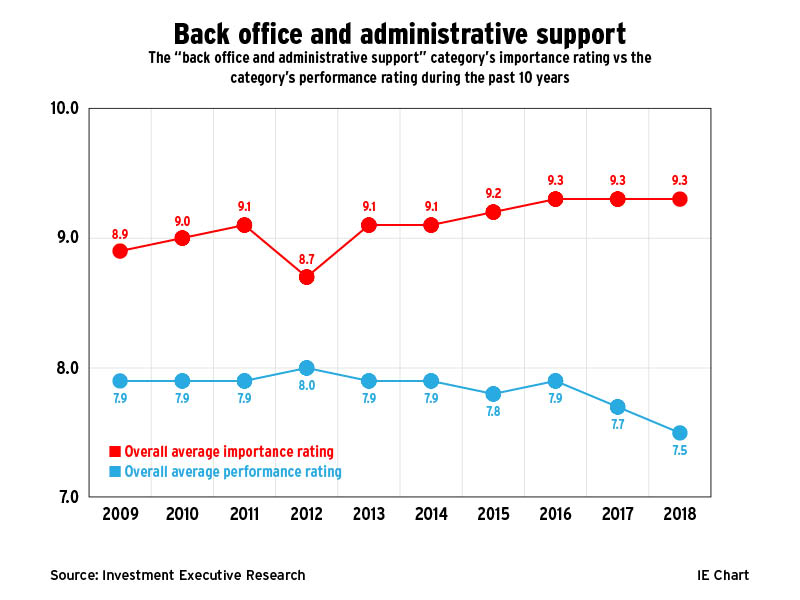

5. Back office and administrative support

The importance of back office support to an advisor’s business has grown over the course of the past decade. In 2009 the “back office and administrative support” category’s importance rating was at 8.9. That rating has risen steadily since, with the exception of a dip in 2012, to 9.3 in 2016, 2017 and 2018. Advisors reported that the back office is critical because when things go wrong, it reflects poorly on their businesses and the firm. Unfortunately, firms have largely struggled to meet advisors’ expectations from the back office as the consistently wide satisfaction gap makes clear.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

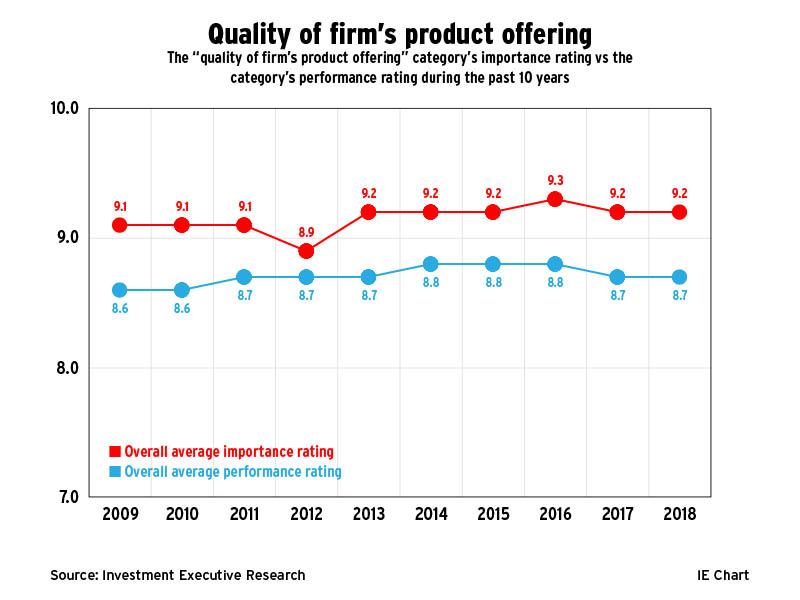

6. Quality of firm’s product offering

Advisors’ opinions have remained largely consistent during the past 10 years when it comes to the quality of the products their firm make available. Between 2009 to 2018, the importance rating for the “quality of firm’s product offering” has remained between 8.9 and 9.3 while its performance rating ranged from 8.6 and 8.8. Advisors who feel that their firms meet their expectations said they do so by offering good investment models and a deep product shelf. Conversely, advisors who are less than pleased with their firm’s product offering said it’s because there’s little difference between their shelf and those of competitors, or that the selection is limited.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

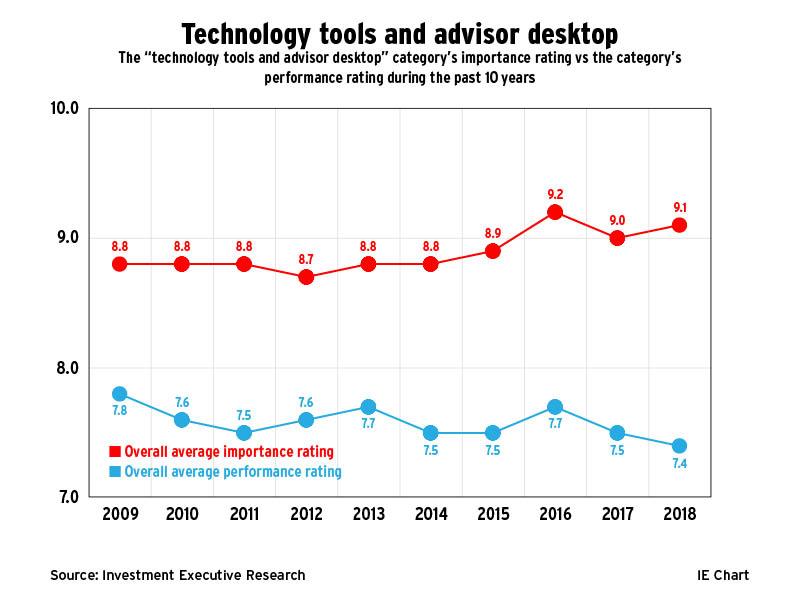

7. Technology tools and advisor desktop

Technology is a catalyst for change in the financial services sector; thus, it’s no surprise that tech tools are becoming more important to advisors. Indeed, the “technology tools and advisor desktop” category’s importance rating has risen from 8.8 in 2009 to a 10-year high of 9.2 in 2016 to a slightly lower, but still strong, 9.1 this year. Advisors acknowledge that keeping up with their expectations and the pace of technological change can be difficult for their firms — a fact made clear by the category’s declining performance rating during the past decade and widening satisfaction gap.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

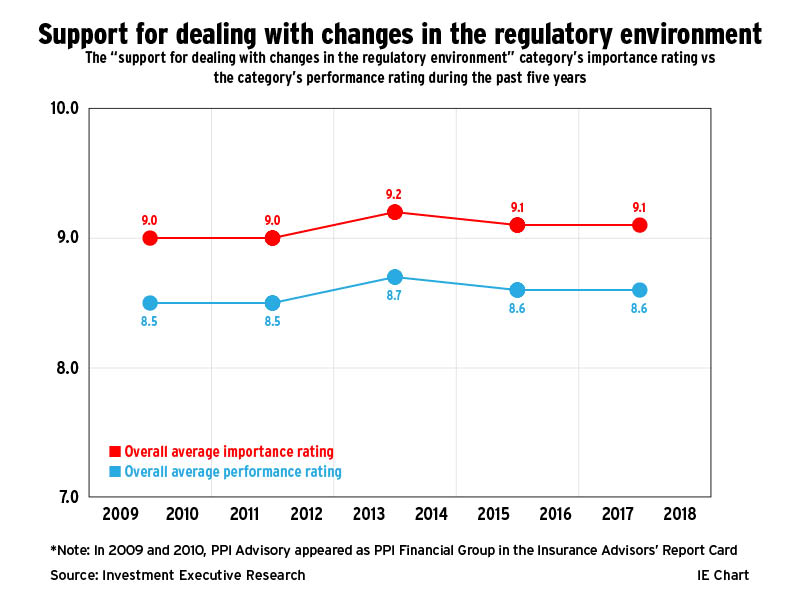

8. Support for dealing with changes in the regulatory environment

Since the “support for dealing with changes in the regulatory environment” category made its début in the 2014 Report Card series, it has received among the top 10 importance ratings, ranging from 9.0 to 9.2. Advisors pointed out that having such support is important as they never want to be caught off guard by regulations. For the most part, firms are meeting advisors’ expectations as the category’s performance rating has remained between 8.5 and 8.7, leading to a relatively small satisfaction gap.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

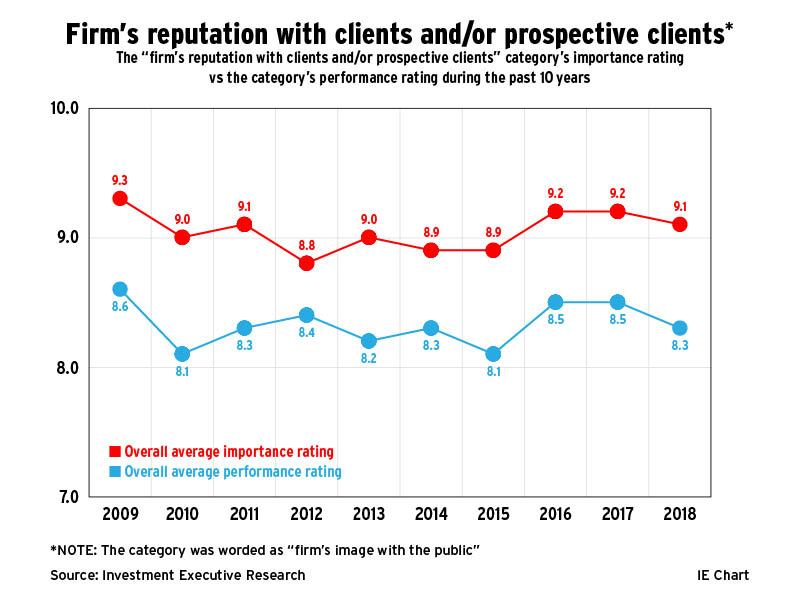

9. Firm’s reputation with clients and/or prospective clients

Advisors pride themselves on the fact their businesses have been built on the trust they’ve established with clients, but many still value having a strong brand name on their business cards. Indeed, the “firm’s reputation with clients and/or prospective clients” category received one of the highest importance ratings this year and has also held relatively high importance ratings during the past decade. For example, the category’s importance rating has increased over the years following a dip to 8.9 in 2012, which marked a 10-year low, with the biggest increase taking place between 2015 and 2016. In contrast, the category’s performance rating hasn’t fared as well; in fact, this rating has declined to 8.3 in 2018 from 8.6 in 2009.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

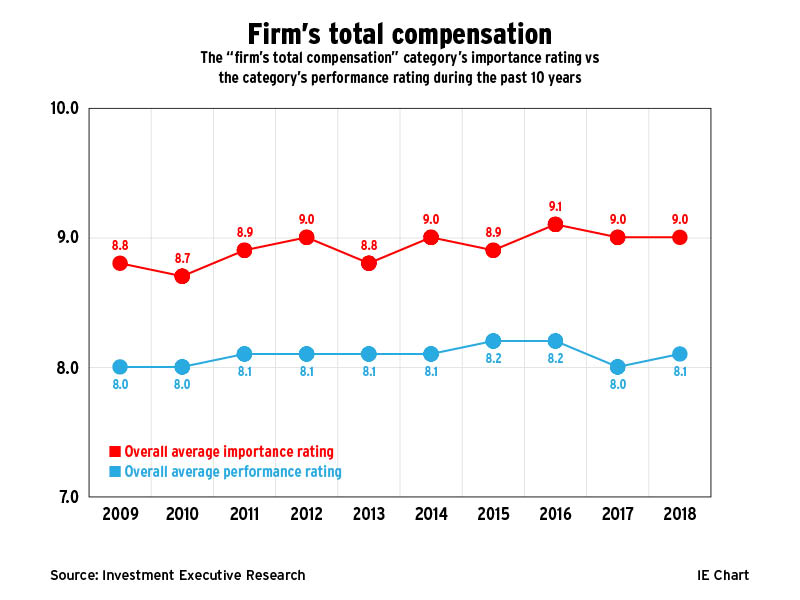

10. Firm’s total compensation

The “firm’s total compensation” category received an importance rating of 9.0 this year. Indeed, for advisors, receiving fair pay for the work they do always has been important — although it has become slightly more so recently. In fact, this year’s rating is up from 8.8 in 2009. The category’s performance rating also has remained consistent during the past 10 years, ranging between 8.0 and 8.2, as has its satisfaction gap, with some advisors taking issue with cuts to their payout grids over the years.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Advisors’ Report Card 2018: What matters most to advisors

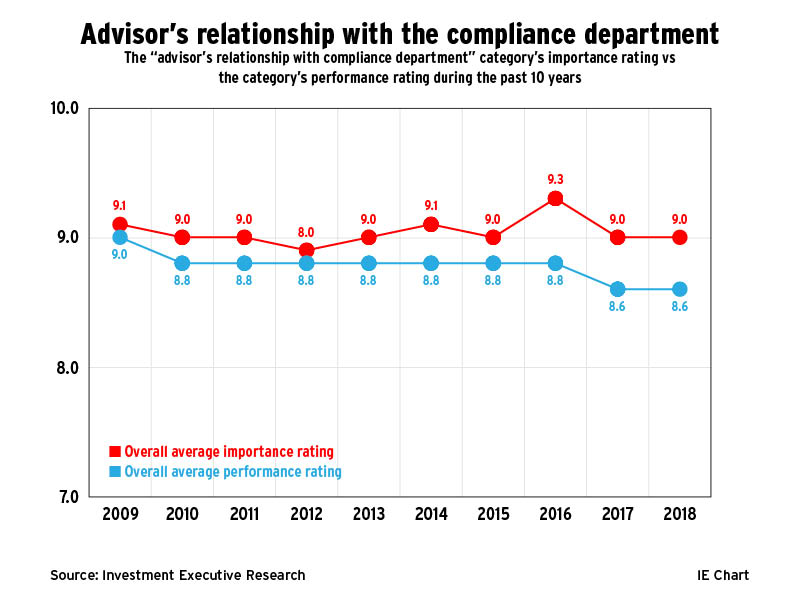

11. Advisors’ relationship with compliance department

Advisors have rated the relationships with their compliance departments remarkably consistent during the past 10 years given how mixed their opinions can often be on the topic. The “advisors’ relationship with compliance department” category rounds out this year’s list of what matters most to advisors with an importance rating of 9.0, a rating the category has received in six of the past 10 years. For some advisors, having a good relationship with the compliance department is important because it helps advisors to stay out of trouble and protect their reputations.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive